You’re self employed. Youreceived your Paycheck Protection Program funding. Now what?

You hear that you can get in trouble for using your money wrong. People are being thrown in jail for PPP loan fraud.

Did you bite off more than you can chew? How do you stay out of trouble?

More importantly, how do you spend that PPP money in a way that you make sure you get your loan forgiven?

It’s not as bad as a lot of people are making it out to be. Let’s wade through the confusion, hysteria and bad information and find the good information about how you need to use your money as an independent contracotr, a self-employed individual, or gig worker with apps like Doordash, Uber Eats, Grubhub, Instacart, Lyft and others.

Disclaimer: This is my analysis based on research. This article is intended for educational purposes. Do not take it as personal, legal, or tax advice. If you need specific advice relative to your personal situation you should seek out your own professional advice.

The most important term you need to understand about the PPP: Owner Compensation Replacement

There’s a lot of goofy advice out there about what to do with your money. Some advice I’ve seen floated out there has made it harder for people to receive their funds. Other advice just makes you jump through some weird hoops. They make it more complicated than it needs to be.

Where does it all come from? It comes from an unnecessary fear.

“You can get in trouble for not spending the money right.” “If you don’t use it for just the right things, the loan won’t be forgiven.” “You have to spend 40% on other forgivable expenses.”

Some of it comes because there are really two types of borrowers. There are small businesses who have multiple employees, and then there are the individuals or sole proprietors. When the CARES Act introduced the PPP in early 2020, the earliest information on eligible expenses and payroll expenses seemed to be mostly written for businesses with employees.

Small business owners with no payroll and no employees were left relying on information about unauthorized purposes verses eligible expenses. It’s easy to get overwhelmed.

There’s one requirement for how you spend Payroll Protection Program funds:

Use it primarily for payroll.

You CAN be used UP TO 40% for certain business expenses.

You don’t have to.

The original intent was to use it 100% for payroll. Then they decided to make allowances such as if you had a business with office space that included mortgage interest payments, insurance premiums, utility payments, internet access, etc, they COULD use UP TO 40% of their ppp funding for those costs.

That’s not the same as REQUIRING that part of your Paycheck Protection Program loan amount on those things. There is no requirement to use it for other things.

If you’re self-employed, it’s really quite simple. 100% of your ppp loan proceeds can go to payroll.

But that’s where the confusion, and a lot of the hysteria, comes into play. What if you don’t have payroll? Gig economy contractors (Grubhub, Doordash, Uber Eats, Uber, Lyft, etc.) have no payroll.

I see a lot of advice out there to create a payroll system for yourself. That advice is missing the point.

When you get right down to it, payroll becomes very simple for those of us who are self-employed.

This is where owner compensation replacement comes in.

The PPP looks at owner compensation replacement as a part of payroll. If you are a sole proprietor without employees, owner compensation is 100% of your payroll.

In fact, in the most common small business structures, the owner of a business cannot be put on payroll. Generally you have to have created an S-Corp or C-Corp tax structure to put yourself on actual payroll.

The government recognizes this. Thus the PPP doesn’t require a payroll system where the owner’s income is concerned.

If you are a sole proprietor or a single member LLC without employees, your payroll can include owner compensation that is up to 2.5 months worth of your Schedule C income or up to $20,833 (whichever is lower).

Most of us in the gig economy have no employees. 100% of our payroll is owner compensation. If you had no other employees and your loan amount was based on 2.5 months worth of your Schedule C income, one hundred percent of that loan can be used for owner compensation replacement.

In other words, you meet the spending requirements the moment you receive the money. 100% of your proceeds have been used for payroll.

Bench Accounting has a good article that further discusses how Owner Compensation Replacement works.

Okay, so how do I pay myself?

The same way you pay yourself as an independent contractor.

You are paid the moment that money ends up in a personal account. That’s it. You don’t need a long drawn out system.

The thing I want to tell you about paying yourself is that you literally can pay yourself however you want. You can pay it all in a lump sum to yourself right at the beginning. You can pay yourself in weekly checks, you can do an ACH out of one account into another, you can transfer it from your business account into your personal account. …Distribute it to yoruself however you would like.

Hannah Smolinski, CPA, from the Clara CFO Group on “How do I pay myself with PPP”

Most self-employed people choose to deposit in their personal account. They’ve done all they need to do.

If you created another account under your Social Security number just for the PPP you haven’t really accomplished anything. That’s because it’s still a personal account. Transferring money around between personal accounts creates no business transaction, and gives you no advantage.

The only real difference here is if you’ve already established a business account. I don’t mean a separate account you will use for business. That’s not technically a business account. It’s when the account has been created using your EIN or Employer ID Number.

