As a Doordash delivery driver, you provide delivery services as a business, not as an employee. We’re technically small business owners, which has tremendous benefits for you when it comes time to file your taxes.

The main benefit is what you are taxed on. Your business tax bill is based on your profits (what’s left over after expenses), not what you received from Doordash. In other words, you can write off your business expenses.

So, what exactly CAN you write off? Aren’t we better off claiming the standard deduction? How do we know what is deductible and what isn’t?

We’ll take a look at how business expenses work as tax deductions for Dashers, including:

- Why you can write off expenses even if you take the standard deduction

- The best guideline for what you can claim as an expense

- Three types of costs that are NOT business expenses

- Some common Doordash driver deductions, listed by expense category

- How to write off expenses on your Doordash taxes.

- Frequently asked questions about Doordash Tax Write-Offs

About this article

The purpose of this article is to explain how business expenses can be taken as a tax write-off for Doordash independent contractors. It’s one of several articles in our series about Doordash taxes in the United States. We’ll link to other articles where appropriate, and you can view the entire Doordash tax series list here.

This is not tax advice, and you should not take it as such. We intend to educate and explain how taxes work for Dashers and other gig workers. We only discuss U.S. taxes in this article. You should seek a tax professional who can guide you in your specific situation and understands your local and national tax rules.

Why you can write off expenses even if you take the standard deduction

A common myth costs many Dashers a lot of money. Both prevent Doordash delivery drivers from tracking and claiming legitimate business expenses. It claims it’s not worth tracking expenses if you take the standard tax deductions.

That myth is wrong.

You CAN write off Doordash expenses regardless of whether you itemize or take the standard tax deduction. That’s because business expenses are not tax deductions. They are treated differently and handled in different parts of the tax return process.

As a sole proprietor, profit determines an independent contractor’s taxable income. You list expenses and income on Schedule C, not on your itemized deductions. This allows you to write off your business expenses and simultaneously claim the standard tax deduction.

At the end of the day, it’s always better to claim a business expense than it is to take a tax deduction. That’s because business expenses reduce income for purposes of figuring Door Dash Self-Employment taxes, whereas personal tax deductions do not.

The best guideline for what you can claim as an expense

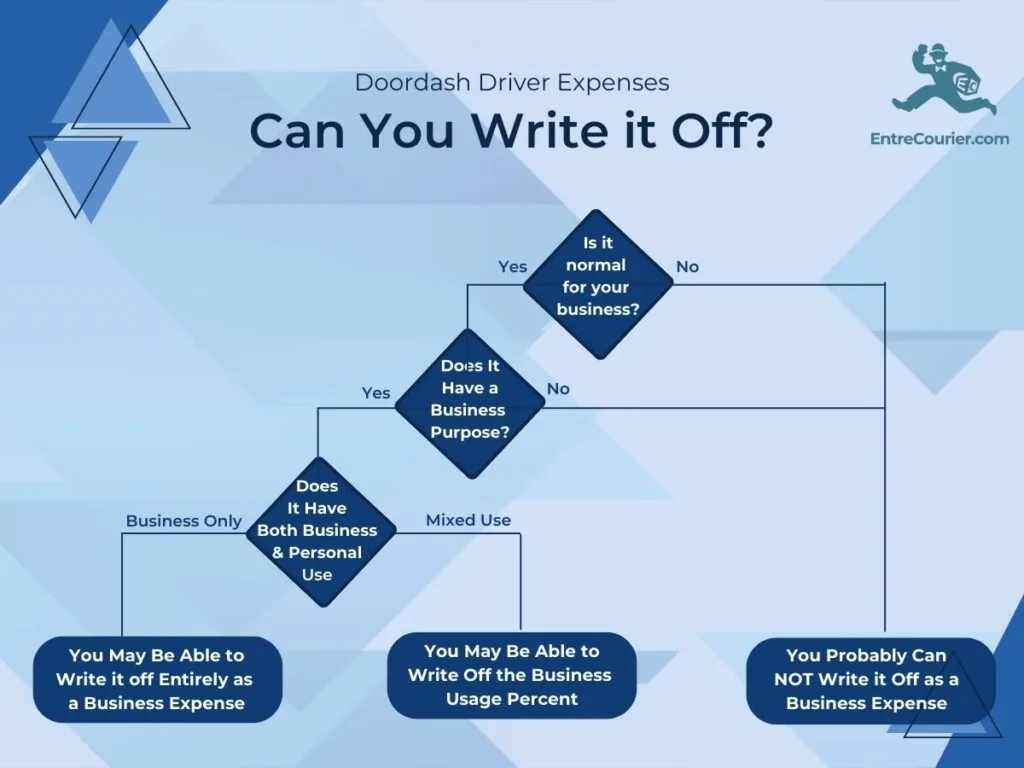

You can’t just claim something was for your business to write it off. You must demonstrate that your deduction is a legitimate cost of doing business.

