The Stride Tax mobile app is one of the best known free mileage tracking apps for self-employed individuals. It’s especially well known in the gig economy, if you’re a Lyft or Uber driver or contract with food delivery services like Doordash, Grubhub, Uber Eats, Instacart and others.

How does the Stride app stack up? Is it a good accurate mileage and expense tracker? Is it the best GPS tracking app for gig workers and other freelancers and independent workers?

The TL;DR: Stride Tax scored a D+ in our report card. The good news is the app is free and designed to be ultra simple to lose. The bad news is there’s just too much that Stride Tax doesn’t do.

We graded Stride Tax on four things: Tracking miles, expense tracking, income tracking, and tax features. Read on to see how we came to that grade, the pros and cons of the Stride app, and how it stacks up against other popular GPS mileage and expense tracking apps. We take a closer look at all of the following:

- Using Stride to track mileage.

- Stride Tax’s expense tracking

- Income tracking with Stride

- Tax features of the Stride Tax app

- Additional features on the app

- The final grade for Stride Tax

- The best pros of the Stride app

- Stride’s greatest weaknesses

- How does Stride compare to other mileage tracking apps?

A note about the categories and grading.

First off: these are my own opinions. You may feel completely different about Stride. You can download Stride by going to Stridehealth.com/tax.

This is part of a series of reviews on several gps mileage tracking and expense tracking apps, all geared towards how these apps can help the independent contractor for food delivery platforms like Doordash, Uber Eats, Grubhub, etc., or Rideshare platforms like Uber and Lyft.

We’ll look into the same categories for each. We’ll also grade each app on different aspects, average those grades to come up with a final grade. This is the grading scale we’ll use:

- A = You can’t get much better than this

- B = Above average but a little room to improve

- C = Average or slightly below

- D = It does the bare minimum to get by

- F = Falls short of the minimum.

We’ll grade on the first four topics (mileage, expenses, tax features, income tracking, and extras). I’ll figure a GPA for each. Then when doing the final grade, mileage and expenses will count double, as those are the most important things. I’ll use all that to come up with the final grade.

I won’t grade on the additional features. My premise is that a good app should track income, expenses, mileage, and help with your tax return. There shouldn’t be a penalty for not doing something extra. However, if the app does do something extra that’s kind of a wow factor, there may be a bonus point or so.

Using Stride to track mileage

One thing many drivers love about Stride is that it’s a very easy to use mileage tracker.

And hey, being free isn’t a bad thing, is it?

Here’s the thing: when we drive our cars as part of our independent contractor business, we can put a LOT of miles on our cars.

And when you can reduce your taxable income by 62.5 cents for every single mile (for the second half of 2022), it’s critical that you keep track of every mile you drive.

Here’s another way to look at it: Reducing your taxable income by 62.5 cents per mile means that the typical contractor (10% federal income tax bracket) is going to reduce their taxes by about 16 cents for each business mile.

Sixteen cents doesn’t seem like much. But last year, I personally put 26,000 business miles on my car. That’s more than four thousand dollars in tax savings. All of a sudden, 16¢ a mile doesn’t seem so small, does it?

Let’s look into Stride’s mileage tracking feature and see if it’s a good fit for you.

How to start and stop tracking miles with Stride.

Tracking with Stride is pretty simple.

At the bottom of the Stride app, no matter what screen you are in, is a little green “plus” symbol. Tap that symbol, then on the start screen, tape on “Start a Drive” and Stride will begin tracking where and how far you are driving.

Once you are done driving, tap “I’m done driving” and you’re done.

That’s it.

Easy.

In the app settings, you can choose the type of business you are running (such as delivery, rideshare, etc.). If you have more than one business type, you can select which business type your trip was for after you’ve stated that you were done.

I’ll give you a heads up on my overall opinion of Stride – it can be summed up in what I feel about this particular feature:

- I love that its designed to be incredibly easy to use.

- I think that being too easy to use can be a problem.

I’ll explain more in a moment.

One thing that I should note: Stride does not offer automatic mileage tracking. There is no upgrade option that lets you add that feature. You have to manually start and stop all trips. Forgetting to do so means you don’t capture your miles for the day.

Looking at Stride’s mileage results

You can look at your mileage deductions in the Stride app. This is a good idea to check on a regular basis, just to make sure that Stride is capturing all your drives.

Click on the Taxes icon at the bottom of the home screen. Then tap on “View all transactions.” There you will find a list of all deductions (including business mileage for each of your recorded trips). You can tap on any of the trips and view details of the trip.

Stride will show you a postage stamp sized map of your trip, the date, distance, and what job type your trip was for. You can tap on the map and get a map view of your trip.