In that instance, you’ve created a separation between y our business and your personal finances. In this instance, transferring money from your business to your personal account is when you get paid.

Don’t I need a paper trail for loan forgiveness documentation?

I hear this all the time. You need a paper trail to show your payroll activity.

Some will tell you to write a check each week for ten weeks so you have cancelled checks. They’ll point to information from the Small Business Administration showing all the things you need for documentation.

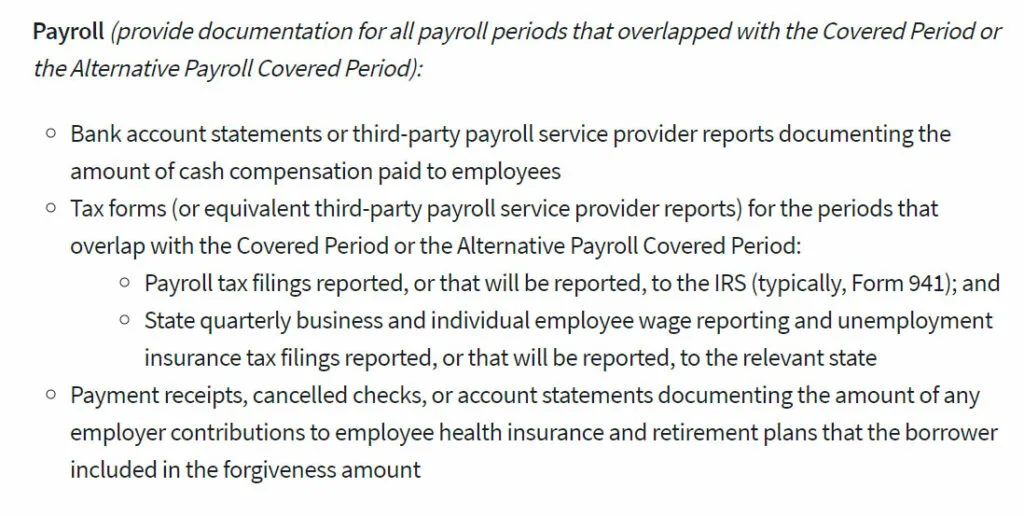

I see this screenshot posted all the time in Facebook groups and other forums. This is from the Small Business Administration’s list of documentation you need when applying for forgiveness. In that, the SBA lays out the things you need to prove you used the money for payroll:

- Bank account statements or reports from your payroll provider that show how much was paid to employees.

- Tax forms showing payroll for the covered period (typically IRS form 941)

- Documentation of payments made for employee benefit programs

So, doesn’t this mean we need a paper trail?

No. Because here’s the thing: None of the things that people are suggesting will ever meet those qualifications. This is all about actual payroll. No check that you write to yourself will demonstrate any of this because it’s not payroll.

And, the IRS requires something completely different for owner compensation documentation.

Why your paper trail is meaningless.

First off, you are not an employee. You’re an owner. That’s an important distinction.

If your business is structured as a sole proprietorship or a single member LLC, you don’t put yourself on payroll. In fact, you can’t legally give yourself a salary. You can only take a draw unless you have an S Corp or C Corp tax designation.

What this means is, you’re not on payroll.

All of that transferring money back and forth and writing yourself a check? All you’re doing is moving your personal money around as an individual. It has no bearing on whether you paid yourself. If you submit your bank records or checks to the SBA as documentation, they’ll just say, “this isn’t payroll.”

In fact, you couldn’t DO that if you hadn’t already paid yourself that money. And everything that happens now is a personal transaction.

You don’t have a payroll record. There is no 941 form that you file. You don’t file SUTA or FUTA (state and federal unemployment taxes) or any of those things.

Second, the IRS has different documentation requirements for owner compensation.

I would love to say the SBA is real clear on what they do require. Maybe the reason there’s so much confusion is that you do have to dig to find the answers.

Here’s what the SBA says:

For borrowers that received loans of $150,000 or less that use the SBA Form 3508S, the borrower must submit the certification and information required by section 7A(l)(1)(A) of the Small Business Act and, for a Second Draw PPP Loan, revenue reduction documentation if such documentation was not provided at the time of application

SBA Interim Final Rules on PPP Program Loan Forgiveness Requirements page 39, Section 6 (b).

For all loans, the 2019 or 2020 Form 1040 Schedule C or F that the borrower provided at the time of the PPP loan application must be used to determine the amount of net profit allocated to the owner for the covered period.

SBA New Interim Final Rule on PPP Loan Forgiveness Requirements, page 40, end of Section 6(b).

