It’s one thing to make money with delivery apps like Doordash, Uber Eats, Grubhub, Instacart, or doing rideshare with Uber and Lyft.

But how do you avoid sending too much of that money to Uncle Sam at the end of the year?

Here’s something you may not know: As an independent contractor, you can claim your car expenses and other business deductions off your income taxes even if you’re claiming the standard deduction.

What’s the best way to do that? How do we track all that? They never told us we needed to be accountants when we signed up as contractors for these gigs.

That’s why we’re taking a deep dive on several tracking apps and programs. Now it’s time to take a look at Hurdlr.

We put Hurdlr through the ringer. We tested all its features and looked at it through the eyes of a delivery driver or rideshare driver.

Is Hurdlr a good option for Doordash, Uber Eats, Grubhub, Instacart and other delivery platforms? How does Hurdlr wrok for rideshare contractors with Uber, Lyft and some of the up and coming companies? We’ll examine the good and bad and help you get a feel for if Hurdlr is a good option for you.

Never heard of them? Join the club. They’re not as well known as Stride or Quickbooks Self-Employed or some of the others out there.

Hurdlr has a free and a subscription version. We’ll look into its features and tax benefits. We’ll explore what comes with the subscription option (Premium) and whether the free version might work for you. This review will look at the following:

- What is Hurdlr?

- What does it do?

- How does Hurdlr compare to other mileage and expense tracking apps?

- What does it cost?

- Our final verdict on the app.

What is Hurdlr?

Hurdlr bills themselves as an automatic business expense and mileage tracker. They are becoming popular among gig economy contractors who rely on accurate mileage logs to reduce their tax bill.

In my opinion, they’ve evolved far beyond a simple tracking mobile app. What I love is that it seems like a great app for record keeping, but it’s so much more. There are some advanced features for managing your business finances.

How many of us actually think in terms of business finances in the gig economy?

The part I appreciate is that it’s a pretty powerful record keeping and management system geared for independent contractors and self employed individuals.

Hurdlr offers a free app that allows manual tracking of miles driven and of income and expenses. You can upgrade to subscription versions that automate tracking and provide more robust accounting features.

As I reviewed various apps, I noticed that some didn’t have a browser based function, where Hurdlr has a pretty powerful web version. That’s especially powerful when it’s available on the free version.

What does Hurdlr do?

I see four primary features of the Hurdlr app and software program:

- Mileage tracking

- Expense tracking

- Income tracking

- Income and self employment tax estimates and reporting

There are some other features that can make versions of Hurdler a full blown accounting program. I’ll touch on those when I talk about the different tiers. However, these four best summarize the functionality that I see for those of us who contract with gig apps like Doordash, Uber Eats, Grubhub, Instacart, or even Uber and Lyft.

Mileage tracking

This is a big one for gig economy workers. Those of us who use our cars extensively for our business need an accurate and reliable mileage tracking program. The standard mileage deduction has a major tax impact for us.

The free version of Hurdlr gives you unlimited manual tracking of mileage. You manually start and stop tracking your trips. With the premium and pro versions, Hurdlr recognizes when you are driving and automatically tracks your trips.

With the manual tracking, Hurdlr provides one feature that none of the others I reviewed offered. They have an Android widget that places a start and stop button on your phone’s home screen.

The widget removes the extra steps of having to log into the app to start or stop your trips.

When I ran tests where I compared how well Hurdlr actually tracked miles to my odometer readings, I found Hurdlr to be quite accurate. The manual version was 100% accurate while the automatic tracking was 98% accurate.

One thing to remember is that automatic tracking apps is they know when to start tracking based on your speed. This is so they don’t accidently record your walking miles. In heavy traffic, you can drive awhile before any of the apps recognize that you’re driving. This is why the slightly lower accuracy. Other apps with automatic tracking had significantly lower accuracy rates.

One last note about mileage tracking. Hurdlr keeps a route map that shows where you drove. Some apps only show starting and finishing points.

