You want to track your miles, income, and expenses but aren’t ready to pay for a program, so which is the better free app to do so – Stride Tax or Hurdlr?

Let’s take a look at both programs, compare Stride Tax vs Hurdlr, and see which is the best free mileage/expense tracking app for those who deliver with Grubhub, Doordash, Uber Eats, Instacart and other delivery apps.

Stride Tax and Hurdlr are both free apps that give you the ability to keep a GPS record of your business miles, and track your income and expenses. How can they do it for free? Stride uses their app to promote their insurance offerings, primarily health insurance. Hurdlr uses theirs to promote the paid, fuller featured versions of their app.

Try Hurdlr for Free

Hurdlr has a free version. If you want the Premium version for 20% off and add automatic mileage tracking, auto expense and income tracking, and added tax calculations and reports, use my affiliate link and sign up.*

*I may be paid for purchases through affiliate links.

Try Stride Tax for Free

How we will compare Stride Tax vs Hurdlr to look for advantages of which free mileage and expense app is best for delivery contractors.

We’ll go through both apps and ask these questions:

How easy is it to track miles?

What are the mileage reports like?

How easily can I add income and expense records?

How is it for reporting and taxes?

What are the extras?

After we look at all these questions, we’ll wrap up with some of the overall pro’s and cons as to which is better, Stride Tax vs Hurdlr, as a mileage tracking and expense app for those of us who are drivers with Doordash, Grubhub, Uber Eats, Postmates and others.

Question 1: How do Hurdlr and Stride Tax Compare at tracking miles?

Neither Stride nor the free version of Hurdlr have automatic tracking available. You will need to start and stop your recording manually. Hurdlr has an upgrade option that will allow manual tracking, Stride does not.

Stride tax mileage tracking.

tracking miles is as easy as clicking the plus button on the bottom of the screen. You will be asked if you want to add income, add an expense or start a drive. The moment you choose Start a Drive, the app will start tracking miles for you.

When you are done, you can click on “I’m done driving” and Stride will stop tracking. Stride does allow you to set up several different work types, and if you have more than one chosen, you can choose which job the trip was for. There is not an option to classify a trip as personal.

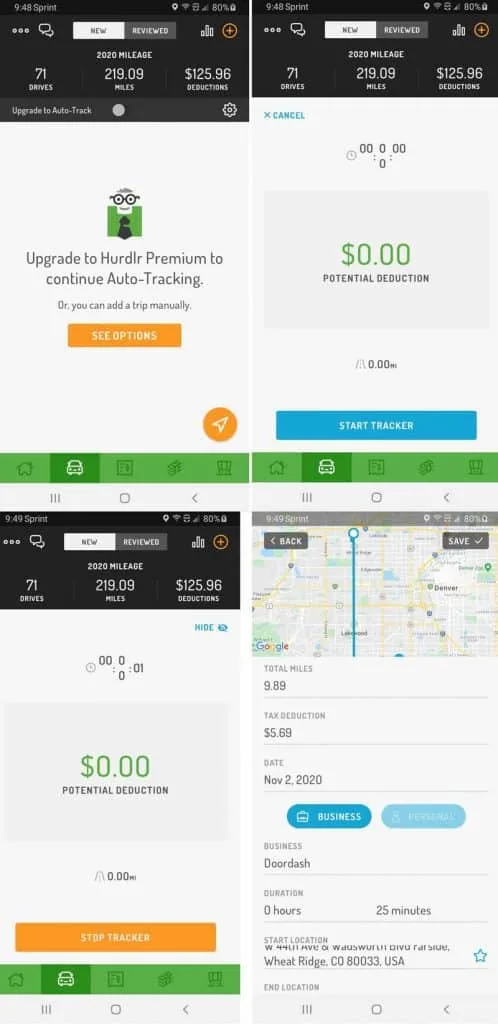

Hurdlr Mileage Tracking

If you have an Android phone, you can use the widget with Hurdlr to start and stop recording from the home screen of your phone.

