In a side by side test of seven different mileage and expense tracking apps used on live deliveries at the same time, Hurdlr scored the highest overall, with TripLog being the best at strictly tracking miles.

What’s the app for a Doordash driver or Uber Eats courier? What about the Uber driver or Instacart shopper? That depends on your own priorities and preferences. You can use the results from our test to determine what might be the best fit for you.

We looked at seven different apps, running them all at the same time while performing deliveries for several different delivery services like Grubhub, Doordash, and Uber Eats.

In our analysis, we ranked each app first to last on the following five criteria:

- Tracking accuracy

- Quality of the trip information

- Additional features

- Power consumption

- Value

Below, we go into detail on each app, how it ranked for each criteria, and why.

- How the comparison was done.

- Hurldlr (32 points)

- Triplog (30 points)

- Everlance (19 points)

- Stride Tax (16 points)

- Gridwise (15 points)

- MileIQ (14.5 points)

- Quickbooks Self Employed (13.5 points)

- Best backup: Google Maps

- Final thoughts

How mileage and expense tracking apps were evaluated

The main purpose of using a gps mileage tracking app is obviously, to track miles driven for our delivery work. A good app will also let you track additional expenses as well.

Because we can deduct 62.5 cents (for the second half of 2022) for every mile we drive for our deliveries as independent contractors, a good mileage tracking app can save you hundreds or thousands of dollars off your taxes.

I looked at these apps from a delivery driver perspective. I wanted to find which app was going to be best to help independent contractors with tax deductions AND manage their delivery business.

All seven apps were turned on at the same time on the same deliveries. That allowed me to see how each app stacked up with other apps. Then I rated each ap from first to last in each category, giving the best app seven points, the next one six points, on down to one point for last.

Ranking apps like that can be subjective. But for each app, I share my reasons and thoughts on how the app performed in each area.

Before we dive into the apps, I’ll talk about the criteria I chose:

Accuracy

The whole point of tracking miles is to document how far we’ve driven. The point of doing that is to get as much mileage deductions as possible. But if the mileage tracking app isn’t tracking miles very well, you’re leaving money on the table.

In the second half of 2022, every thousand miles tracked lets you take $625 off your taxable income. If you’re in the 10% tax bracket, at tax time that’s about $158 less you pay.

Capturing those miles you drive is important.

How good is the app at tracking miles? How often does it fail to track? What are the final totals like compared to odometer readings? Is there a possibility that it misses miles (thus costing money)?

Accuracy can be a bit tricky to evaluate, especially with differences between apps with automatic trip detection and those without.

With manual tracking, you can forget, and that can be expensive. It also will usually track everywhere you go, even when walking.

Automatic tracking has its own issues. A common issue with some apps is when it doesn’t notice that you’re driving. But the other issue is in how automatic tracking works – usually it waits until you are going a certain speed (like 5 miles per hour or faster) before it determines that you’re driving. That means it may not start tracking for hundreds of feet, sometimes for several blocks.

Quality of trip information

Mileage tracking is no good if you can’t use it. Does the app provide downloadable information that qualifies as an IRS-compliant mileage log?

More than that, a good record of where you’ve been can be incredibly useful. Especially in an age when customers will like about not getting their food in order to get a free meal. Sometimes having good location data can make all the difference in avoiding deactivation.

Does the app give you more than just a mileage total? Can you see a map of where you were? Is it possible to know where you were at a certain time?

Extra features.

What else does the app do besides tracking miles? How easily can you get the information you need? Will it let you track business expenses? Does the app provide information that no others do?

Power use.

If you deliver more than just a very part time side hustle, you can run your phone down pretty quickly with all the apps you might use. Even with a car charger, you’re constantly taking your phone off the charger to go into the restaurant or when you drop off the delivery with the customer.

On my Android phone, I can pull up a report of what apps are draining my battery the most, and which is using the most resources.

