Filling out Schedule C is possibly the most essential part of figuring out your taxes on Doordash.

It’s even more critical than the Doordash 1099 you get early each year (or any other 1099’s from other gig economy companies). That’s because your Schedule C, and not your form 1099-NEC, is the form that determines your taxable income.

Even more important: Schedule C is the form that lets you write off your business expenses and Doordash mileage or actual expenses even if you take the $14,600 standard tax deduction (2024 tax year, $29,200 for joint filers).

And the thing is, it’s a bit simpler than you might think. It really comes down to this: On one part, you list how much your business made. In the next part, you list your expenses. You subtract expenses from income, and that’s your net profit.

That net profit is the part that gets moved over to your 1040 form as income. Your net profit (not your 1099 income) is added to other income on your Doordash tax return to determine the income tax portion of your tax bill.

It’s that same total that’s left after expenses that your self-employment taxes (our version of FICA taxes) are based on. We’ll look a bit deeper at Schedule C for Dashers. In this article we’ll look at:

- Some important information about this article

- Using Schedule C to find the right tax software for Dashers

- Filling out the business and personal information part of Schedule C

- How the income part of Schedule C works

- How the expense part of Schedule C works

- What happens after Schedule C is done?

- Final thoughts and questions about Schedule C.

Some important information about this article

This is part of a series of articles on Doordash taxes. There’s a lot more to it than you can cover in just one extensive article, and that’s why we wanted to give you some more in-depth information. You’ll find links to other articles, and you can find a list of other articles in the series.

Because this form has several entries, I thought it would be helpful to do a lot of this in a question-and-answer format. Many of the sections will have their own set of questions and answers. At the end of the article, we’ll have a complete list of all questions.

DO NOT take any of this as tax advice. The purpose of this article is to provide education on how the Schedule C form works for independent contractor taxes. For detailed information about your individual situation, you should seek out a tax professional who can provide specific answers for you.

We do focus on Doordash with this article. However, most of these principles apply to gig economy contractors with companies like Grubhub, Uber Eats, Instacart, Uber, Lyft, and many others.

Finally, this is about filing a federal return in the United States. This does not get into state or local taxes or taxes in other countries. Check with your tax professional for details related to your location.

Using Schedule C to find the right tax software for Dashers

I said this already, but I’ll repeat it. Seriously consider finding a tax professional who understands independent contractor (especially gig economy) taxes. The savings they can find may often save you far more than you pay in, and they are far more likely to keep you out of trouble.

However, if you choose to do your own taxes with a tax software program, be careful about what program you choose.

First, you must make sure that the software supports Schedule C filing. If you use the lower-priced or free programs, you may get something that doesn’t let you write off your expenses. Trying to save money can often cost you a LOT more.

Second, be careful about the free programs that support Schedule C. I’ve walked through the process on some of the free programs. I found that it’s really easy to miss important things if you don’t know what you’re doing.

The interview process in these programs is incredibly important. The less you know about the tax process, the more you need a program that will walk you through things with the right questions, asked in the right way, to ensure you don’t miss anything.

Look for the Self-Employed version of a software program. In my experience, the more established programs with self-employed versions (H&R Block, Tax Slayer, and Turbo Tax are better at 1: leading you to the correct forms like Schedule C and 2: making sure you get it right.

Filling out the business and personal information part of Schedule C

The first part of form Schedule C is where you identify yourself and your business.

You’re most likely to fill out Schedule C if you are a sole proprietor or if you’re operating a single-member LLC. If you’re unsure which one you are, it’s a good guess you’re a sole proprietor. That’s the official term for someone simply doing business as themself without any other formal business identity.

Your business is what the IRS considers a “pass-through” business. That means that the self-employment income from your business is taxed as part of your personal income taxes. It’s just another form of income that gets added to your total income on your Federal tax return, just like W2 wages.

For that reason, the IRS needs to know who you are as an individual and how your business is made up. They’ll want your social security number. They want to know what your business is. That’s what this part of Schedule C is about.

We’ll walk through this part with a question-and-answer format.

What is my principal business or profession (line A)?