This extra level of detail is critical for delivery contractors when customers for Uber Eats, Doordash and Grubhub have often lied about not receiving the food. A GPS record showing exactly where you were can be critical for identifying exactly when you were at a particular location.

Expense tracking.

This is where I think Hurdlr’s business expenses feature really shines compared to other apps (including Quickbooks Self Employed).

Hurdlr creates a list of expense categories. If you have business expenses, you can easily record that purchase in the app. Using your phone’s camera is an easy way to take a picture of the receipt, or upload the PDF of the receipt on your computer.

Some apps try to oversimplify expense tracking. Some won’t even let you track expenses that don’t fit into their list of categories. This is where I appreciate Hurdlr, in that you can customize expense categories.

Where this can be really important is with “other expenses” that don’t fit the IRS’s list of expense categories. “Other expenses” are common with gig workers, such as fees paid to gig companies, memberships, etc.

When you have ‘other expenses,’ the IRS requires you to break down those other expenses, with descriptions, on your Schedule C. Quickbooks and Stride Tax, for example, don’t let you do that. That forces you to spend more time adding up and inserting those ‘other’ expenses.

The free version of Hurdlr gives you unlimited manual tracking and basic expense reports. With the paid subscriptions, you can automatically track by linking to your bank account. Then all you have to do is update the category of the expense.

Income tracking.

Why is income tracking so important? After all, as independent contractors don’t we get a 1099 form showing our business income?

If you’ve ever noticed the problems that Doordash and Grubhub have had getting accurate 1099 forms out to contractors, you understand why it’s important to track income.

Recent aid programs like the EIDL and Paycheck Protection Program have had income requirements. You need to provide accurate gross revenues in order to receive those funds as an independent contractor.

Like with the expense tracking, Income tracking is a definite strength for Hurdlr. The most popular alternatives only allow you to track general income, with no way to break down how much you earned from different sources.

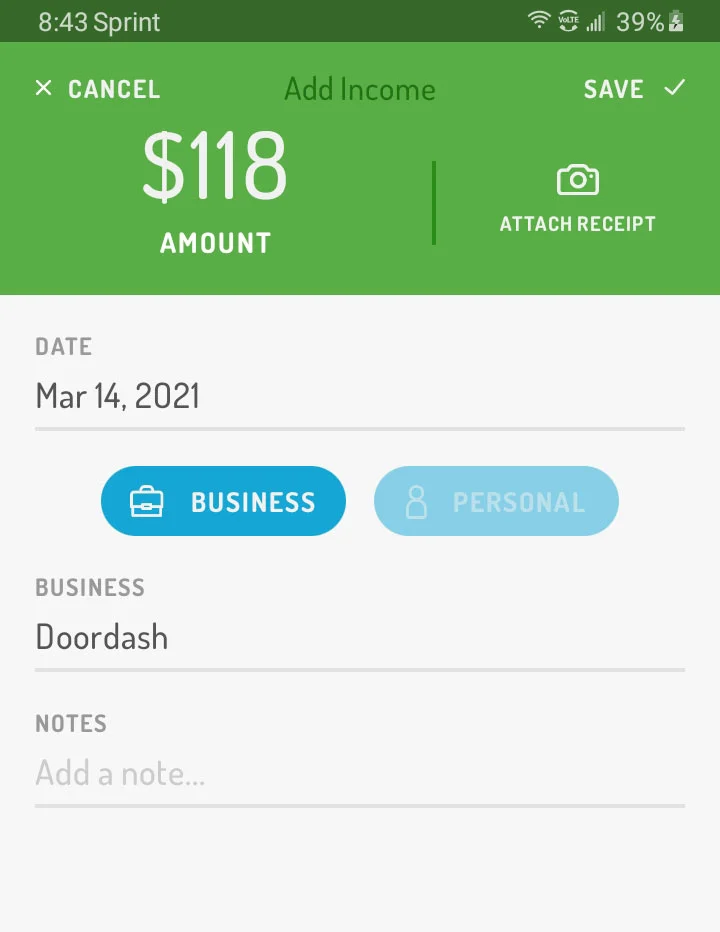

I’m a huge proponent of working multiple apps. In my opinion, it’s critical that an income tracking app allow you to track by type of income. Hurdlr allows you to create ‘businesses.’ As you enter your income, you assign it to the business.