The other thing about delivery is, you can run a lot of apps at one time. If you work multiple apps each one is using resources. Then you have your tracking app. Are there other apps to help you manage your work? Maybe you’re listening to podcasts.

Where does the app fit in with this? Just as important, does it work well when there’s so much else going on with your phone?

Value.

What does the app do for you for what you pay? Some apps have a subscription cost. There are some that are free, but are the free apps giving up too much in functionality?

Hurdlr: 32 Points (First Place)

When all was said and done and they were all rated, Hurdlr was the top pick. Hurdlr combines a very solid mileage tracking feature with an extremely robust expense tracking program. The tax features are very impressive.

Hurdlr was the only app of the seven that had a full featured free version (without limits on things like the number of trips) AND a subscription option that added valuable features.

Hurdlr scored very well in mileage tracking, coming in slightly behind Triplog. However, because of the strength of their accounting features and ease of use it scored the highest overall of all the apps.

The free version in my opinion ran circles around other free apps like Stride and Gridwise. In fact, I felt like the free program was better than some paid plans like Quickbooks Self Employed and MileIQ.

The main difference between the paid and free versions is that the paid version does automatic trips. You can link to your bank account and set it to automatically detect when a trip is happening. This can be valuable for someone who doesn’t want to manually start and stop the app (or is prone to forget).

You can read my full review of the Hurdlr mileage and expense tracker app here.

Accuracy – 6 Points

Hurdlr has been substantially more accurate than the other automatic trackers (other than Triplog). It captured 98% of business miles driven compared to the baseline odometer readings.

At 98%, a full-time driver who puts 25,000 miles on their car loses 500 miles. On average that 500 miles costs a food delivery driver about $78 extra on their tax bill.

I did not use the manual tracking feature on this test. Other times I’ve used it, it’s been probably 99% or better, provided of course that you remember to start tracking right away.

I had no issues with it missing or skipping when the phone was heavily used. In the time I’ve been testing it I haven’t run into any glitches at all with the app that caused it to miss any trips.

For manual tracking, on Android devices there’s a widget that lets you start and stop tracking from the home screen. That means there are far fewer steps you have to take in order to start recording miles.

Usable Trip Data – 6 Points

Hurdlr does let you pull up a map of your trip

Hurdlr does not have the mid-trip data points that Triplog has. It works a lot like how Everlance does, in that you have the route for the trip segments. The thing that sets Hurdlr well ahead of the Everlance app is that it’s more sensitive to stopping and starting.

On a 22 delivery day, Everlance recorded ten trips. Hurdlr recorded 45. That means you have a map with start and stop data (including time) for just about every restaurant AND customer location along the way.

Features – 7 Points

This is where Hurdlr really rises above all the others.

The free plan on Hurdlr has an accounting program that’s far more powerful (and flexible) than Quickbooks Self-Employed. And frankly, it blows Stride’s expense tracking out of the water.

One of my biggest beefs with a lot of expense trackers is, they give you a limited number of categories, and there’s nothing you can do if something doesn’t fit that category other than mark it as “other.” Hurdlr is more flexible than programs that cost a lot more money.

Hurdlr has what I believe to be the best tax features of any of the accounting apps. You tell Hurdlr your filing status, about other income, all of that, and it estimates specifically how much you should set aside for your taxes.

One of the best features about Hurdlr is the ability to move from a free program to add premium features on the paid plan. By comparison, if you want more flexibility with Quickbooks Self-Employed, you have to move to Quickbooks Online, and you can’t just migrate your data. You have to start all over.

Battery Useage – 6 Points.

There was only one other app (MileIQ) that used less power than Hurdlr.

One issue with many of the auto tracking apps is that if the app is in power saving mode, it may not start tracking for you. Some won’t even start up if your phone is set to anything less than full power usage. I never had any issues with Hurdlr’s ability to track trips when in power saving mode.

Value – 7 Points

I created a separate account in Hurdlr to experience the free version. There are no limits on the number of trips that you can record or any of the business-related expenses or income you report. Of the free options it seems to be the most powerful and unlimited option.