The IRS instructions say to describe your business here. A short, simple phrase works nicely. I have always used “on-demand delivery services.”

What is the best business code for Doordash contractors (Box B)?

In the back of the Schedule C Instructions starting on page C-17, there is a list of different business codes. The best Doordash business code I could find (and other delivery platforms) is 492000 for Couriers & Messengers.

Should I put anything down for a business name (Line C)?

Do not put Doordash (or any other platform) as your business name. You are not filing taxes on behalf of Doordash. You are filing as a business that has contracted with the food delivery service. However, you are not a part of Doordash.

If you have not registered a business name, such as by creating an LLC or some type of corporation, do not enter a business name here. If you do have an official business name, use that name.

What should I put for my Employer ID Number (Box D)?

Most of us will leave this blank. You only put an Employer ID Number (EIN) if you actually HAVE an EIN. If you’re not sure if you have an EIN, you probably don’t. An EIN is assigned to your business by the IRS if you apply for one. Generally, it’s used if you have employees or want a tax number that identifies your business instead of yourself. It’s a good way to avoid putting your social security number out there more than necessary.

What accounting method should I mark on Line F?

If you’re asking the question, you’re probably using Cash Accounting. The vast majority of independent contractors for gigs like Doordash, Uber Eats, Grubhub, etc. use cash accounting. It simply means you pay as you go and get paid as you go. Accrual accounting is a more advanced form of accounting used by larger businesses.

If you’re using accrual accounting, you either know what to put here or you have an accountant who knows what to put here.

Did I materially participate in my business as a Doordash independent contractor?

Almost certainly, yes. I have yet to meet someone in the delivery gig economy world who did not materially participate. If you were involved in the actual deliveries or managed the deliveries in any way, you materially participated.

Should I check box H that I started my business in 2024?

The IRS instructions say, “If you started or acquired this business in 2024, check the box on line H. Also, check the box if you are reopening or restarting this business after temporarily closing it, and you did not file a 2023 Schedule C for this business.” If you filed a Schedule C in 2023, you would not check this box.

For clarification: this relates to filing taxes for the 2024 tax year.

Should I check “yes” on Line I (required to file form 1099) if I received a 1099?

The wording of Line I is a little confusing. This is not about if you received a 1099 form but whether you had to send a 1099 form to someone else. If you used a subcontractor and paid them more than $600, you are required to send a 1099 form to them and the IRS. That is when you would check yes.

The first section of Schedule C is the personal information part of the form. This is where the IRS needs to know who you are and who your business is.

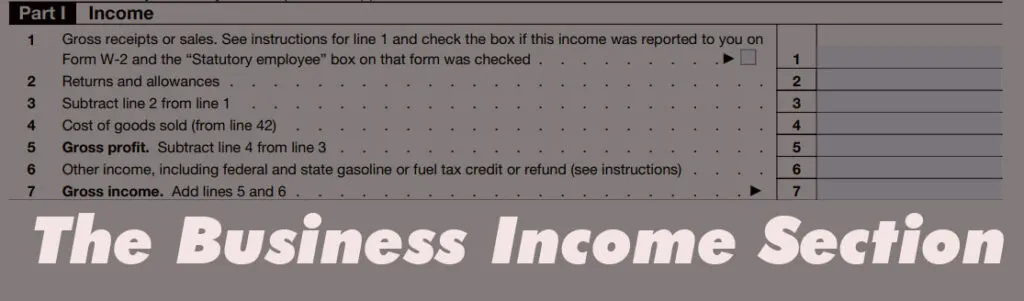

How the income part of Schedule C works

This is where the IRS asks: How much did your business make?

Many independent contractors confuse their 1099’s with W2 reports from an employee. There are some significant differences between the two.

A W-2 will report your taxable income. It just gets added to other income on your tax form. However, 1099 income is your business’s income, not your personal income. It’s added to the income part of Schedule C to help determine your personal income. We’ll get more into that when we get into the expense section.

Most Dashers will fill out just one line: Gross receipts. Because we’re not selling items, we don’t have returns and allowances or the cost of goods sold.