Otherwise, Hurdlr has one extra step involved. You will tap the car icon at the bottom of the home screen, tap the Navigate icon at the bottom left, and then tap on Start Tracker. Stopping is as simple as tapping “Stop Tracker”

Hurdlr has a lot more options for categorizing your deliveries. You can look at a delivery record and swipe left or right to categorize as business or personal. You can also set up categories for other businesses, such as if you want to track separately for Doordash, Uber Eats, etc, or you can set up a category for Charitable work if you wanted to track that.

Stride Tax vs Hurdlr in Mileage Tracking – the advantage goes to…

Hurdlr.

They are similar in ease of use and accuracy. The widget option and the additional flexibility in categorizing the trip gives Hurdlr the edge.

Question 2: How do Hurdlr and Stride Tax compare with mileage reports?

Tracking miles is pretty useless if the tracker isn’t providing a good mileage report. How do Stride Tax vs Hurdlr compare when it comes to the mileage reports? Are the reports compliant with IRS requirements?

The IRS requires a log that provides the following details: The date of the trip, the number of miles, where you went, and the business purpose.

Hurdlr Mileage Reports.

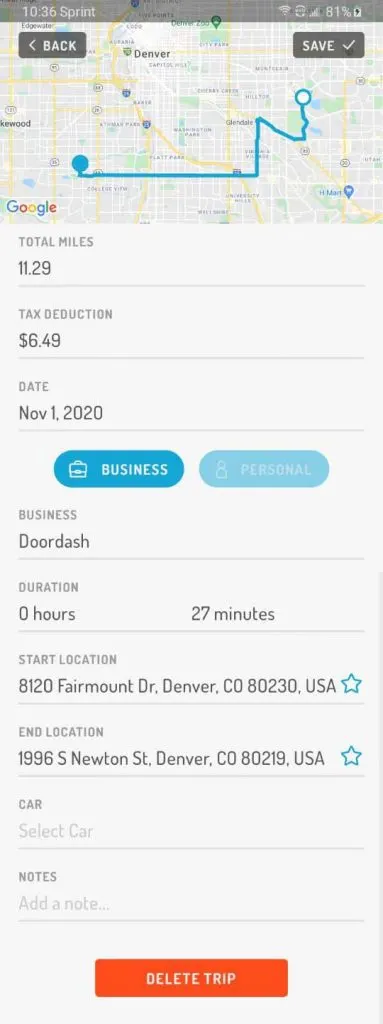

With Hurdlr, you can choose between trips you have classified or haven’t classified. When you click on an individual trip, you get a screen with a map showing where you have been, and details of the trip.

With the Hurdlr map, you cannot zoom in on the map to get a better detail of the location that you drove. This is unfortunate if you want to use that detail to show that you were indeed at a particular address.

Hurdlr provides a lot of detail including approximate start and end addresses, how long the trip took, and even the ability to choose which car you were driving.

You can download three different mileage reports. You can get a PDF report of your miles by business, a spreasheet of mileage detail that is IRS compliant, and a report of personal miles by category (Charity, medical, moving, or other).

Finally, Hurdlr has a web portal where you can pull up an information over your desktop or laptop browser. You can get detail there as well. Interestingly, Hurdlr chose not to show the route driven on the web version. But it does show a little more detail including the start and stop time for each trip.

Stride Mileage Reports

To get mileage details on your trips with Stride, you need to tap on the Tax icon, choose to view all transactions, and you will get a list of trips that were recorded (as well as any expense transactions). When you select a trip, you will see the date, miles driven, estimated deduction value, elapsed time and a map.

One advantage for Stride is you can zoom in and out on the map. That allows you to get a closer look at exactly where you were along the trip.