One nice thing that Stride does is they allow you to zoom in on the app to see the route that you took. This can be useful as proof that you actually were at a certain location sometime during the day (such as if a customer claims you didn’t deliver). Unfortunately there is no data to show what time you were at any given point in your trip.

You can edit a trip. However, that option only allows you to change the job type (if you have multiple jobs listed) or to add a note to the trip.

How accurate is Stride’s tracking?

For most trips, Stride was very good at keeping an accurate record of how far I went. I keep a spreadsheet with odometer readings, and most trips on Stride were right in line with the odometer readings.

Stride tracks you wherever you go with your phone. I deliver downtown a lot, which means often parking a half block or more from the restaurant. All of that walking gets tracked. Any time you walk through an apartment complex gets tracked.

Obviously, if something happens and your phone shuts down or loses signal, Stride cannot track. You lose those miles. If an issue blocks your phone from a GPS signal, Stride cannot track. Usually when that happens, Stride will simply calculate the distance between the last two known locations.

Stride does not like battery optimization. If I put the phone in a power saving mode, Stride will send a notification saying they cannot track in that mode. While it will still track, the success rate isn’t very high. It doesn’t seem to refresh locations as often, resulting in it estimating based on straight lines between points rather than calculating where you would have driven.

If I want accurate mileage, I have to put my battery in high performance setting, which drains my battery faster. This is an issue because Stride is a really bad battery hog. When I look at a report of battery usage on my phone, Sttride is consistently at the top. This has created problems on longer delivery shifts.

One small factor here is manual tracking makes it easy to forget to track. That’s not the app’s fault if you forget, and you can manually add a trip. This just goes with the territory when using manual tracking apps. But if you forgot to track miles, how do you know how many miles to put down?

What if you forget to track?

If you forget to track a trip, you can manually enter trip details. You can click the Plus button, Add an expense, then “add miles manually.” There you can enter the date, how many miles you drove, and then you can put a description of your trip in the notes section.

Unlike some other apps, Stride will not let you enter starting and ending points and calculate distance based on those locations.

What are mileage reports from the Stride app like?

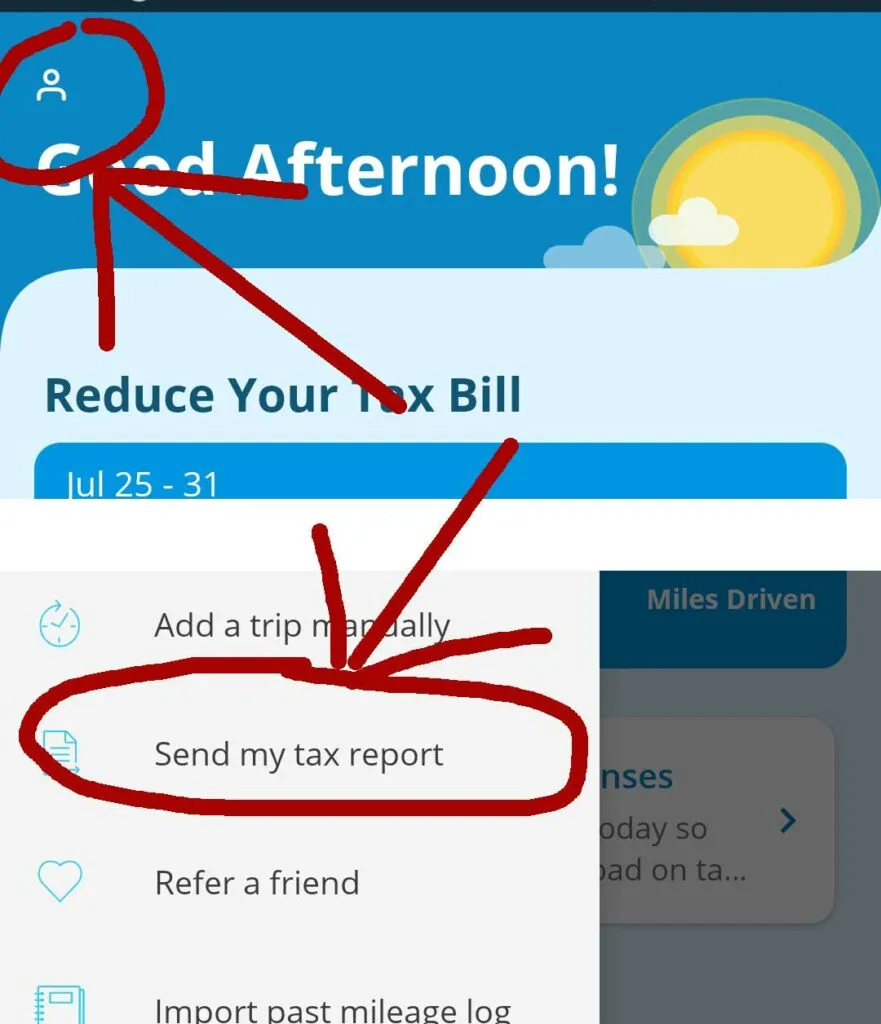

Stride lets you request a mileage report. If you tap on the profile icon (the little head and shoulders icon at the top of the app in most screens) then you can ask for your tax report. Stride then confirms your email address and emails the report to you. The report comes in the form of a CSV file, which can be opened as a spreadsheet.