On line one, you enter your business’s total earnings (sales and income). If all you did was deliver for Doordash, your gross earnings are your non-employee compensation on your Door Dash 1099-NEC.

If you didn’t make enough to get a 1099, add your personal records of what you earned. Independent contractors who contract with several companies will add gross earnings from each company and customer tips. Enter that total on Line 1 of Part 1:Income on Schedule C.

What would I put for returns and allowances?

Returns and allowances are rare for delivery contractors. This is used if you received money, such as for selling an item or getting paid for work, and then had to return or refund money.

What is Cost of Goods Sold?

Cost of Goods Sold (COGS) is usually related to selling products. The purchase cost for materials you resold is a Cost of Goods Sold.

If I have to drive to provide my service, isn’t that a Cost of Goods Sold?

No. Cost of Goods sold and Business expenses are different. Equipment and transportation costs are an expense, a cost of doing business. Driving is an indirect cost; thus, vehicle costs are recorded as expenses. That’s different from the direct cost of purchasing or producing items you sell.

Is there a time when I would have a Cost of Goods Sold as a Doordash contractor?

I can’t think of any. There might be a place where it’s used with some gig platforms. For example, Uber Eats will report they paid $13, but you only received $10 (hypothetical numbers). They then say they charged you a $3 service fee. Some accountants say to use Cost of Goods Sold for that service fee since it’s a cost related directly to the service you are providing. Others will tell you to put it down as an “Other Expense” in line 27.

I have more questions about what income and 1099s on my Doordash taxes

You can look for more information in our article in this series about how Doordash 1099’s work, where we answer questions like do I have to file taxes for Doordash if I made less than $600.