You cannot pull up a mileage report on the app itself with Stride. In fact, I had a hard time figuring out how to get my miles. You have to go into the main menu, ask for it to send your tax report. Stride will email you three documents, one being a mileage log in a spreadsheet format.

The Stride mileage log is IRS compliant. It includes details about your start and stop points and will list your company. It does not include the times of the trip. That information is not required by the IRS but it does come in handy for documentation purposes to show what times you were driving.

Hurdlr vs Stride Mileage Reports – the advantage goes to….

Hurdlr.

There is one area where Stride holds an advantage, and that is the better ability to zoom in on the route map and see where exactly you drove.

That said, Hurdlr has a lot more information available on a wider range of categories. The personal categorization allows you to capture personal mileage information, where Stride is not that flexible. Another advantage for Stride here is the ability to report multiple vehicles. If you use more than one car, you have to file information for each one.

Try Hurdlr for Free

Question 3: How do Stride Tax and Hurdlr compare in tracking income and expenses?

Stride Tax and Hurdlr both do more than just track miles. Both apps have options where you can record your income and expenses. This makes them both valuable in helping you stay on top of the things you need to know for your taxes.

How does Stride Tax work for tracking income and expenses?

Stride Tax is designed for simplicity. I think they were designed primarily with Gig workers in mind, and most do not have an accounting background. There’s some wisdom in making things as simple as possible.

I am concerned they maybe went too far.

Stride is supposed to have a bank integration feature. This can be great for going through and categorizing all your income and expenses. I don’t know if they disabled it or if there’s a glitch, because the app gave me an error message when I tried to set it up.

For manual entries, you enter your income and expenses the same way you add a delivery trip. Click on the plus and then choose add income or add expense.

One of the biggest problems I have with Stride Tax is that you cannot track income from different delivery apps individually. There is no option to make a note on it to show which was Grubhub and which was Doordash. It doesn’t matter though, Stride Tax is set up to only allow you to enter one income transaction for the week. If you make money from multiple apps, you have to add the income together.

Entering expenses on Stride

When you enter expense transactions, Stride Tax has designed their expense categories so that the most common categories will pop up. They have a built in category for Hot Bags, which is brilliant. However, if your expense doesn’t fit into the few categories they choose, you can only put it in “Other.”

Stride Tax will not let you track your actual car expenses. They make the assumption that the per mile rate will be a higher deduction, so why bother with tracking actual expenses? I can understand this from the simplicity approach. They don’t want to confuse drivers by adding too many options. That said, I see value in tracking actual expenses.

One thing I found that shows both a pro and con for Stride Tax is when I attempted to enter phone bill information. The pro is, Stride asks which percent of the bill is for business use. This is especially important for independent contractors on an item like your phone bill. However, Stride does not provide a way to split the transaction. For most of us your phone bill has a part for the phone lease and a part for the phone service itself.

How does Hurdlr work with tracking income and expenses?

Hurdlr does not have an option to link your bank account in the free version. They put the links there to let you do it, but when you click on it, it will prompt you to upgrade to the paid version.