IRS-ready mileage logs require the following four elements.

- The date of the trip

- How far you went (miles)

- The business purpose of the trip

- Where you went.

Stride Tax provides an IRS-ready report that meets the standard mileage log format requirements. The business purpose is covered by Stride simply stating which job type you were on. On my report, it says simply “Delivery.” Stride provides details of the starting and ending locations in the description. Any notes that you make if editing will also show up in the description field.

Unfortunately there’s no way to get reports for a given time period such as monthly or quarterly. Stride only sends details for the entire tax year. You can of course sort your file by date and pull the trips that meet that date range.

One thing that I think is a big downfall for Stride is you can’t pull up details on the web. The only place you can get any information on your trips is the app. Too many other apps (including free ones) give you more than that.

What if you work multiple businesses?

One little thing I don’t like is related to the business purpose (job type). Stride has a set list of jobs when you set up a profile. There is no option to customize the job type. For instance, I keep separate records related to my website and there’s not really an appropriate category for that. I either have to choose something that doesn’t fit, or I have to select “other.”

In fact, Stride does not provide a report by business type. You’ll have to sort your records in a spreadsheet and run totals for each one.

If you wish to track based on which gig platform, such as if you multi-app, there’s no way to do that. While taxes don’t require you to break down your mileage by platform, many drivers like to have that information for their own analytics. About the only work around is that you can edit each trip, and then put the gig platform name in the notes.

Grading the Stride app on mileage tracking.

For mileage tracking we’ll look at the following factors:

- Ease of use

- Accuracy

- Trip details and reports

- What to do with forgotten trips

Ease of Use: B

This is probably the best thing about Stride. It’s easy. The only reason I didn’t give it an A is that you do have to tap a couple of places to get started. When you look at the app it’s not real intuitive to begin with where you go to start recording.

Accuracy: C

If I were doing pluses, I might be C+ here. When Stride is working well, it works well. When there are no issues, Stride seems to keep a pretty accurate record.

However, I’ve had just enough trips on Stride where it stopped recording, or missed a chunk of miles, or had issues with connectivity. The battery drain and Stride’s admitting they have troubles recording if using battery optimization mode also get in the way.

Trip Details: C

I had to talk myself out of a D here. The reports and details that Stride provides meet the minimum specifications, but not much more. You can’t actually run a report.

If you want to get totals by business type, you have to use a spreadsheet. I just feel like, what’s the point of getting an app if it’s not providing what you need.

The lack of web access to your records is a big downfall in my opinion. I’d almost nudge them closer to an F for that if not for that’s not an absolute necessity.

The only thing that nudged me into giving a C here is the map detail. While even that wasn’t much more than lines on a map, it’s better than some other apps out there. In reality I’d be closer to C- or D+.

I commented earlier that being easy to use can work against Stride. I think this is seen in the lack of features and inability to customize. My guess is that they thought that adding more might be confusing to drivers. Unfortunately I think the extreme simplicity leaves the app lacking overall in this and other categories.

Manually Adding Forgotten Trips: D

On this one, Stride really does only do the bare minimum. There’s nowhere to add start and stop locations, or time details or anything like that, other than in a notes section. You can add trips to the report, but nothing really more than that.

Overall grade for mileage tracking: C.

Stride does the minimum and just a little bit more. The ease of use is really the one thing that keeps Stride out of D territory.

Stride Tax’s Expense Tracking.

Stride lets you track expenses in much the same way you track miles.

