Doordash rolled out a pilot program in some areas recently to test out a new mileage tracking feature. Fortunately, my market was one of those test markets. This gave me a chance to test it out.

We’re three weeks into the four week program and I thought I’d offer my thoughts on what I’ve seen so far.

I do have to give Doordash some credit. In just a few weeks I’ve noticed more improvements to the Dasher experience than I think I’ve seen in the four years previously that I’ve been a Dasher. I’m glad to see they’re trying this, though I think there’s a lot more they can do with it.

Doordash has been busy with a lot of pilot programs. For instance, in late 2022 Doordash introduced their Drivewell pilot, which signs Dashers up for an app that monitors driving and provides safety suggestions.

Here’s my opinion of this particular program in a nutshell: While it’s better than what Doordash has done in the past, it’s still very disappointing. If Doordash doesn’t make drastic improvements, Dashers can lose a lot of money by way of taxes if they rely on this program.

You still need to track your own miles. Sadly, Doordash’s mileage tracking isn’t even a good backup option.

We’ll talk about why I feel this way. In this article, we’ll look at:

Doordash’s mileage tracking pilot details

On January 24, 2022, I received the following email:

In case there’s any problem reading the image, here’s what it says:

Did you know that tracking your miles while dashing can be important during tax season? It’s a big reason why we are piloting a new program to track it for select participants like you.

Here’s how it works:

Each week in the pilot, we will provide you with a summary of the miles you traveled for every dash, including the miles while you were not actively on a delivery. The pilot will start Monday, January 24th and end Sunday, February 20th.

And then it refers you to some of their additional information about tax season and gives you an opportunity to opt out. At the end, the following is in fine print:

Disclaimer: As an independent contractor, you are responsible for keeping track of your earnings and accurately reporting them in tax filings. If you have any questions about what to report or deduct on your tax return, you should consult with a tax professional. DoorDash cannot provide you with tax advice.

I thought that disclaimer was worth posting because it’s right on the money. One thing I should add: You are also responsibility for keeping track of your expenses, including miles. Don’t rely on Doordash. I’ll talk more about that later.

How the mileage pilot program works

There’s not a lot of detail in this email. Doordash hasn’t really said any more since then, but here’s what I can put together from what they’ve said and done so far.

The way it appears, Doordash is actually tracking the miles you drive via the GPS on your phone. This does not seem to be an estimate, but actual tracking. If so, that’s a good thing.

You’ll notice that I used a lot of iffy language in that last paragraph. That’s because Doordash doesn’t exactly say how they’re doing it or what they’re using. There are a lot of unknowns here:

- When exactly do they start tracking?

- What if you begin your Dash outside the zone? (I can do that now with a feature called “Dash along the way”)

- Do they keep tracking if you pause your dash?

- Will they track the miles you are driving BACK to your zone if you took a delivery that went out of zone?

I haven’t been dashing much lately, I’ve focused on other platforms. However, I I couldn’t pass up the opportunity to try to figure each of these things out, and see how Doordash would do.

Late each Monday I’d get an email like the following:

As promised, it was a summary email. I was curious about if they would send a daily breakdown, which would make this program more useful for a couple of reasons. Unfortunately, all they send is a weekly total.

My results verses actual miles driven

I dashed for a lunch shift each week. I tracked the odometer readings at the start and end of the dash AND tracked miles using Hurdlr.

Some of the things I did during these dashes:

- I would start the dash outsize of a zone and ‘dash along the way.’

- There were deliveries I normally wouldn’t take because of the distance, because they gave me the opportunity to see what happened when deliveries took me outside my dash zone.

- I intentionally paused or drove extra miles between orders to see if those miles were tracked.

- If I thought a restaurant might not quite be ready with the food, I’d drive a little out of the way to see if Doordash tracked those miles.