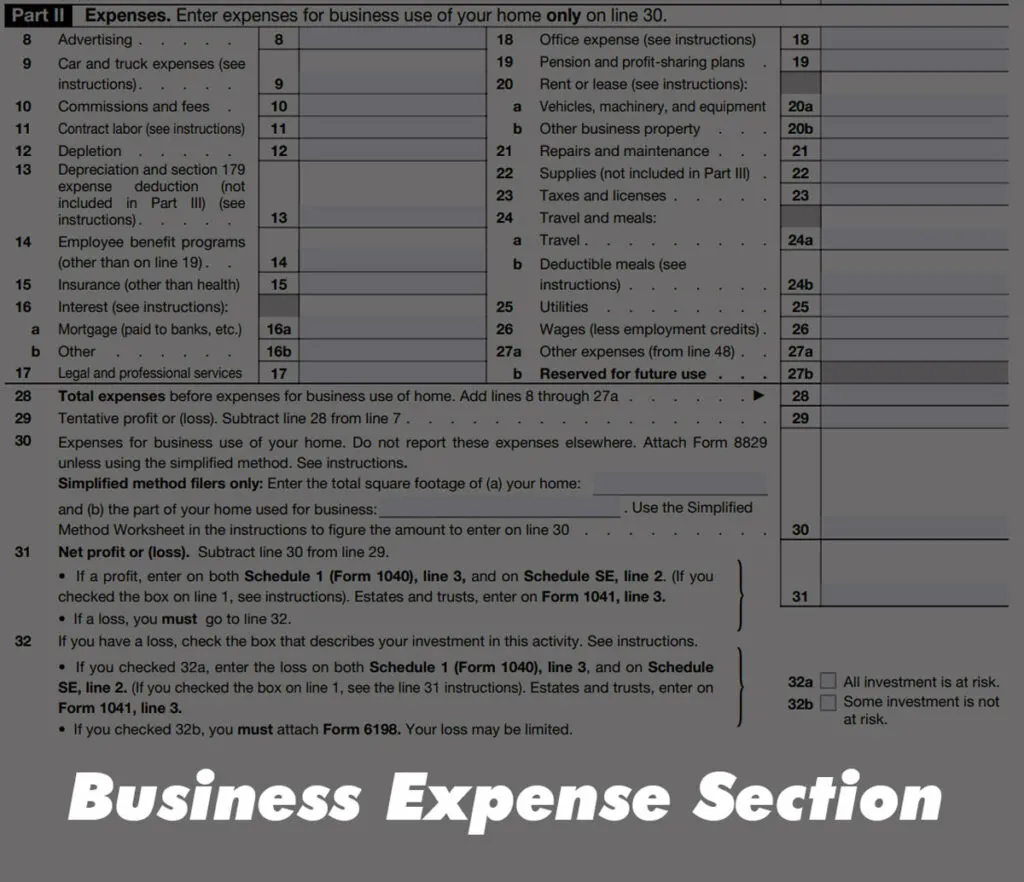

How the expense part of Schedule C works

The IRS requires you to break down your expense totals by category. There are twenty such classifications. We go into more detail about questions like what can I write off as a Doodash driver.

For more information on how the vehicle expenses work, we discuss things like if you can write off gas for Doordash and mileage vs actual expenses for Dashers in the care expenses section of our Doordash tax series.

Put the sum of all expense categories on line 28. Line 29 subtracts expenses from income to establish a tentative profit or loss.

There’s a spot for the home deduction. Can I claim a home office?

The IRS requires two things if you are going to claim space for a home office: 1) the space is dedicated to your business and is not used for personal purposes, and 2) a substantial part of your business operations happen in that space. In most cases, it’s difficult to make a case that a significant part of our operations as an on demand food delivery driver happen in your home office. We go into more detail on the home office deduction for Doordash drivers.

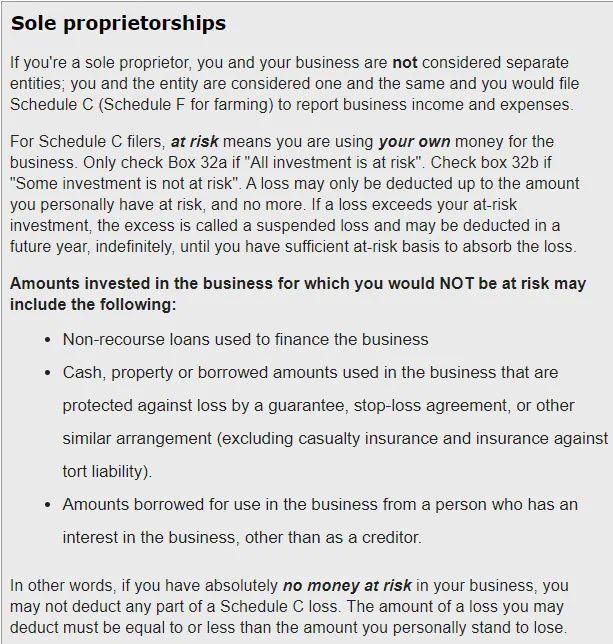

What does question 32 mean by if my investment is at risk?

On line 32 of Schedule C, you indicate if your investment is at risk if you had a loss. As gig economy contractors, we’re probably thinking, what investment? Loophole Lewy explains it as well as anyone in the screenshot below: “as a sole proprietor you are using your own money for the business.” Vehicle expenses and other business expenses are investments in your business.

You would only check that it’s not at risk if there were outside interests that would absorb the loss. That’s pretty rare for independent contractors.

What is Part IV:Information on your vehicle for?

This section is where you enter additional details about your vehicle deduction (line 9 in the expense section of Schedule C).

What do I do if I had more than one vehicle?

You should keep records separately for each vehicle. On a lot of tax software programs, they’ll have you input information for each vehicle. Then the program generates a Part IV for each car.

Was my vehicle used for personal use during off duty hours?

You would select yes if you used your car for personal use outside your Doordash deliveries or other business driving. If you were strict about using the car only for business, you would put no.

Why would they ask if I have another vehicle for personal use?

I see this as a consistency check. For example, if you listed 100% of your miles for business use but said you didn’t have another vehicle available for personal use, that can raise some doubts.

What kind of evidence are they asking for in question 47?

The main thing they’re looking for is if you have a record of your miles. The IRS requires a log that has a daily record of your business miles, showing date, miles driven, where you went and the business purpose. You can read more about the mileage log requirements for Dashers here.

I used Hurdlr or another GPS app to track my delivery miles. Does that mean it’s not written?