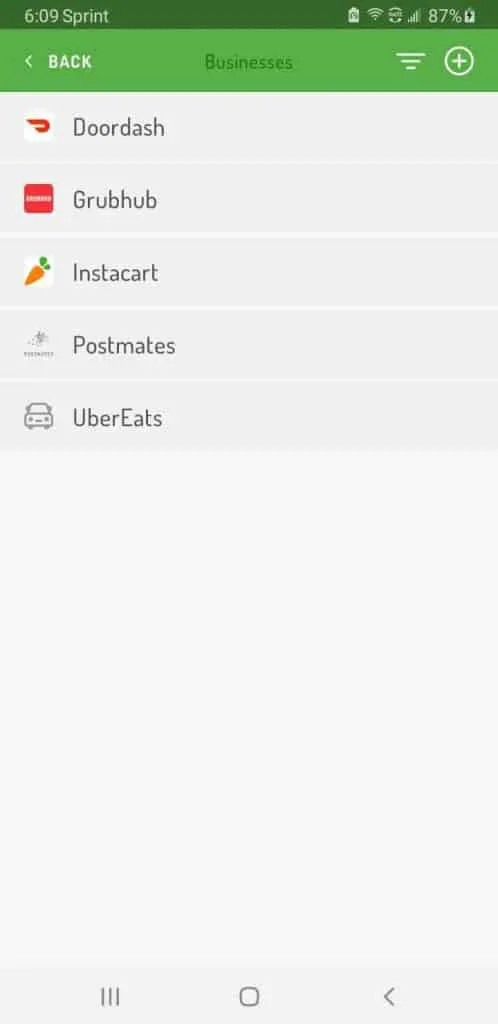

With Hurdlr, you have the option to set up ‘businesses’ within your delivery work. That means you can set up Grubhub, Doordash, Uber Eats, Instacart all individually. You have the option to link your income, expenses, and miles to those categories.

Hurdlr not only allows you to make multiple income entries for not just the same week but for the same day, but it also allows you to categorize the income. That means you can keep a running total for Doordash, Grubhub, Uber Eats, Instacart or any other apps you work with.

This is extremely important because some of these apps (Doordash in particular) are terrible at giving you the wrong information on your 1099’s.

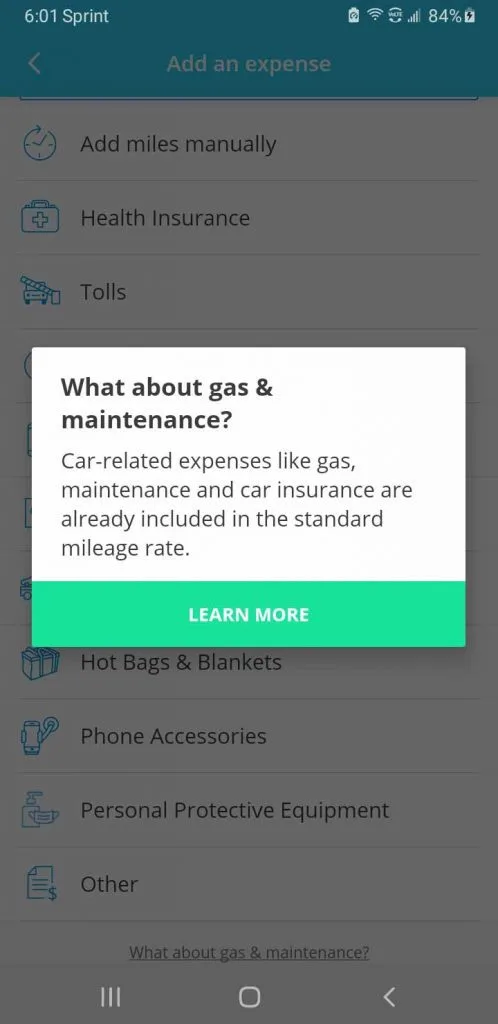

Adding expenses in Hurdlr

Hurdlr is more of an accounting program than Stride. This is good and bad for independent contractors.

Stride Tax was smart in understanding that most of their users aren’t going to understand all the different expense categories. Unfortunately they were not good at providing any options beyond their simplified approach.

Hurdlr is much more flexible and better at actually accounting. That can make it harder to use. Where Stride offers way too few options when choosing a category, Hurdlr provides a wide variety to choose from. Not all of them are immediately available, some are sub categories of the others.

Hurdlr has a vendor field in their expense record. This is something you should have, that Stride Tax doesn’t do. However, it’s a bit of a pain because you can’t just type in the name of who you paid. You have to add a step to add the vendor.

While you do have to do a bit more thinking and searching to find the right category, the reality is that there are a lot of expenses we can have that fall outside what some consider the norm. Interest expense on your car, memberships such as AAA or Kover.ai, etc. In fact, you can go in and create your own expense categories in Hurdlr.