Week 1 results:

- Odometer miles 50.9

- Hurdlr miles 50.22

- Doordash summary: 48.29

Week 2 results:

- Odometer miles 32.6

- Hurdlr miles 34.72

- Doordash summary: 1.1

Week 3 results:

- Odometer miles 47.4

- Hurdlr miles 47.6

- Doordash summary 46.37

My thoughts from the results

I was pleasantly surprised on week 1. That’s when I did the most “extra” driving. That Doordash was as close as they were to the actual thing was quite encouraging.

Week three results were more accurate still. Doordash was only a mile off.

The problem is week 2. I was disappointed but not surprised to get my summary of1.1 miles. In fact, I’m pretty sure they missed an entire day as I’d logged on for 1 mile earlier that week.

So here’s what I gather so far from my experience

One, Doordash does indeed appear to be tracking every mile on a dash. I did a lot of extra driving, and if they’d gone only on their estimated miles they would have been a lot further off. This is good.

Two, Doordash is Doordash. Their app glitches. It’s not a surprise that their mileage tracking glitched as well. Even a single day of not tracking is not good.

One of the reasons I chose to only deliver for one day of the week was so I could know exactly what Doordash was tracking, since they were only giving a weekly total. The one problem with the small sample size is it’s hard to know how frequently Doordash glitched. Is one out of four days the norm, or was it really one out of 21 that it didn’t work.

There’s some promise in the results but even missing one day is not good. Overall, Doordash only captured 74% of my miles.

Think about it this way: If Doordash misses 26% of your miles, you’re losing out on $152 per thousand miles in mileage deductions (at the 2022 rate of 58.5¢ per mile). That’s an expensive problem.

How this compares to what Doordash has done in the past

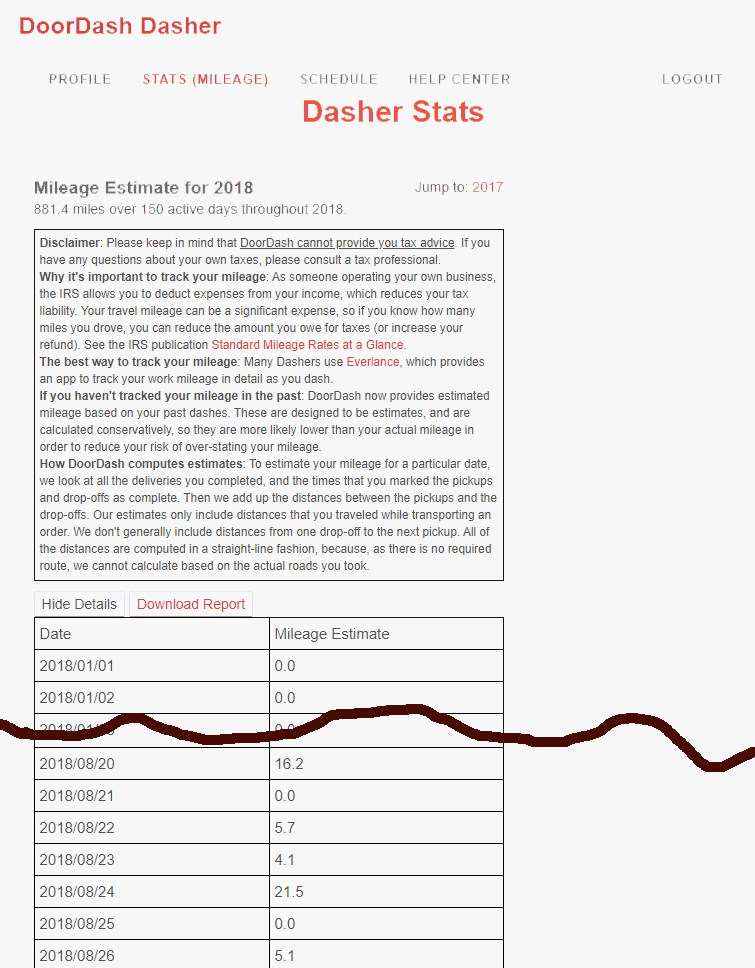

Up until now, Doordash has only provided mileage estimates. There have been two different versions of their estimates in the four years I’ve been a Dasher.