This is why it’s better to understand how expenses are defined than to simply look at a list of Doordash tax deductions. Just because you bought something on a list of expenses doesn’t make it deductible. How you use it and what it does for your business determines the deductibility.

To be deductible, a business expense must be both ordinary and necessary. An ordinary expense is one that is common and accepted in your industry. A necessary expense is one that is helpful and appropriate for your trade or business. An expense does not have to be indispensable to be considered necessary.

IRS Publication 535: Business Expenses

If you purchased something specifically for your business that is “ordinary and necessary” for your business, it’s likely to be deductible. In other words, it should make sense that you would use it in your type of business, and there must be a business purpose.

A high-end camera, tripod, and microphone are not ordinary for Doordash delivery. They would be ordinary expenses if you were a YouTuber. A catering bag is “ordinary” for a Dasher but probably not for an insurance salesman.

The other part of the definition is it must be necessary. The IRS says that “necessary” doesn’t mean you must be unable to live without it. The idea is that it has to help your business. An expense can have a business purpose by helping you improve your business or meet business goals.

Three types of costs that are NOT business expenses

In publication 535, the IRS points out three situations in which money may not be claimed as an expense. They may still be deductible in other ways, depending on the situation. They state: “therefore, it is important to distinguish usual business expenses from expenses that include the following:”

- The expenses used to figure cost of goods sold.

- Capital expenses

- Personal expenses.

1. Cost of goods sold (COGS)

Cost of Goods Sold refers to the cost of purchasing or producing items that you sell. It’s an accounting term and not typical for delivery drivers in the gig economy.

COGS can be claimed, but it works differently. First, it’s not an expense item but is calculated in a different part of the Schedule C tax form. Second, you can’t claim the expense until after selling the item.

2. Capital expenses.

This usually refers to property or high-cost items. Your vehicle is a good example. When you buy your car, that purchase is not an expense because you’re receiving one asset (something of value) in return for another asset (your money). The IRS looks at it like you still have the same number of assets, only distributed differently.

There is an expense related to capital items, but it happens when they lose value. That’s known as depreciation. If you bought your car for $20,000 and sold it for $15,000, that’s a $5,000 depreciation expense. Only depreciation, not the purchase price, can be written off as an expense.

3. Personal expenses.

The IRS says, “generally, you cannot deduct personal, living, or family expenses.” For example, meals and clothing are personal purchases you need regardless of your business operations. Wearing clothing and eating while Dashing does not make these expenses deductible.

Some items may have mixed use. Cell phone bills make a good example. You need it for business but also use it for personal reasons. In that case, you would determine the percentage of usage for business and claim that percentage.

However, if you have an expense for something that is used partly for business and partly for personal purposes, divide the total cost between the business and personal parts. You can deduct the business part.

IRS Publication 535 on items that have both a business and personal use.

Use of your personal vehicle falls into this category. If, as a Dasher, you claim the actual expenses of your car, you’d determine what percentage of miles you drove were for business. Then you would deduct the business percent of actual costs. However, if claiming business miles, you can’t do any of this.

Some common Doordash driver tax write-offs, listed by expense category

Remember that your income as a Doordash contractor is your profit, not your total earnings from tips and Doordash pay (your gross earnings). Complete the IRS form Schedule C: Profit or Loss from Business to determine your taxable income.

This screenshot shows Part II. You list your income in Part I, then list the total spent for each category in Part II. Subtract expenses from income to determine profit (line 31). Your profit is what you move over to your Doordash income tax return as taxable income.

Schedule C is designed to fit several business types, and some expense categories rarely apply to Doordash drivers. We’ll look at each category and provide examples of common expenses for each.