Both of these quotes are part of the SBA’s answer to “what documentation are borrowers who are individuals with self-employment income who file a Form 1040, Schedule C or F required to submit to their lender with their request for loan forgiveness?”

What it boils down to is simple: The Schedule C that you used as the basis for your loan amount. That is your documentation that you were in business.

In other words, no paper trail. The ‘paper trail’ only relates to actual payroll records.

Spending things in the right way.

The most reliable PPP source on an ongoing basis, in my opinion, is Max Maher. His videos have been in depth and accurate. In particular, he has sources at the SBA that provide answers and clarification on PPP and EIDL questions.

He explains it well:

Make sure you’re spending things in the right way. Now, how do you spend things in the right way? Great question. For most people if you don’t have employees, it’s as simple as can be. All you have to do is pay yourself.

Now what does that mean? They don’t really define it that well. And it seems like they don’t really care as the SBA if we’re being completely honest. Paying yourself just means money is in your bank account.

Now originally we had thought paying yourself means your money is deposited into a business bank account and then sending weekly disbursements to your personal account. And they basically said since then, it’s not even that complicated. Don’t even worry about it that much…

…All you have to do to pay yourself, if you don’t have employees, is to either have the funds deposited into your business bank account, however you want to transfer them… and boom, you’ve paid yourself. Maybe you don’t have a business bank account, you just have a personal bank account which many people do. If the funds were deposited into your personal bank account, boom, you’ve paid yourself. Congratulations, you can get full forgiveness once you’ve applied. It’s really that simple if you don’t have employees.

Max Maher: Complete guide to get 100% PPP Forgiveness and Avoid Trouble.

Should I get a second bank account for my PPP Loan?

Creating a second bank doesn’t do a thing for you.

Here’s the thing: The entity that applied for the loan has to own the account. If you applied for the loan with your Social Security Number as your identification, you have to deposit the money in a personal account tied to your SSN.

What does that mean?

First, a second account using your social security number means nothing. If money was deposited to a personal account, you were already paid. Nothing you do transferring funds between personal accounts will give you any documentation of any business transactions. All of that is something that has happened after you were paid.

You may also have created suspicion with the bank. Think about it: You create an account. Uncle Sam deposits thousands of dollars. You pull that money out right away. That’s the kind of stuff that raises red flags. I know of some who had their financial institution close their account before they could touch their money.

So maybe you decide to create a business account. You need an EIN for a business account. So you get one, create the account. Guess what? You can’t deposit to a business account registered to an EIN when your application is tied to your Social Security Number.

Here’s the only time I can think of that it makes sense to create a new account for the PPP. If you have an EIN and used that EIN when you applied, but you don’t have a business account for that EIN. Your lender might not deposit the funds in a personal account. Remember, the owner of the account must match the application.

That will be rare. Usually, if you’ve taken the trouble to establish an EIN for your business, you probably set up a bank account.

Related: PPP and Self-Employment: 6 Myths, 11 Best Reasons to Apply.

It IS a good idea to use a separate account for your business.

It’s just not necessary from a PPP loan forgiveness standpoint.

You should keep your business and personal taxes separate. The better job you do of that, the easier you will be able to justify your business expenses.

When you have your business and personal finances all in the same account, you muddy the water with the IRS. How do they know which is business and which is personal?

If you were trying to figure out if you met the 25% income reduction qualification for PPP 2.0 and had to go back through bank records to see what you earned each month, you’d have an easier time doing it if all of your deposits went into an account dedicated to your business.

Ultimately, having a separate bank account makes bookkeeping and taxes easier. Nerdwallet has a good article on how beneficial it is to use a separate bank account as a gig worker.

A bank account dedicated to your business is a big part of my recommendation for how to handle your money:

- Have your earnings from your self-employment (such as deposits from Grubhub, Doordash, Uber Eats, Instacart, Uber, Lyft and others) deposited directly into your business account.

- Set aside money for taxes, future expenses, and possibly some paid time off.

- Transfer the remaining funds to your personal account.

Getting a different account is a good idea for your business. But it’s only useful if you’re using it regularly and consistently FOR your business.

So how DO I get my PPP loan forgiven?

Here’s what I did.

I waited. 22 weeks after disbursement (close to the end of the allowed 24-week period, my lender sent an email letting me know it was a good time to apply.

The loan forgiveness process was easy. Businesses with loans less than $150,000 use a one-page form 3508S. Since $20,833 is the maximum loan amount for a self-employed individual without employees, that includes all of us who drive in the gig economy.

That form is pretty simple. You enter your loan amount, loan number and when you got the loan. You’re asked how much is for payroll costs.

