Yes, delivering for Uber Eats is self-employment. If you signed up with Uber Eats, you did so as an independent contractor. That means you deliver as a business, not as an employee. That’s a form of self-employment.

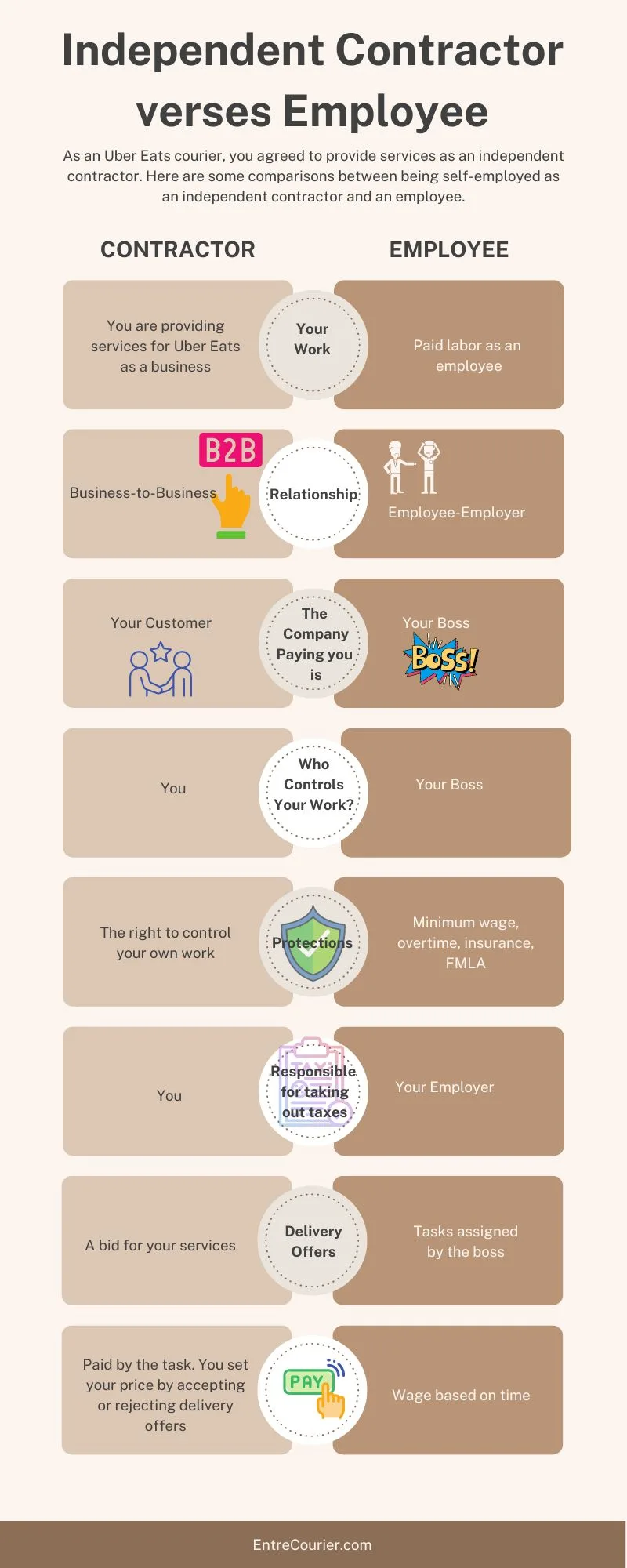

You must understand the differences between an independent contractor and an employee. They are not just different versions of the same thing.

Not understanding could create serious money problems, especially around tax time. For that reason, pay attention to what it means when you sign off on a contract that says you’re an independent contractor. To help with that, we’ll look at the following realities of being an independent contractor:

- You are providing services for Uber Eats as a business

- You are not an Uber employee

- Uber Eats is your customer

- Uber can not control your work

- There is no safety net

- You are on your own for taxes

- Uber Eats delivery offers are a bid for your services

- You get to set your own price

- Your best strategy is to be your own boss

This article is part of a series on being an Uber Eats delivery contractor. You’ll find links to other articles that go into more depth about different topics, and you can find a list of articles at the end of this one.

You are providing services for Uber Eats as a business

That’s pretty much the definition of being an independent contractor. You’re doing something for a business as another business rather than as an employee.

Technically, legally, and contractually, this is a business-to-business relationship. Uber Eats has outsourced delivery work to us as small businesses.

I often refer to gig economy workers as accidental business owners. Most contractors aren’t thinking of operating a business. They’re just looking for a way to make money.

You are not an Uber employee

Because you are performing services as a business, you are not an employee.

Your relationship with Uber Eats is very different than an employee relationship. You don’t have a supervisor.

You don’t need to worry about performance reviews, an employee manual, or anything like that.

There are no office politics.

You don’t have to worry about a supervisor or micromanagement. Uber Eats support personnel are not your bosses.

Understanding that you’re not an employee completely changes the relationship. The fact that you’re in a business-to-business relationship gives you power.

However, there are trade-offs. If you want employment protections, you are out of luck.

Uber Eats is your customer

If you are operating a business, you must have a customer, right?

Uber will try to tell you that they are not your customer. Instead, they claim to be a tech company that connects you to customers. There are several reasons this is incorrect:

- You sign your contract with Uber, not with the end user.

- Uber controls the relationship with the customer.

- Uber Eats is the one that pays you.

- If there is an issue, Uber Eats makes decides to terminate the business arrangement.

The bottom line is that they are your customer in this relationship, no matter how Uber spins it.