Income tracking on the free version is manual. You have to enter the information from scratch. The Premium subscription and Pro versions allow you to link up with your bank account. All you do is tell it whether the income came from Doordash, Uber Eats, Grubhub, Lyft, or whomever.

However, there’s some room for improvement.

Unfortunately, if you’re tracking income from each of the different apps, Hurdlr doesn’t treat these as different forms of income. Instead, they treat it like you’re running completely different businesses. This can complicate things.

I’m disappointed that there’s no option to enter who paid you on an income record. There’s also no way to add income categories like you can expense categories.

Having said that, popular apps like Quickbooks Self-Employed and Stride Tax fall even further short. All they offer is one income category. Compared to them, Hurdlr is still far more advanced.

Income and self-employment taxes estimates and reporting

One of the biggest challenges that self employed person or sole proprietor faces is knowing how much money to save for taxes.

Here’s one place where Hurdlr runs circles around everyone, in my opinion.

One of the tax features in the Hurdlr app is their easy income tax calculations.

It starts with filling out a tax profile. You tell Hurdlr things like your filing status, dependents, and even if you will have other income and tax withholding from W2 jobs for yourself or your partner.

With that, Hurdlr will calculate how much they think you’ll owe come tax time. Now you know how much to set aside so taxes are paid off by tax season..