At the end of the year, up through the 2019 tax year, Doordash used to publish a log of estimated miles that you could download. The good news was, the log was IRS compliant, in that it gave you a daily total.

The bad news was, the log was very inaccurate. As they stated on the estimate, it was based on a straight line measurement between the restaurant and the customer. It did not take into account the drive to the restaurant and didn’t measure what a realistic driving route would take.

Compared to the miles I recorded for Doordash deliveries, the log they created only captured 41% of the miles I drove.

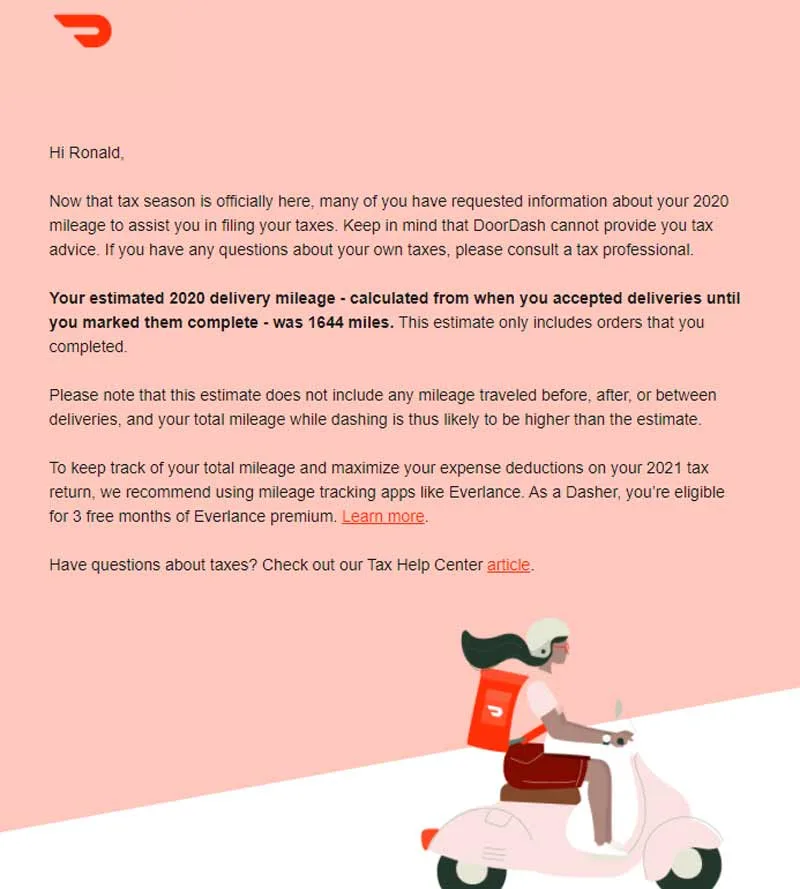

Starting in 2020, Doordash switched to sending only an annual estimate. On February 22, 2021 I received my annual mileage estimate email from Doordash.

I anticipate that they will do the same thing for 2021 miles.

This too was an estimate “calculated from when you accepted deliveries until you marked them complete.” I’m pretty sure what they did was just add up all of the estimated miles that appeared with every offer, but only on offers that were completed.

This did not track miles between deliveries, or miles driven to restaurants on orders that were reassigned. This time, Doordash captured 85% of the miles that I actually drove for Doordash deliveries. A huge improvement over 41% but still lacking.

The difference I see in this pilot program and what Doordash did before is that this time, Doordash is tracking actual miles driven. It’s no longer an estimate. When their system is working, it’s far more accurate than estimates for previous years.

Where Doordash mileage tracking can and cannot help independent contractors

In the past, relying on Doordash estimates has been an expensive mistake. Doordash didn’t capture all the miles that they could have.