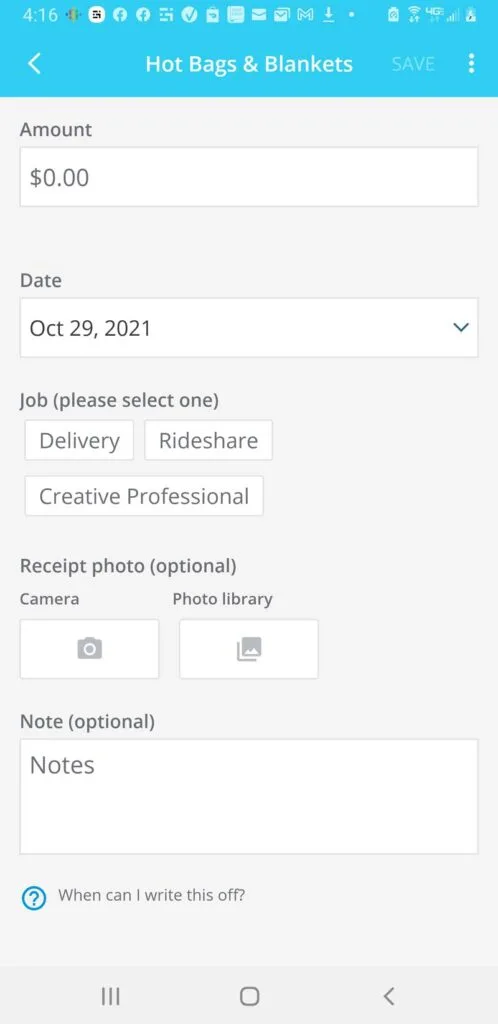

You start with hitting the Plus. Then tap on “Add an expense.” Stride presents a list of categories to choose from. This will allow you to log expenses.

Once you choose one, you have the option to enter the amount and the date. You can choose which business the expense was for. You can add a note, and take photos of your receipts.

For some expense types where you might have personal use as well as business purposes, Stride will ask you what percent of the expense is for business. I think this is a plus for Stride, in that they are geared towards the independent worker. Too many accounting programs are geared more towards traditional businesses and may not take mixed use into account for their options.

There is no vendor line or a place to enter who you paid. You can put something in the notes. Stride has no option to split a transaction, meaning you can’t assign part of the cost to one expense category, and part to another.

The only way you can add expenses is in the app. Stride does not provide a browser interface for you to use if you’re sitting at your laptop entering expenses.

Expense categories in the Stride app

I think I know what Stride was trying to accomplish here when they created their expense categories.

To their credit, they know that most independent contractors aren’t thinking like they’re running a business. There are a lot of business expenses they may not quite understand all the different business categories that are related to a Schedule C. Rather than overwhelm drivers with all the choices, they chose expense categories that are common to the type of business they are doing.

Here’s a list of expense items for Delivery drivers:

- Health Insurance

- Tolls

- Parking

- Phone and Service

- Inspections

- Roadside Assistance

- Hot Bags and Blankets

- Phone Accessories

- Personal Protective Equipment

- Other

For Rideshare they add these items:

- Passenger Goodies

- Music and Paid Apps

- Food & Drink

- Dashcam

There are some expense categories in other job types. In fact if I checked off every business type that Stride had to enter, a total of 33 additional options come up.

The problem with expense categories for Stride

This is another area where they tried to get too simple.

There are too many potential tax deductions that don’t show up under the Delivery profile.

For instance, paid apps and dashcams are legitimate expense categories for delivery drivers. But you can’t choose from them unless you also add Rideshare as a job type.

Here’s a huge one: Interest. Were you aware that you can claim the business percent of your car interest even when claiming the standard mileage allowance? Drivers who got Paycheck Protection Program loans that aren’t forgiven can write off the interest on those loans, as they are business loans.

Yet Stride Tax doesn’t have an interest category for ANY of the jobs listed. The only way you can record it is to choose “Other.” Along with everything else that doesn’t fit one of their pre-selected categories.

You cannot customize and select your expense categories. There’s no way to create categories that Stride just never chose to include.

You also can’t split transactions. For instance, your cell phone bill might have the lease amount as well as the service. Under the IRS categories, those are very different expense types.

Tracking actual expenses verses standard mileage deduction.

Did you want to track your total car expenses so you can decide whether or not you want to use the actual expense method? Or at least to get a better picture what it REALLY costs to use your car?

You can’t do it.

Stride has decided that the standard mileage rate is the only option for you. At the bottom of the list of expense categories there’s a link that says “What about gas & maintenance?” When you click on that, you get this:

Car-related expenses like gas, maintenance and car insurance are already included in the standard mileage rate.

Stride Tax explanation for why gas and maintenance are not included.

Here’s the funny thing. That explanation has a link where you can learn more. That link takes you to a guest post on the Stride blog explaining the difference between standard mileage and actual expense methods.

It’s not a bad article actually. It does a good job explaining what goes into the actual expense method. It’s just ironic because Stride doesn’t give you an option to use that method.

Stride’s Expense reports

Stride does their expense reports the same way they do their mileage. You ask for a tax report and they send you a .CSV file.

Stride will send you a Schedule C report as well. The problem is that it’s useless if you had anything in the “Other” category. For tax purposes, it’s too likely that many of those “other” expenses should go into a different Schedule C category.

If you run multiple business types (perhaps you file a different Schedule C for rideshare than you do for delivery, or you are like I am and you make money in other areas as well) there’s no way to get your report that breaks the expenses down.