They ask how much payroll you had. The SBA says for the self-employed, that’s 2.5 months worth of your Schedule C income.

Sound familiar? It’s the same criteria for determining your loan amount.

It’s not even based on your payment records. Your full forgiveness is based on the same Schedule C used to determine your loan amount in the first place.

You qualify for full forgiveness, based 100% on payroll (your owner compensation replacement).

Don’t get caught in the confusion over eight-week period or twelve-week periods. Only 8 weeks of taxable income on your Schedule C was forgivable in the original CARES act. New legislation including the Paycheck Protection Program Flexibility Act expanded that to up to 12 weeks (making the amount fully forgivable).

They may ask for your Schedule C again and tax return again. You may have to provide documentation that you were in business before February 15, 2020. For second ppp loans you may need proof of a reduction of income such as bank statements or a book of record.

That’s about it. It’s really that simple.

The government is intentionally trying to include more independent contractors, NOT trying to make things harder.

Here’s the thing. There are a lot of people taking this loan out. If the government were to dig into whether you’re writing yourself a check and all of that, they’d be spinning their wheels wasting a lot of time. That’s why the SBA and Treasury Department created what they called safe harbors.

So much of the stuff I see out there is playing on the fear of accidentally committing fraud by not taking the right step. Frankly, I think a lot of people are using that to convince you to buy certain products (like bank accounts) and they get a commission. But the whole idea of a safe harbor is to protect against accidental fraud like that.

Think about it. They opened things up to self-employed individuals. Then they expanded the amount that is forgivable. Next, a second-draw loan created the opportunity to add to the funding you received the first time.

At one point, if you received the $1,000 forgivable grant as part of the economic injury disaster loan (EIDL), that did deduct $1,000 from your forgivable amount. Originally, that portion would have to be paid back (but over five years at only 1% interest). The December legislation that opened everything up again changed that. Now the EIDL grant doesn’t impact forgivability at all.

Most recently, the administration changed rules so the loan could be based on your gross income (Schedule C Line 7) rather than just net profits (line 31).

Finally, they made the loan forgiveness application process easier. For the owner compensation part of payroll, it’s not even based on payment records. It’s all based on your Schedule C.

The whole point here is, they’re trying to help small businesses out. That includes you. It’s about taking away barriers to the funding, not creating more.

Summing it up.

There’s a lot of overthinking going on here.

The bottom line is, the best way to spend your money for PPP forgiveness eligibility is, pay yourself. I know that seems too simple, but that’s what it comes down to.

Obviously, if you had employees, now it gets a lot more involved. But as a delivery driver for third party delivery companies like Doordash, Uber Eats, Grubhub, Instacart, etc., or a rideshare contractor with companies like Uber or Lyft, it’s really pretty much it.

Don’t go creating additional bank accounts and moving money around. It doesn’t help you. It can raise suspicions because that kind of money movement isn’t natural.

That doesn’t mean you can’t get in trouble for fraud. What they’re trying to do though is focus their enforcement on people who are actually intentionally committing fraud. That includes doctoring numbers, making up fake documentation, things like that.

If you applied in good faith, quit worrying. Stop jumping through hoops that the federal government never put in place themselves. Relax.

Pay yourself. And go back to running your business.

Michael Wilson

Thursday 17th of June 2021

Hello, I applied for PPP initially through Womply and they were asking for duplicated information as there is a glitch in their system so I applied through Blue acorn and was funded. Now Womply has funded via Harvest. I sent an email to Harvest requesting cancellation before funding but they did not respond and sent the monies to my bank today 6/16/21. How do I send the monies back to Harvest? Harvest has no phone communications as when the number listed is called you are directed to send an email. Harvest just funded but I do not want the monies as I've already received my first draw through Blue Acorn. How do I rectify this? Harvest has not responded to my email and they do not have live chat neither is their phone accepting calls.

Angel

Monday 10th of May 2021

This was a great article that got straight to the point! Thank you for all your due diligence and sharing your findings with us.

ronald.l.walter

Wednesday 19th of May 2021

Thank you. I appreciate the kind words.

Anna

Wednesday 5th of May 2021

My husband did what you suggest, simply transferred the amount to a personal account in a lump sum. However, now that we are applying for a 2nd loan, biz2credit is asking for more documentation on how the money was spent: "if the client has transferred their Draw 1 funds into another account. Then please provide that account's MTD Statement with highlighted expenses as in where was the money spent. The given statement only shows the money being transferred to another account the very next day it was deposited. (client needs to justify their Draw 1 Utilization)" Has anyone been in a similar situation? How was it resolved? Thank you.