Stride Tax vs Hurdlr Income and Expense Entries – the advantage goes to….

Hurdlr

There are some things I do like better about Stride Tax. The app is designed to be the least intimidating possible for contractors who are completely unfamiliar with delivery. I appreciate that they put an option in that lets you mark what percent of that expense is for business.

Unfortunately, Stride oversimplified things. They added no options to add anything that goes beyond the few categories they felt would be a fit for delivery contractors. The inability to track individual earnings from gig companies is a huge miss in my opinion.

I like the flexibility with Hurdlr. The tracking by delivery company is a huge plus. I like that you can track both your actual expenses and your miles without doubling up the deduction. I prefer having the option for other expense categories, but don’t like how hard it can be to find them. Overall though, the flexibility and accuracy trumps simplicity.

Try Stride Tax for Free

Question 4: How do Hurdlr and Stride compare for reporting and taxes?

After all, much of the point of tracking your income and expenses is so that you know what to put down on your taxes. How well can you look up your progress throughout the year? How does it do in helping you understand what you should save for taxes?

What is Hurdlr like for reporting tax information and profit and loss?

Hurdlr provides a variety of report options. If you track your miles, expenses and income by delivery app, you can get reports for each app. At any time, from within the app you can either download the reports or have them emailed to you. From the web interface, you can view the reports on your screen.

Where Hurdlr’s reports really stand out are the tax information. You can select a Schedule C report, and Hurdlr will provide a Schedule C already filled out for you. Getting the dowload of the Schedule C from the app requires the paid membership, however on my free account, I was able to download the Schedule C from the web browser interface.

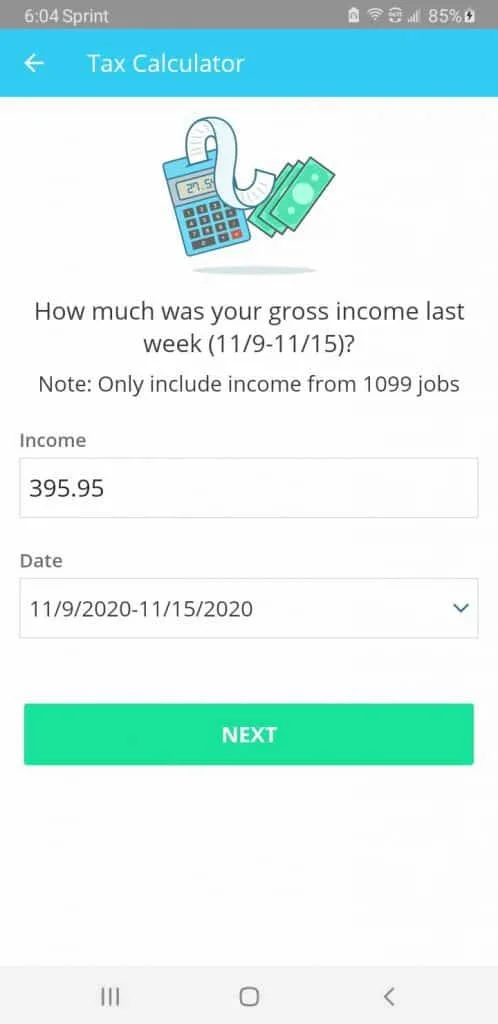

Another valuable tax feature with Hurdlr is that it will calculate how much you should set aside for taxes. Hurdlr will ask you questions about your filing status, almost like what you do when you fill out a W-4 to help an employer figure out your income tax withholdings.

Once you have updated your information, Hurdlr updates how it calculates what your taxes are. Below is a before and after of the home screen in Hurdlr, with a tax estimate before I put anything in settings, and one after I did so.

This takes all the guess work away when you are trying to figure out how much to save for taxes. Even without the reports, the home screen is telling you exactly how much you should have set aside for taxes.