- Line 8: Advertising

- Line 9: Car and Truck Expenses

- Line 10: Commissions and fees

- Line 11: Contract Labor

- Line 12: Depletion

- Line 13: Depreciation

- Line 14: Employee Benefits Programs

- Line 15: Insurance (other than Health)

- Line 16: Interest

- Line 17: Legal and Professional Services

- Line 18: Office Expenses

- Line 19: Pension and Profit Sharing Plans

- Line 20: Rent or Lease

- Line 21: Repairs and Maintenance

- Line 22: Supplies

- Line 23: Taxes and Licenses

- Line 24: Travel and Meals

- Line 25: Utilities

- Line 26: Wages

- Line 27: Other Expenses

Line 8: Advertising

Advertising includes services or materials that promote your business. While Dashers don’t usually advertise, some costs may apply.

- Business cards can advertise your ability to provide direct courier services.

- Printed material for customers. Many Dashers attach stickers to the order that thank the customers and ask for a rating. Printed materials that seek to improve business profits qualify as advertising.

Line 9: Car and truck expenses

This is where you claim either the business portion of your actual car expenses or the standard mileage rate. You can also add parking fees and tolls incurred while Dashing (even when claiming miles).

We won’t get into detail here about vehicle expenses, as we write in this part of our series about how to deduct mileage for Doordash (or actual expenses). We also detail how to find Doordash miles (Hint: It’s better to track them yourself than rely on Doordash’s estimate),

how to track miles for Doordash and other food delivery services, which miles you can track while Dashing, and what actual car expenses Dashers can claim.

Line 10: Commissions and fees.

TaxSlayer defines these as “amounts paid for services rendered on behalf of your business.” If someone arranged a delivery job for you and you paid them a finder’s fee, that would fit here.

Many businesses will list processing fees they pay to companies like Paypal and Square in this category. Uber Eats drivers often list their service fees from Uber here. Doordash does not charge any such commissions.

Line 11: Contract labor

A payment to a subcontractor for help with deliveries would go here. Keep in mind that if you pay any individual more than $600 for contractor services, you have to report that income to the IRS and send a 1099-NEC form to the contractor

Line 12: Depletion

Depletion is the using up of natural resources by mining, drilling, quarrying stone, or cutting timber. It’s not a typical expense category for gig workers.

Line 13: Depreciation

We mentioned earlier that capital purchases, such as vehicles, are not expense items. That’s because you trade one asset (money) for the other (the car or other item). However, it does become an expense when that property loses value.

The loss of value is called depreciation. This is where you would claim the business portion of your car’s depreciation. However, you can only do that if you use the actual expense method for your vehicle deduction. You cannot do it if you claim the standard mileage deduction.

Generally, items or property that cost more than $2500 must be capitalized, meaning you can only claim the depreciation. Here’s where you would also claim depreciation on a high-end bicycle, motorcycle, or e-bike that you use for delivery work.

Line 14: Employee Benefits Programs

We won’t touch on this category as few Dashers (if any) hire employees.

Line 15: Insurance (other than health)

This is to write off the business insurance cost for your delivery work. Car insurance must be included in your vehicle cost using the actual expenses or the standard mileage method.

The IRS states that health insurance premiums do not go here as they are not business expenses.

- General business and liability insurance.

- Motorcycle, bicycle, or scooter insurance. Two-wheel vehicles are not considered car and truck expenses (line 9). You’re not allowed to take the business mileage allowance for them. However, you can claim the business use percentage of the premiums.

- Self-employed worker’s compensation or occupational accident insurance. If you purchase special insurance to cover you for some accident while you’re working, that insurance may be deducted here. See your tax professional for clarification.

Line 16. Interest Expense

You can claim interest expenses on loans or financing related to business-related purchases. If there’s a mix of business and personal costs in the financing, claim the percentage related to business use.

For example, if you borrow money and use 70% of it for business and the other 30% for a family vacation, you can generally deduct 70% of the interest as a business expense. The remaining 30% is personal interest and is generally not deductible.

IRS Publication 535 Personal versus Business Expenses

- Automobile loan interest. Dashers may deduct the business portion of interest part of their car payments. Car interest is claimable even when using the mileage method. If 60% of your miles are for Doordash or other business purposes, you can claim 60% of interest payments.

- Business loan or credit card interest. Suppose you paid for business items with a credit card or other financing. In that case, you could claim the business portion of the interest payment.

- Paycheck protection program or EIDL loan interest. Interest for pandemic relief loans that were not forgiven may be written off here.

Line 17: Legal and Professional Services

Fees and charges for short-term professional advice related to your business are deductible. Some examples include:

- Accounting services. If you have a tax professional (a great idea!) do your taxes for you, ask them to break down the portion of these expenses for your business and what part is personal.