When you think of them as your customer rather than your boss, that changes the dynamic of the relationship. It also creates a different mindset for how you operate your business.

For instance, the relationship has no obligation until you have agreed to accept a delivery offer. You don’t have to do what Uber wants. Uber Eats doesn’t have to give you anything either.

Uber can not control your work

In fact, it’s illegal for them to try to control you.

There are laws defining when a company can use independent contractors and when they have to hire employees. There’s one common element in all of the laws, which is control.

The only thing that Uber can expect from you in an independent contractor relationship is that you complete the task you agreed to do. How you achieve that result is up to you.

Uber Eats is not allowed to tell you when to work. They cannot require you to have a specific acceptance rate. All they can do is expect you to fulfill your agreement when you accept an order from them.

This gives you the freedom to set your own schedule and make decisions about how you operate your business. You determine when you will work and what orders you will accept. Uber can not penalize you for those decisions.

There is no safety net

Being an independent contractor means you don’t have any legal employment protections.

Remember that you agree to do this as a business. If you open a restaurant and no one shows up, you’re out of luck. If you start a YouTube channel and don’t get viewers or ad money, there’s nothing you can do about it.

The same applies to independent contractors for gig economy companies like Uber Eats.

There are no guarantees. You don’t get any minimum wage or overtime with Uber Eats.

If Uber Eats deactivates your contract, you don’t have the same recourse or right to due process that an employee would have.

You are on your own for taxes

This is the one difference that probably gets more drivers in trouble than any others.

Employees are accustomed to having taxes taken out of their paycheck for them. There is no such withholding with Uber Eats. Uber Eats pay is not the same as a paycheck.

It is up to you to set aside money for your Uber Eats taxes. That includes your federal income taxes, state and local taxes, and Social Security and Medicare taxes.

If you’re not paying attention and are unprepared, you can owe several thousand dollars when tax time comes around.

Tax news isn’t entirely bad for independent contractors. Because you’re doing this as a business, taxable income is your profit, which is what’s left over after expenses. You can write off business expenses regardless of whether you itemize or take the standard tax deductions.

Uber Eats delivery offers are a bid for your services

When Uber Eats sends a delivery offer, it’s not an assignment. You are not required to accept the offer.

Instead, Uber Eats is saying we have a delivery available. Here are the details, and this is what we expect it to pay. Do you want to take it?

In other words, it’s a bid for your services. You can say yes or no.

It’s not all that different than walking up to someone and offering ten bucks to paint your house. You can’t expect them to take the offer and there’s no obligation on either part unless the two of you come to an agreement.

You get to set your own price

Some will say that you can’t really set your prices, that Uber Eats is the one setting the pay formula.

However, there’s a lot of variety in what you get offered. How much you make with Uber Eats is a combination of the Uber Eats base pay, incentives, and the customer tip. Some deliveries take longer and require you to drive further than others.

When it’s all said and done, you can look at a delivery offer and determine if it makes enough sense to accept it.

Doordash, another gig economy delivery company, says in their contract that contractors “are free to negotiate their compensation by among other things accepting or rejecting opportunities transmitted through the Doordash platform.”

I put this into practice by setting an hourly rate as my price and then breaking it down to a per-minute amount. My rate is $30 per hour or 50 cents per minute.

When I get an offer, I ask if it will pay 50 cents per minute. If Uber Eats offers $10.00, I ask myself if I can complete it in 20 minutes or less. If I think I can, it meets my price, and I accept. Otherwise, I’ll reject it.

Uber offers a bid for your services. You get to decide whether or not that bid meets your price.

Your best strategy is to be your own boss

Some say Uber misclassifies drivers, exploiting them by bypassing employer responsibilities when designating them as independent contractors.

I think you could make a solid case for that. However, it doesn’t accomplish anything to dwell on it. All it does is give Uber power.

When you’re a business owner, everything is your fault. That’s a good thing because it means you’re in control.

Gary Veynerchuk

Instead, when you decide it’s all up to you, that changes everything. Your successes and your failures become your own. You no longer rely on Uber, nor are you at their mercy. Make your own decisions. Be strategic about when and where you deliver.

Your agreement with Uber says you’re doing this as a business owner. You can beat them at their own game by taking those words to heart. Treat this like a business and decide you are the one in charge of what you do.

Uber can’t assign tasks to you. They can offer an opportunity to you, but it’s only a bid for your services. You can decide whether that opportunity makes business sense.

And if Uber is a customer bidding for your services, you must understand that you can have other customers. If Uber Eats won’t meet your price, maybe Doordash, Instacart, Grubhub, or someone else will.

If you don’t think you’re running a business here, don’t sign the contract and expect to be given something you didn’t agree to.

The Uber Eats Delivery Driver Series

A series of articles that cover all different aspects of delivering for Uber Eats as an independent contractor.

This is the overview article of the series, touching on each of the main topics that are covered in other articles.

We discuss how much Uber Eats drivers can make, and how pay works for independent contractors on the Uber delivery platform.

Guidance on how to determine the best times and days to deliver for Uber Eats.

Five questions to ask to determine if delivering full-time makes sense, and eight keys to success if you do make that decisions.

How delivery opportunities are offered to Uber Eats couriers, their freedom to accept or reject, and tips for making good decisions.

How taxes work for independent contractors who deliver for Uber Eats. This is the first article of a series related to Uber Eats tax issues..

A review about how delivering for Uber Eats works, and pros and cons of working with Uber Eats as an independent contractor.