What is Stride Tax Like for Reports and Taxes?

In Stride Tax, you can tap on the Tax icon and get an overview of your income, expenses, and their estimate of your taxes.

You have two options from that page to get more detail. You can click to get a list of transactions. There you’ll find an unsorted list of all of your expenses, or an option to get an unsorted list of all your income.

Remember this from earlier – Stride does not allow you to track your income from different gig apps separately, so you don’t have the capability to pull a report of your Grubhub earnings only or of only your Doordash revenue.

You can also tap on “View Estimated Taxes” and get a weekly list of the tax estimates.

Your only other option for getting any reports is to tap the triple bar at the top of the page and request a tax report be emailed to you. You will receive three documents in your email: An expense summary report, a spreadsheet of all of your expenses, and a spreadsheet of your mileage logs.

Nothing in any of the reports details any income. You have to go back into the app and look at your income total on the home screen to get that information. There is no actual profit and loss statement that you can pull from Stride.

There is no tax profile to set up in Stride Tax. They don’t take into account any external information or filing status. In fact, Stride simply estimates taxes by calculating 30% of your profits. That’s it.

Hurdlr vs Stride Tax for reporting and tax estimates – the advantage goes to…

Hurdlr.

It’s not even close.

Stride really doesn’t have any reports other than the expense summary. That expense summary doesn’t even have a total for your income. You can’t pull a report of your income, period.

Hurdlr goes to the opposite extreme. They offer more reports than you probably would ever need. However, their tax calculations are pretty precise based not just on profit and loss, but on your tax profile as well.

Question 5: How do Stride Tax and Hurdlr compare on are the extras?

We’ve been looking at Stride Tax and at Hurdlr for how they perform as free apps that track miles, income and expenses. What else do they do?

Are there any extra capabilities with Stride Tax to be aware of?

The one extra that there is to Stride Tax is their benefits.

In fact, Stride’s business model has nothing to do with bookkeeping or mileage tracking. Stride Health exists primarily as a marketplace for insurance and benefit plans for independent contractors.

The business model is more about selling insurance and other services to independent contractors. Stride has been brilliant in using the app to provide a service to contractors and introducing contractors to the services and affiliate programs they work with.

Tap on the Benefits button and you get a long list of products and services.

As far as extra capabilities in the app itself, I didn’t really find any. Stride Tax doesn’t have much in the way of an online portal. You can log in and request the same reports that you can request through the app. Even the summary online fails to reference your income.

Are there any extra capabilities with Hurdlr to be aware of?

Two things stand out about Hurdlr.

The first is the online interface. You can log into your account either through the app or through a web portal. The home page is a dashboard showing a glimpse of your expenses, miles, profit and loss.

From there, you can go in and treat this like an online bookkeeping program, entering income and expenses from your desktop or laptop computer as well as from your phone. You can pull up any of the reports online as well.

The second plus is that if you want expanded capability, there is an option to upgrade to their paid plan. Let’s be honest, the free version is designed to encourage you to upgrade to the paid plan.

In fact, Stride has a second Tier that includes a more advanced accounting platform. That option allows full double entry accounting. It has the ability to track your business accounts and assets along with expenses and income, and provide more advanced business reports. Generally the Pro version is something you wouldn’t likely use as a gig economy contractor, however if you operate other businesses, I see it as a very solid alternative to programs like Quickbooks and Freshbooks.

Is it worth upgrading? That really depends on if the upgrade adds any features that would be valuable to you. Some of the benefits include automatic tracking (rather than having to rely on starting and stopping the app manually), the ability to link your bank account and automatically track income and expenses, and more detailed access to tax calculations and tax information.

How do Stride Tax and Hurdlr compare when it comes to the extras? The advantage goes to…

Hurdlr.

That’s kind of an easy call when Stride doesn’t really provide any extras. There is no way to upgrade or get more capability out of Stride. There is no access to logging on to a desktop to add income or expenses over your computer. What you see in Stride Tax is what you get.