As long as an acceptable mileage log can be printed out, that qualifies as a written log.

What’s the purpose of Part V Other Expenses?

Several expenses don’t fit well into the expense categories in lines 8 through 26. Part V is where you write a description of the items and the total paid for those items. Not having a description makes it easier for someone to simply make up an “other expenses” number.

“Other expenses” might omc;ide business subscriptions and memberships (think AAA or if you joined an online community of Dashers), Uber Eats service fees, etc.

This other expense section is one reason I’m not a fan of Quickbooks Self Employed or Stride Tax. Neither one lets you create different “other” expense categories for tracking. Thus you get stuck doing a lot of work later.

What happens after Schedule C is done?

If you had more income than expenses, you made a profit. That profit is added to other income for figuring out your taxable income, thus figuring out your income taxes. This part of our series details the rest of the income tax filing process for Doordash delivery drivers.

Income from your business is also moved to Schedule SE. Schedule SE is the form that calculates your self-employment tax. We talk more about how that works and answer questions like does Doordash count towards social security?

If your business had more expenses than income, you had a loss. That loss may be deducted from other income for income tax purposes. Speak with your tax professional to determine if this is the best way to approach a business loss on your taxes.

You might not have to pay Self-Employment tax if your Schedule C profit was less than $400. However, you still add profit to your other income for income tax purposes.

You should notice that all of this is part of the income portion of your income tax process you go through at tax time. Schedule C is where your personal income is determined. That’s an important point because of the fact that this is where your business expenses are claimed.

Too many contractors make the mistake of thinking they have to itemize their tax deductions to claim business expenses. That’s an expensive mistake.

Once done with Schedule C, you’ll wrap up the rest of the tax process. Our Doordash tax calculator helps you estimate how your profits impact your tax bill.

Final thoughts and questions about Schedule C.

The basic concept behind Schedule C is pretty simple.

- Enter your personal and business information

- Add up your income for your business

- Subtract your business expenses

- The difference is the part that impacts your income and self employment tax bill.

That’s it in a nutshell. Some of the details can get more involved which is why we have so many questions and answers on this page.

Frequently asked questions about Schedule C

Schedule C is called “Profit and Loss From Business.”

You list your income and expenses as an independent contractor for Doordash, Uber Eats, Grubhub, Postmates, and other gig platforms. Completing a Schedule C essentially creates the self-employed person’s version of a W-2. That’s because your profit from line 31 is what gets moved over as income to your 1040 form.

You should not file taxes as an independent contractor without a Schedule C. Schedule C allows you to reduce your business income by claiming business expenses. It also makes sure all the correct taxes are paid. If you skip Schedule C, you skip necessary business deductions and thus pay higher taxes.

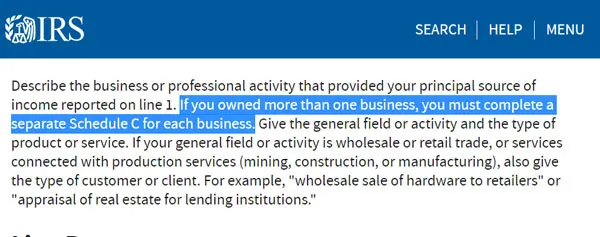

No. Independent contractor work for other food delivery services is the same type of business. You should not create multiple Schedule C forms for the same business code.

Suppose you operate more than one type of business with a significant difference between the types of business. In that case, creating a Schedule C for each business type is a good practice. For example, I make a schedule C for my online business that is different than my Schedule C for delivery work. One is home based with office expenses, while the other is out on the road.

If you do different styles of gig work that are similar, then it becomes a matter of choice. For instance, I think you can make a strong enough case for completing a single Schedule C for both. At the same time, if you prefer to keep them separate, they’re different enough that two Schedule C’s would be reasonable.

The IRS phased Schedule C-EZ out beginning with the 2019 tax year. It was a simplified version of Schedule C but is no longer an option.

The number of hours you put into this is irrelevant. Independent contractors for food delivery apps are operating a business, even if only for a few hours. You are eligible to claim expenses and use Schedule C regardless of whether you Dash full-time or not.