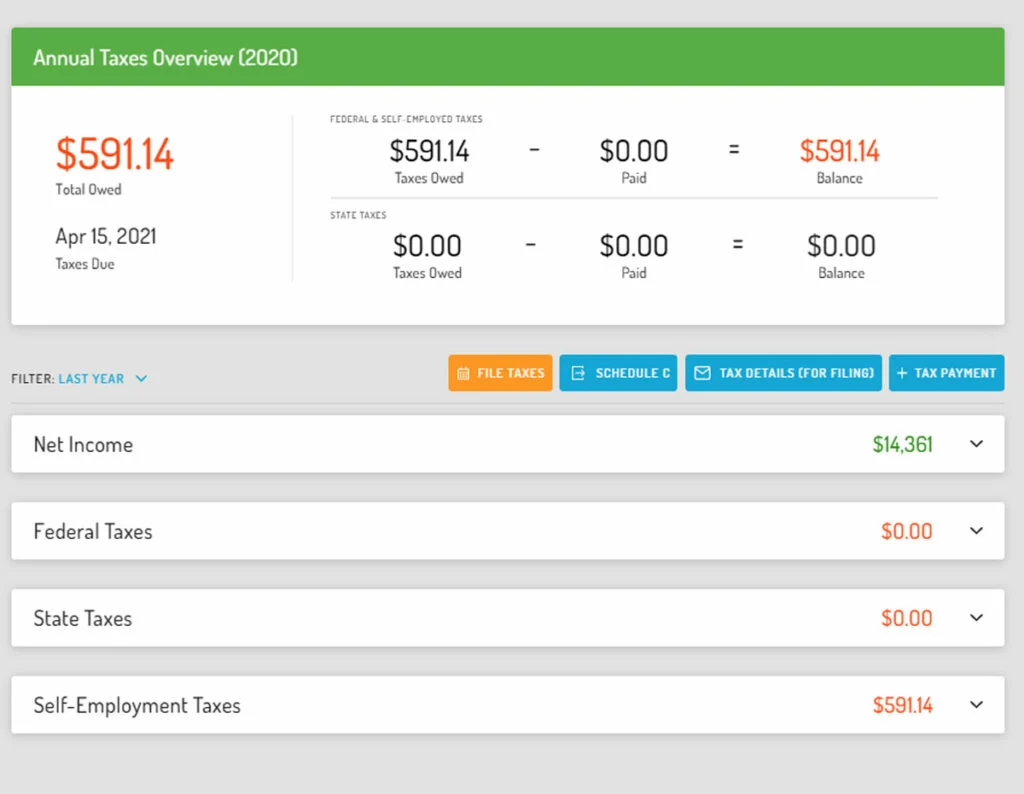

I created a hypothetical tax situation, complete with additional income, a joint tax return, expenses, miles and income. Hurdlr estimated owing $591 at the end of the year. I ran a tax return and our hypothetical friend had a $625 real-time year end tax bill.

The subscription version of Hurdlr does provide more detail.

The basic calculation is available on the free version of Hurdlr. In a nutshell, the home screen will show you an estimate of how much you should have saved for taxes.

The Premium version gives you more advanced tax reports, with a breakdown of estimated federal and state income taxes, and self employment tax. It also lets you download a pre-filled Schedule C which makes taxes much easier.

The Pro version includes the Self Employed version of Tax Slayer. That can be a pretty significant value when you look at the cost of tax programs for self employed individuals. Ultimately, Hurdlr is great at helping small business owners track and maximize their tax deductions.

I had hoped that being able to import your information to Tax Slayer would make the tax process easier for gig workers. My experience when trying it out is it actually complicated things. Without going into a long story, it turned out it’s simpler to manually enter your tax information if you use the Tax Slayer interface.

How does Hurdlr compare to other mileage and expense tracking apps?

I ran a 7-app comparison, testing out a wide variety of mileage tracking apps. Five of those apps also had expense tracking functions. I ranked them on accuracy, usefulness of mileage reports, extra features, performance, and value, all trying to determine the best gps mileage and expense tracking app for independent contractors.

Hurdlr came out on top. You can check out the link above for a closer look.

Really, only one other app came close. For the accuracy and mileage reports, Triplog ranked slightly ahead of Hurdlr. Once you look at the bigger picture and the expense reporting, Hurdlr was the better overall choice based on that review.

Perhaps the most popular app out there for mileage tracking is Stride Tax. I’m a little puzzled by its popularity because it’s an incredibly limited program. It doesn’t have a browser interface, there’s no flexibility in what you can track.

It might be because Stride was once the only prominent tracker that was completely free. However, when I compared Stride Tax to Hurdlr, there wasn’t a single area where Stride outperformed Hurdlr.

When it comes to expense and income tracking, Quickbooks Self Employed is the primary competitor. However, I find that even the free version of Hurdlr is far more flexible and far easier to use than QBSE.

What does it cost?

For the independent contractor or self employed sole proprietor, there are three options with Hurdlr.

Hurdlr has a free version that is going to be adequate for a lot of contractors. The mileage tracking works quite well and, as I mentioned, the expense and income tracking are more advanced on the free version than on the paid Quickbooks Self Employed.

You can pull a profit and loss report off the free version and get all the information you need for filling in your Schedule C on your taxes. You can also get an update of the calculated tax savings you need on the free version.

The next level up is the Premium version.

I think this is going to work great for 95-99% of independent contractors who feel it’s worth making an investment into something more full featured.

The Premium version is $60 per year, or $8 per month if paid month to month. You can get 20% off with my referral link. The three most important Premium features, in my opinion, are:

Automatic mileage tracking. Hurdlr senses when you are driving and begins tracking your route immediately.

Ability to link your financial institution for automatic income and expense tracking. This simplifies the process of updating your books.

Advanced tax reporting. The free version lets you download a pre-filled Schedule C which makes filing taxes easier.

Finally, Hurdlr offers a Pro version.

The pro version is $120 per year, with no monthly subscription option.

The main features of the Pro version are:

Tax Slayer Self Employed is included with the Pro version, which costs $55 if purchased alone.

The Pro version has true double entry accounting, where you can track assets and liabilities as well as expenses and income. For example, if you took out an EIDL loan, you can track the balance of the loan.