All you can do is download the CSV into a spreadsheet, and then sort based on business type and on expense category.

The other problem is that you can’t line up your expense report with Stride’s expense categories. Stride labels their categories in terms that you would know what to do with, such as Personal Protective Equipment, Hotbags, or Roadside Assistance. But when they run their report, the total them by the IRS categories. For example, the PPE equipment and hotbags get put into Supplies on Schedule C.

While that’s helpful for you in not having to think about where to put things, it’s harder if you’re trying to figure out what stuff ended up where on your report. Especially if you didn’t put any notes in about what exactly you got.

Stride’s bank interface

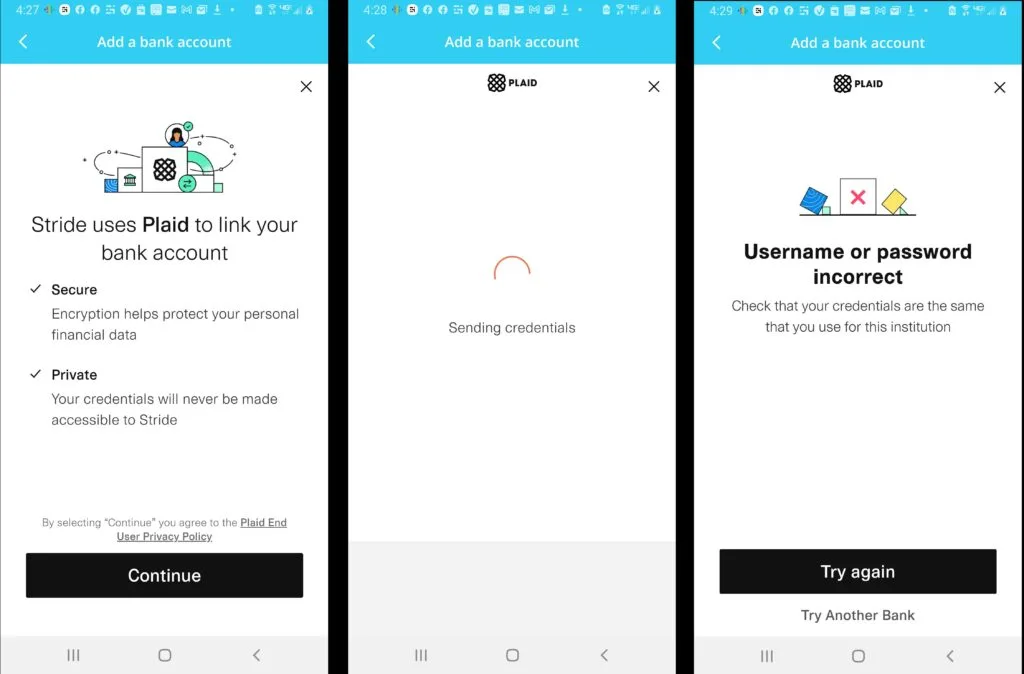

Stride is supposed to be able to log into your bank account and then imports expenses and income records. They connect using a common bank interface called Plaid.

I’ve been unable to get that to work. I personally use a nation bank specifically because it works with different apps and programs. I connect through Plaid for a lot of things. I’ve never been able to get Stride to connect to my account.

I double checked and triple checked my password. I logged in to my bank from another app using Plaid with no problem.

But here was the interesting thing: If I intentionally entered the wrong password, I would immediately get a message that the password and user name were incorrect. When I’m using the correct password, I get a screen that says it’s sending credentials and it sits for several seconds before I get the incorrect login result.

That’s unfortunate. I’d like to review how Stride works with categorizing expenses from the bank. What does Stride do with personal expenses, since there’s no category for personal when entering transactions?

I would like to hear from anyone who has tried connecting to their bank. Have you been able to connect successfully? Or are you also having issues doing so?

Grading the Stride app for Expense Tracking

Here we’ll talk about when we get into the Expense Tracking:

- Ease of use

- How good is it for tax reporting?

Ease of Use: D

In my opinion, Stride does just the bare minimum here.

Barely.

Which is ironic because as far as I can tell the whole design of Stride is to make it as easy as possible to know what to put down. Stride created their expense items list based on things common for a particular business type. The idea here was to protect you from the brain damage of figuring out the IRS expense categories.

It was a noble idea. However, the simplicity actually works against them as far as ease of use.

What do you do when an expense doesn’t match the expense category? What do you do if you have multiple businesses? Now you have to do a bunch of extra work in the end sorting all the stuff. And then, all the stuff in “other” now needs to be categorized anyway.

The lack of a web interface is a problem, in my opinion. Maybe I’m too old fashioned, but a lot of times when I’m entering expenses I’d rather do it from my computer than on my phone. It’s just faster and more efficient.