- Legal fees. Using a lawyer to help you create an LLC or handle business-related legal issues.

- Business coaching and consulting. If you hired a coach or consultant to help you operate your business more efficiently and profitably.

Line 18: Office expenses.

Dashers rarely use a business office, especially as most of the work is done on the road. However, several day-to-day operational costs fit the best in this category.

- Software subscriptions and paid apps. Mileage tracking apps like Hurdlr or driver productivity apps like Solo.

- Bank charges: Monthly service fees, transaction fees, purchasing checks for a business bank account. The $1.99 transaction fee from using Fast Pay (instant payment to your debit card) counts as a deductible bank charge.

- Cellular and mobile data plans. Determine what percentage of your phone usage is for business, and write off that portion of the services bill. Charges for your phone would go under another category (likely depreciation, supplies, or rent).

Line 19: Pension and profit-sharing plans

These are employment-related costs and thus extremely rare for Dashers. This is not where your personal retirement contributions go.

Line 20: Rent or Lease

The rental payments go here if you rent or lease equipment for your business. Office rental, which is extremely rare for Dashers, would go in part B. Other property, including your car lease (if claiming actual expenses), goes on part A.

- Vehicle rent or lease. You can not claim your lease payment if you use the mileage deduction. If you claim actual expenses and have a lease (not a loan), the business percentage of the lease payment goes here.

- Cell phone lease. The business use percentage of monthly lease payments on your cell phone goes here. You might have to split your cell bills, with the service portion going under office expenses.

- Bike, e-Bike, scooter, or motorcycle rental. For example, I once rented an e-Bike for a day to try out for delivery. Your costs will go here if you use bike-share or scooter rentals to help you get around on deliveries.

Line 21: Repairs and maintenance

Repair and maintenance of the equipment you use for your business, other than your car. If the equipment is used both personally and for business, claim the portion relative to your business usage.

- Bicycle, motorcycle, e-Bike or scooter repairs. Expenses for two-wheeled vehicles are not claimed under line 9 for car and truck expenses. Therefore, you claim the business portion of repair and maintenance costs here if you use such vehicles to deliver.

- Cell phone repair. Repair costs such as for cracked screen, for the percentage of what you use that phone for business.

Line 22: Supplies

These are the items you use to operate your business. Some possible deductions include:

- Cell phone holder and other phone accessories

- Battery packs or chargers

- Emergency tool kits

- Collapsible carts for hauling large orders

- Hot bags (catering and delivery bags)

- Drink holders

- Work-specific clothing, such as Doordash branded gear.

Note: typical street clothing can not be written off as a business expense, even though you wear them for work.

Line 23: Taxes and licenses

This includes taxes and regulatory fees related to your business. It does NOT include state and Federal income taxes or self-employment taxes.

Do not include sales tax payments here. The IRS considers sales tax to be part of the cost of the item and should be claimed under the appropriate expense category.

- Business licenses: Some states and communities require you to obtain a business license

- Incorporation fees. Fees for creating an LLC, incorporating, or forming some other business entity.

- Property tax on your vehicle or business equipment. The IRS says explicitly that you can claim the business portion of your vehicle property tax even when claiming the mileage deduction.

- Permits such as special parking permits allowing parking in loading zones or other specific areas.

Line 24: Travel and Meals

Travel and meal costs for business trips go here. Meals that are eaten locally within specific IRS parameters go here as well. Meals that are eaten while Dashing are not deductible.

- Business-related trips. The best example that comes to mind is if someone had a meetup for gig workers. If you’re learning tips and tricks to improve your business, the travel costs, lodging, and meals for such a trip are deductible.

- Business meals. The IRS requires that a business meal have more than one person in attendance, and the meal must have a business purpose. You should record details of who was in attendance and what the meeting was about. Suppose you took a friend to dinner to discuss them signing up for Doordash. You have a potential business benefit if they use your referral code.

Line 25: Utilities

We won’t discuss these, as Dashers rarely rent office space for their business.

Line 26: Wages

We won’t discuss these, as Dashers rarely hire employees.

Line 27: Other

Several expense items don’t fit comfortably into any of the above expense categories. You can claim those expenses under line 27. The IRS requires a description of the expense, which you would list in Part V of Schedule C.

It’s not uncommon to have several different “other” expenses listed. We’ll list just a few:

- Professional memberships, such as membership fees for trade organizations. Perhaps you joined a Patreon group or online membership with the express purpose of improving your delivery business.