You have an option where you can invite your accountant, a feature usually reserved for programs like Quickbooks.

The question here is, will you ever use any of these features? I was disappointed at how clunky the experience was to try to run a tax return imported from Hurdlr into Tax Slayer.

I see things like this through two different sets of eyes. As an independent contractor in the gig economy (Doordash, Uber Eats, Grubhub and Postmates) I don’t see an application for the advanced program. As a professional blogger, something more full blown becomes a bit more attractive.

Our final verdict on the app.

I think this is one of the most important tools you can take advantage of as a gig economy contractor.

The free version is pretty powerful by itself. If you don’t have the budget to spend a few bucks a month on an app, there’s nothing I’ve seen that will work better for you. In fact, you can get a free trial of the premium and the pro paid version.

Four things I love about Hurdlr.

- The app works well. In all of my testing, it hasn’t glitched on me or stalled in recording. It was accurate and it didn’t drain my battery like some others. In fact, I’ve been able to use it reliably in power-save mode on my phone, something I couldn’t do with some other apps.

- It’s easy to use. I feel like the user interface is clean and intuitive.

- Hurdlr is feature rich for its price. In my opinion the free version runs circles around the $15/month Quickbooks Self Employed. There’s a lot more information, you can record a lot more details, and you can customize it to fit what you do.

- You can start with the free and seamlessly move up if and when you need. You can’t even do that with Quickbooks Self Employed. This to me is a great way to protect your investment, letting you use this program for far longer.

Four things I hope Hurdlr can improve.

- I really wish they had a little more flexible way to record income. It would be more tempting to use it full time for my blogging business if it were.

- I wish some of the reports were more flexible. Maybe I’m spoiled by the full featured accounting program I do use, but on that I can run reports that break my income down into monthly or quarterly totals. There are times that can come in handy. Instead, you have to run multiple reports, one for each month or quarter.

- I found a couple of the expense categories showed up on their Schedule C differently than I would have put them. Cell service was listed as a utility, and most people I know put that in “other expenses.” Parking was put in “Other expenses” instead of into the car expenses.

- Finally, I was really disappointed that the interface with trying to run taxes with Tax Slayer. I was really excited about trying that feature out. I’ve run other tax programs that aren’t very intuitive. I thought that if everything were imported into Tax Slayer well it could be a great option to recommend. Unfortunately, I felt like the way it’s set up, it would be easy for someone who didn’t know what to look for to miss out on some things.

Are any of those issues dealbreakers?

By no means.

There is no perfect app. However, even where I felt that Hurdlr could improve, I felt like they were far better than the alternatives.

There are some accounting programs that will do a lot of what I’d like to see. However, they’re full blown accounting programs that are either much more expensive or much more complex.

I personally use Quickbooks Desktop Pro for my accounting. It does all the extra stuff that I want it to do. Hurdlr would have a hard time keeping up.

However, I wouldn’t recommend Quickbooks desktop (or online) to most gig workers because it’s overkill. It also takes more knowledge about accounting to get it set up to begin with.

Here’s where I think Hurdlr really stands out when you deliver for Doordash, Uber Eats, Instacart, Grubhub, or even Uber and Lyft:

It’s easy to get started, and it’s easy to use. Hurdlr is designed for a self employed person without requiring a lot of set up. It’s great for your side hustle and advanced enough to handle a full time business.

Sometimes some of those issues are the trade off for simplicity. It’s probably not reasonable to expect a free (or $5 per month) program to be all things to all people. I get that.

Hurdlr runs circles around all the alternative apps for the self employed, despite the issues I mentioned above. In fact I think the free version is superior to subscription programs like Everlance and Quickbooks Self-Employed.

I would say that Hurdlr is one of the most important tools a delivery or rideshare contractor could use. If you’re already using another program and it’s working for you, I won’t talk you into changing. Go with what works.

But if you want a good mileage, income and expense tracking app, my review concludes that Hurdlr is a very good option.