Maybe if the bank integration were working better, I might move them up a little.

How good is it for tax reporting: F

Stride is really bad here.

They don’t account for all the possible expense categories that can go with being delivery or Uber or Lyft drivers. You can’t break it down by business type.

One thing I noticed in the Rideshare categories that can be misleading: Food and Drink. I’ve seen a lot of people on social media use that as evidence that you can claim personal meals while out driving. You can’t. There are a few things that can be claimed but only under certain circumstances.

The inability to split transactions is a problem. A glaring example is that they use Phone and Service as a category. The phone and the phone service are actually two different expense items that go into two different categories. Stride doesn’t make any room for breaking the expenses up like that.

Maybe they figure that the IRS isn’t going to care if you categorize things properly. They might be right. It’s just not a great approach if you’re doing something to help drivers with taxes.

Overall grade for Stride’s expense tracking: D- (0.5 gpa)

I think I’ve said enough about what I think about their expense tracking.

This is a common theme in this review: Stride oversimplified things. I get the idea – they tried to create an expense tracking app that didn’t intimidate the hell out of independent contractors who don’t understand taxes or book keeping or anything like that.

The problem, in my opinion, is when you make it too simple to the point that you cannot do the most basic things, you actually over complicate it all.

Income tracking with Stride

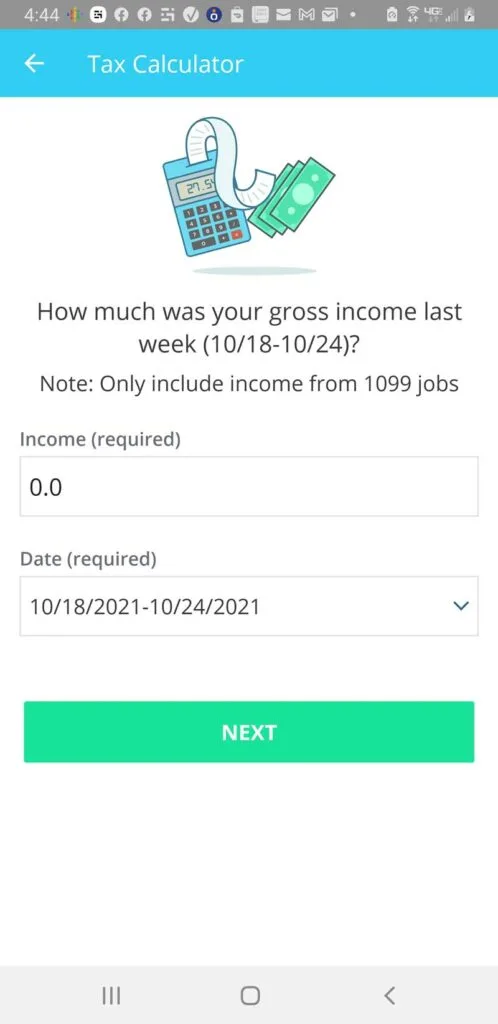

Stride has a very simple process for entering income. You choose the Plus sign, then select Add Income. You come to a screen that askes what your gross income was for the week. Then you choose from the dropdown of which week the income was earned.

You cannot choose a particular date that you got paid. You can only select the week. And you can only put in one entry per week.

What if you deliver for Doordash, but when they were having app problems you picked up some Uber Eats deliveries? You can’t enter your pay from each one individually. At that point, you have to add your pay from one to the other.

I wish I could get Stride to integrate with my bank. I’d love to hear from anyone who has been successful at this. I’d love to see what they do with multiple income transactions.

Unlike their expense entries, Stride does not let you create a note to describe your income. You cannot select the job type, which probably wouldn’t matter if you could since you can only enter one income transaction per week anyway. If you’re filing a different 1099 for your delivery work than for your Youtube channel, there’s nothing that lets you categorize income.

Overall Grade for Stride’s Income Tracking: F

It’s just too simplistic. The inability to track individual income transactions is a deal killer, in my opinion. If your total income for the year doesn’t line up with your 1099’s, there’s no way to go through and make sure everything adds up. Because working multiple apps is becoming more and more important these days, the one transaction per week just doesn’t cut it. At the very least, they should put in a note feature that lets you explain where the income came from.

Tax features of the Stride Tax app

On the tax screen, you can see an Estimated Taxes. Stride Tax shows you your Business profit, what they estimate for your taxes, and gives you an option to view week by week estimated taxes.

The calculation here is very simple: 30% of your profit. They subtract your expenses and your mileage allowance (56¢ per mile for 2021) from your income to get your business profit.

Stride does not adjust their tax estimate based on any factors like other income, tax bracket, tax credits you may have, income levels or anything like that. It’s just a flat 30%.