- Dues and subscriptions. Subscriptions to periodicals or online programs that benefit your business.

- AAA or roadside assistance programs. Such memberships are over and above the cost of operating your car. With significant driving related to Dashing, you may feel such memberships are a business necessity.

- Professional development or training. Two examples are training courses on how to do accounting for your business or how to operate a business.

How to write off expenses on your Doordash taxes.

Remember that your taxes for Doordash are small business taxes. The items above are not tax deductions but business expenses that we list on Schedule C.

You claim these expenses by filling out Schedule C. We write more here about how to fill out Schedule C for Doordash drivers. The process is relatively simple:

- Add up all of your delivery income. Start with your Doordash 1099 form. Include any income from other gig companies and put the total income in Part I of Schedule C.

- Add up all expenses by category. Enter the total for each category in Part II of Schedule C.

- Subtract expenses from income to determine profit.

- Add profit to your other income (such as wages, investments, etc.) on your personal tax return.

You can read more about some additional tax deductions for self-employed individuals who deliver for Doordash. They go in a different part of your tax return, while this article focuses primarily on Schedule C expenses.

Part of Schedule C deals with the home office deduction. You can read more about how the home office works (it usually doesn’t) for Dashers.

Frequently Asked Questions about Business Expenses and Doordash Taxes.

Yes. Business expenses are treated differently than personal tax deductions. They are written off on IRS form Schedule C. This allows you to write off expenses on top of your personal standard tax deduction.

No. The standard mileage deduction can only be used for cars, vans, pickup trucks, panel trucks, and SUVs. You can read more here about how to write off Doordash bike, scooter, or motorcycle expenses.

Yes, you can claim the business portion of your mobile phone and data services, as well as for your phone. A smartphone is a necessary tool as you need to operate the Dasher app and receive delivery offers. You must estimate the percentage of use for business and personal purposes and claim the business percentage.

The Doordash Independent Contractor Agreement has a provision for using subcontractors, making it reasonable that subcontractor expenses are possible. If you pay any individual $600 or more, you will have to report their income and issue them a 1099-NEC form.

No. A vehicle purchase is a capital expenditure, meaning it is not an expense. All you can do is claim the depreciation or loss of value. Depreciation can not be claimed if you take the mileage deduction. You can read more about writing off your car purchase for Doordash.

You can not write off the principal on a car payment, but you can deduct part of the interest. We talk in more detail about if you can write off car payments with Doordash.

You can not claim health insurance premiums as a business expense. You can only write them off as an itemized tax deduction, which does not lower your self-employment tax bill. There is a special tax deduction for self-employed health insurance that Dashers can claim under specific circumstances. That deduction can be taken on top of the standard tax deduction but does not lower your business profits.

No. Regardless of the type of auto insurance (commercial or personal), your primary auto insurance policy is considered part of the actual cost of operating your vehicle. It’s either figured into the standard mileage rate or taken as part of the actual expense method.

Yes. IRS Publication 535 says: “If you are self-employed, you can also deduct the business part of Interest on your car loan, state and local personal property tax on the car, parking fees, and tolls, whether or not you claim the standard mileage rate.” You would calculate the percentage of miles driven for Dashing and multiply that by your car loan interest total.

It depends on whether your actual cost of driving exceeds the IRS standard mileage rate. Most Dashers will find the mileage allowance is better. You should track both to make an informed decision. You can read more about determining your actual expense deduction with Doordash.

Meals that you consume while Dashing are not deductible expenses. They are personal expenses. You can read more here about claiming meals for Doordash.

Some Dashers will pay for food or merchandise orders out of pocket when the Red Card transaction fails. When that happens, Doordash reimburses you for the cost. Whether you can claim it as an expense depends on if Doordash includes that reimbursement as income on your 1099. If they do, you can write that purchase off as an expense. It’s essential to keep track of your earnings to know if that happened.

You can not write off clothing simply because you wore it while operating your business. The IRS states that you can not claim clothing that is generally accepted as streetwear. One possible exception is the purchase of Doordash branded gear that identifies you as a Dasher.

Yes, you can write off the $1.99 fees, as they are essentially bank charges. Many write these off under Office Expenses on Schedule C, while others create an “Other Expense” line item.

Generally, no. You must have space used exclusively for your business, and a significant part of your business operations must happen in that space. The nature of Dashing makes it difficult to make a case for a home office deduction. We go into more detail here about when you can claim a home office for Doordash.