I’m hopeful that Doordash can fix whatever glitch caused it to miss a day of deliveries. If they can, there’s definitely an improvement over what they’ve done in the past.

Where the new mileage program doesn’t help Dashers.

Even with the improved tracking and even if they fix the glitches, you should not rely on Doordash to track your miles.

If you’re relying on Doordash and if they fail to track miles, you’ll lose any mileage deduction for those days they aren’t tracking. I don’t know if the one day they missed is regular (1 in 3 or 4 days) or an anomaly. Either way, they are missed miles.

The other problem with this is, they only give you a weekly total. That total is not IRS compliant, as the IRS requires a daily log of your miles.

Without seeing daily totals, it’s harder to evaluate whether or not Doordash has failed to track. It was easy for me because I only delivered one day a week. But if you deliver every day, it’s harder to tell from the total that something is amiss.

It’s very possible that you will have trackable miles even when not logged into the Doordash app. For instance, if you decide to move from one zone to another. You log out of one zone and go available when you arrive in the other. Doordash won’t capture those miles.

Obviously, this won’t be as much of a help if you are multi-apping. It only captures the miles when you are dashing. If you log out to take an Uber Eats or Grubhub delivery, that’s not going to be captured.

Where the new mileage program can help, if implemented.

The biggest benefit here is that if you forgot to track your miles, Doordash gives you a better backup than you would have had before. That’s assuming of course that they can stop the glitches.

Maybe the best thing about this pilot is that it appears to be tracking most miles you should be able to track. I’ve stated before that the best rule of thumb for when you can track miles is when you are active on the app with intent to accept offers.

Because the Doordash pilot program tracks miles when logged into the app, the miles it tracks are going to be legitimate.

Perhaps the biggest problem with the annual Doordash estimate (besides inaccuracy) is that it’s only one yearly number. While you could attempt to claim miles based on what Doordash sent you, an IRS auditor may not accept that number. That’s because it doesn’t have the kind of detail that would satisfy them.

That’s a subjective decision on the part of auditors. They could choose to accept it because there’s a legitimate basis, in that it came from someone else.

Getting a weekly report might make it a little more likely that an auditor would accept it. It’s a little more detail, even though it still doesn’t meet the IRS requirements.

My suggestions for what Doordash can do to really help their Dashers with better mileage reports

The best thing that Doordash could do is give us the reports in an IRS compliant format. This is something that Doordash could easily do with a simple tweak to their report.

The IRS requires four things in a compliant mileage log:

- The date

- The number of miles

- Where you went

- The business purpose.

It’s not that hard for Doordash to give us a compliant report. They could easily program their computer to print out a table that gives a daily total.

They already did that in the past with the reports they used to let you download. It had two columns. It had date and miles. That satisfies half of the requirement. If they just added a third column that said what zone you dashed in, that would satisfy the ‘where you went.’

The fact that it’s a mileage report of miles driven while delivering for Doordash, that makes it pretty clear that the business purpose was delivering for Doordash.

The other benefit of a daily report is, it would let us see if there were any times where they failed to record. If you made $50 and they show 0 miles, it’s pretty obvious something is missing. If you know a day of data is missing, you could look into something like Google Maps timeline to get a record of how far you drove on that day.

The Doordash mileage tracking pilot is a step in the right direction.

I’m encouraged by some of the adjustments Doordash is making. Obviously there are other things I wish they’d improve on, but it’s a step in the right direction.

That said, even if they roll this out nationwide, I do not recommend that you rely on their report. Doordash is notorious for things not working all the time. I’m sure their tracking will be the same.

After all, in three weeks it’s already failed at least once for me.

Their weekly mileage tracking can work as a great backup in case you forget or something goes wrong with your mileage tracking.

That’s really all it should ever be. One thing I agree with Doordash about: As an independent contractor this kind of thing is YOUR responsibility, not Doordash’s.