The good news is, saving money based on Stride’s estimate will almost guaranteed to have your taxes covered. It’s pretty unusual for gig economy workers to need as much as 30%.

Using a flat percentage isn’t that helpful if you want a more accurate picture of what you need to set aside. There are so many variables that go into what you need to save: What is your total income? Will you get tax credits? Do you have excess withholding from a W2 job that would cover a lot of your tax burden?

In general, you need to cover your self-employment tax (15.3% of your profits). Your tax bill will most assuredly increase by that much regardless of those other factors. It’s the federal income tax that varies so widely, and for a lot of gig workers that portion could be $0.

This means you’ll likely save more than you have to. Maybe a lot more. That’s not a bad thing, unless your finances are so tight that it’s too tempting to dip into your tax savings.

Stride’s H&R Block integration

Stride Tax does have a partnership with H&R Block’s Self-Employed tax filing software. From the Self-Employed tax package you can actually log into your Stride account and download your data.

The benefit to this is that it could all for an easy filing process for you. This can save a lot of time if your expenses and income are very simple and fit within Stride’s categories. This can work if your taxes are simple enough to not have issues.

The problem arises when there’s a lot of stuff you have to put into “Other.” The IRS has a line 27 for “Other” business expenses that don’t line up with any of their expense categories. However, they require you to list the different types of “other” expenses and provide a description. Stride doesn’t do that, so now you have to go through all those expenses and do that yourself.

And then you find that some of your expenses like “interest” or “rental” (think the lease payment on your expensive smart phone) actually DO go in a category on Schedule C.

In today’s gig economy, a lot of people are working several types of side hustles. You might be running two or three different types of businesses. If that’s you, you’ll have to sort all of your income and expenses from Stride so that you can figure out which income and which expenses go into which business type.

The problem is, now that you’ve done that, you can’t import that information now into H&R Block, so it’s all manual and the advantage of the integration is completely lost.

I actually use H&R block, so I thought I’d try importing Stride data. However, I use the desktop version and the integration only works with the cloud based H&R Block Self-Employed.

Grading Stride’s Tax Features: C

Stride does more than some apps in providing a tax estimate and integrating with a tax software package. If you’ve got a very simple operation or your gig income is a small side hustle, this can be great for you.

However, the many limitations of their tax features really hold Stride back from a better grade. The tax calculation is very simplistic and doesn’t take into account any individual tax situation. The issues with how Stride categorizes income (or doesn’t in many situations) can lead to a lot more work at tax time than you would have with other programs.

Additional features on the app

Stride does one thing that I haven’t seen anyone else do: Offer insurance plans.

In fact, that’s their business model. The best thing about Stride is it’s free, but it’s really all about creating a sales funnel for their insurance business. There’s an incredible need for insurance options for self-employed individuals. I can’t speak to the quality or value of their insurance because I don’t use it.

However, I appreciate that they are out there to meet a need for independent contractors.

Stride also has a tab on the app for Deals. You tap on that and you have three tabs you can scroll through:

- Access over 100,000 deals – Auto parts, service & repair, Food & dining…

- Save on Health & Insurance: Prescription discounts, Glasses & contacts, Accident & disability insu…

- Manage your money – Online banking, Discounts on tax filing, Save for the future.

On that page, it says Stride Deals are coming soon. If I recall properly, it’s been saying that for a couple of years. To be fair, a number of the options are available on the benefits tab. Stride has established a couple of business relationships.

It’s easy to be cynical that it’s just ways to make money. However, I won’t fault a company for providing a free service like their app and looking for other ways to support their business. I think there’s value in providing resources for their target market in one easy location.

As I mentioned above, I’m not grading this category. I do appreciate that Stride does offer resources, and so I am adding a bonus point to the final grade.

The final grade for Stride Tax:

Here’s the breakdown of the grades:

- Mileage tracking: C. (2.grade points)

- Expense tracking: D- (0.5 grade points)

- Tax information: C (2.0 grade points)

- Income tracking: F (0.0 grade points)

- Additional features: 1 additional grade point

We’re doubling the grades for mileage and expense tracking, as these are the most critical parts of it.

Stride Tax app final grade: D+ (1.33 GPA)

Overall the extreme limitations on tracking offset the better advantages. I think there was a time when it might have graded out better, but that was because there weren’t other free options that did the same thing.

The best pros of the Stride app

The best thing that Stride has going for it, in my opinion, is what I think their intent was in developing this app.

Bookkeeping is intimidating. Many independent contractors for Doordash, Grubhub, Uber Eats, Instacart, Lyft, and others had no idea when they signed up that they were actually going into business.

I think the idea behind Stride was to create something that was idiot proof. Provide something where people don’t have to think too hard about how to classify things. So they came up with a very simple solution. As someone who operates a website to help people understand the business of being an independent contractor, I can appreciate that approach.