The flexibility of Hurdlr and the ability to add features if you want to upgrade are a big advantage for that program. Add to that the ability to use your phone or your desktop/laptop to manage your business, and it just seems to run circles around Stride Tax.

So: Comparing Hurdlr and Stride Tax, which is the best free app for mileage, expense, and income tracking for contractors with Doordash, Uber Eats, Grubhub, Instacart, Lyft and other gig economy apps?

This one was a shutout for Hurdlr. In all five questions, I didn’t find it was even close.

What are the biggest advantages for Stride Tax over Hurdlr?

The main thing that Stride has going for it is its simplicity. I think the plan was to create an app that is easy to work with and that isn’t as confusing or intimidating as some of the bookkeeping or accounting programs that are out there.

Rather than confuse people about the differences between tracking miles and tracking actual expenses, Stride just defaulted to tracking miles. That is the best way to go for the vast majority of self employed individuals who use their vehicles.

Stride was designed as an entry level tracking program that didn’t require a big learning curve. To their credit, I feel that they have done that well. I think their biggest advantage lies in the fact that Hurdlr’s wider range of options (especially in expense categories) can be intimidating to a new user. There may be times where Stride is better because a person might just not track anything at all if the tracking app scares them.

What are the biggest advantages for Hurdlr over Stride Tax?

Hurdlr did a fantastic job of putting together an app that does the basics and does them well. The mileage tracking is easy and on point. The reality is that there are a wide variety of expenses that we can incur in our delivery businesses and Stride is much better equipped to handle those.

You can read my complete review of Hurdlr here. For comparison, we also wrote a review of the Stride Tax app here.

In this regard, Stride’s simplicity is also its biggest weakness. It is designed to make it as easy as possible, but in that design, there are no options beyond that basic design. The inability to track things like memberships, car interest and property taxes or other things that don’t fit within Stride’s narrow list of categories can cost drivers a lot of money in tax savings.

Hurdlr’s ability to track more things will make it easier for users come tax time. It’s not uncommon for 1099’s from the gig companies to be incorrect, and Hurdlr allows you to see if that was true. When you can categorize some of the more unusual expenses, there’s less work you have to do at the end of the year adding everything up. Finally, a more accurate means of determining how to save for taxes better helps you walk that line between not saving enough and sending too much in in taxes.

When should you use either one?

If you’re intimidated by bookkeeping, and you want super simple, that’s when you might look at getting started with Stride. It’s a good way to get your feet wet. Stride Tax can get you in the habit of tracking your expenses, miles, and income.

If you work with multiple delivery apps, Stride is not going to be a good fit. All of a sudden, when you are trying to enter more than one income record for each week, you’re either overwriting one with the other, or you have to take time and add the numbers up. You lose a lot of simplicity right there.

Do you have a car loan? Don’t bother with Stride. You are allowed to claim some of your interest on your car loan even when claiming the standard mileage rate. If 80% of the miles you put on your car for the year are for your delivery business, you can claim 80% of your interest. Stride doesn’t provide a place to put that interest.

There are a lot of legitimate expenses related to your delivery business. While sometimes it’s not as easy figuring out which category in Hurdlr to assign to the expenses, you CAN track those expenses there. All that Stride Tax lets you do is put it under “Other” and then by the end of the year, you have a lot of things to sort out.

One last question I’ll ask you. How do you like this self employed thing? Does it make you think at all that you might like to do more of this? If you ever wanted to get serious about running a business, I think you’re better off going with an app that is better suited to actually operating like a business.

Still not sure? Try them both out. They’re free.

Try Hurdlr for Free

Hurdlr has a free version. If you want the Premium version for 20% off and add automatic mileage tracking, auto expense and income tracking, and added tax calculations and reports, use my affiliate link and sign up.*

*I may be paid for purchases through affiliate links.