When your phone is set on high performance and you remember to start and stop tracking, the tracking feature works. It’s actually more accurate than a number of automatic tracking programs.

Finally, I appreciate that Stride provides options for self-employed individuals that might be harder to find, especially insurance options. If nothing else, the Stride Tax app is a good introduction to their core business.

Stride’s greatest weaknesses

The huge problem with Stride is that it’s not good at all as an accounting or record keeping option. I get the intent of bringing things down to the level of the contractor who doesn’t understand taxes and bookkeeping.

However, the common theme throughout this review is that in over-simplifying things, I think Stride may actually be over complicating things in the end. When it comes to tax time you just need better information than what Stride provides. What that means is that in the end, you have to go back through everything to figure out what was what.

The idea of tracking your income and expenses is so that you don’t have to do that at the end of the year. As I see it, the end result for too many people is that the over-simplification for Stride leads to defeating the purpose of the Stride app in the first place.

That problem intensifies if you have more than one stream of income. That’s becoming more and more common these days. Delivery drivers can now be doing a half dozen or more platforms. Rideshare drivers are picking up delivery or other gigs. Stride’s inability to track more than one income transaction per week just doesn’t cut it for most self employed businesses.

At the end of the day, adding a little more flexibility and improving the income tracking functions would make Stride a much more useful app.

How does Stride compare to other mileage tracking apps?

When I first started delivering nearly four years ago, I’m not sure anyone else was doing what Stride was doing. At least not with a free app. If you wanted more, you had to pay for it. Stride was the only free option, and that made them the best app for a lot of drivers.

I think the fact that other options have come along, you can do a lot more. Stride never really kept up or expanded their capabilities.

As I provide report cards on other apps, I’ll update them below. Here are the results:

- Solo app report card: Grade C (2.06)

- Stride Tax: Grade D+ (1.33)

I previously spent a significant amount of time running several apps at the same time on deliveries. I rated seven different apps in several different categories. It was a different rating system than the grading that I’m doing here. Here’s how they ranked based on that criteria:

- Hurdlr: 32 points

- Triplog: 30 points

- Everlance: 19 points

- Stride Tax: 16 points

- Gridwise: 15 points

- MileIQ: 14.5 points

- Quickbooks Self-Employed: 13.5 points

You can read more detail on our comparison of Hurdlr, Triplog, Everlance, Stride Tax, Gridwse, MileIQ and Quickbooks Self Employed here.

Frequently asked questions about the Stride App

Is Stride a good app?

The Stride Tax app does the basics and can be a good entry level tracking app for independent contractors. It’s definitely better than not tracking anything at all. However, it’s extremely limited, doesn’t allow tracking of many relevant tax deductions, and the income tracking is only useful if you have just one income source.

Is Stride IRS compliant?

The mileage log from Stride is IRS compliant, meeting all four IRS logging requirements. The limited expense categories in Stride may not allow you to accurately track all of the relevant business expenses.

Does Stride have a free trial?

The Stride Tax app is a free GPS mileage and expense tracker app, thus it does not need a free trial.

How can Stride be free?

Stride Health uses their free app as a way to introduce other services to drivers. They receive commissions from health insurace, accident insurance, financial products and other services applicable to independent contractors and self-employed individuals.

Does Stride work with tax preparation software like TurboTax or H&R Block?

Stride Tax does not directly integrate with tax programs. The tax report from Stride can give you totals that you can manually enter into the Schedule C section of other tax programs. However, you will have to do extra work if you had expenses that didn’t fit into the pre-selected expense categories on the Stride app as you’ll have to manually sort and add up totals of those transactions to fit the IRS expense categories.

Can I track miles automatically using Stride Tax?

Stride does not have an automatic mileage tracking feature. You will have to manually tell the app when to start and when to stop tracking.

How do I print off my Stride mileage and expense reports?

There is no option to print directly from the Stride app. To get your reports, you’ll need to open up the menu by tapping the person icon in the top left of the app, then choose Send my Tax report. Stride will send an email to your email address on record with a PDF with an overview of your income and expenses, and CSV detail logs of your miles, expenses and income.

Final thoughts of this Stride Tax app review

There was a time where it was like the only bookkeeping options for small business owners either had a pretty steep monthly or annual subscription price, or you were stuck with hand written records or using a spreadsheet.

Stride was one of the first to address that problem. With the explosion of the gig economy, Stride produced an app with basic features that catered to the many who needed simplicity.

However, since then, many other options have come along that do it much better. Stride hasn’t kept up. Most independent contractors, gig workers, and small business owners need more. Many are starting to work with multiple sources of income and often they need something that can keep up with all those sources.

I think Stride could fix a lot of that. Until they do, I feel like there are many options that are much better for the self-employed.