The mileage tracking under the free app requires you to manually tap to start recording or stop. One big advantage with Hurdlr is that on Android phones you can use a widget to let you do that from the home screen of your phone.

The paid version of Hurdlr is slightly more than for TripLog or Everlance. However, I give Hurdlr the edge over them simply because the free verion can work perfectly for a lot of people. I also feel like the added power on the accounting side of the app is worth the couple extra dollars.

You can utilize the paid version for a much more full featured record keeping system than even Quickbooks Self Employed. There’s a lot of flexibility in how you record expenses and income. For an overall package that includes expenses, income and mileage, I don’t think anyone else comes close.

Triplog – 31 Points (2nd Place)

Triplog’s biggest strength is in the mileage tracking. In particular they have a unique feature where you can choose to start tracking automatically any time a gig economy app is in use.

The primary focus for the app seems to be in fleet management and tracking for employees of larger companies, such as for mileage reimbursement. However, they’ve added features such as an accounting program and a gig tracking mode that makes it a nice option for delivery and rideshare drivers.

Accuracy – 7 Points

Triplog’s sweetspot is their mileage tracking. They have the most ways to track as well as options to integrate other data.

The one thing that sets Triplog apart the most is their Gig App mode. For all the other apps, the options for tracking are manual, where you have to tell the app when to start and stop tracking, and automatic, which tracks everywhere you drive.

Triplog has an option that pays attention to whether any of your Gig Economy apps are active. Any time you have an app open, Triplog will keep track of your miles. What made them incredibly accurate was that Triplog didn’t have to wait til you got up to speed to start tracking.

One thing I really like is, you can tell Triplog which apps to pay attention to. They don’t just stick to the big companies. If I have smaller delivery apps active like Curri, Veho or DeliverThat, they record automatically as well as if I’m doing Doordash or Uber Eats.

This allows Triplog to have the best of both worlds. In other words, you have the more accurate tracking that goes when the app is always tracking. At the same time, it’s less likely to miss any of the tracking due to forgetting to turn the mileage app on.

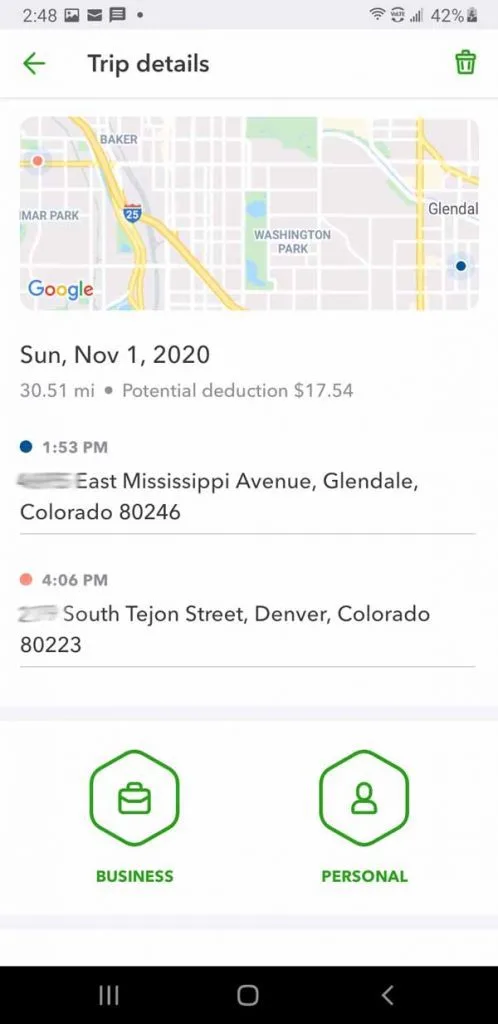

Useable Trip Data – 7 Points

Triplog gives you trip information that goes well beyond any of the other apps.

You can get a map of the route you’ve taken. While other apps do that as well, Triplog takes it a step further.

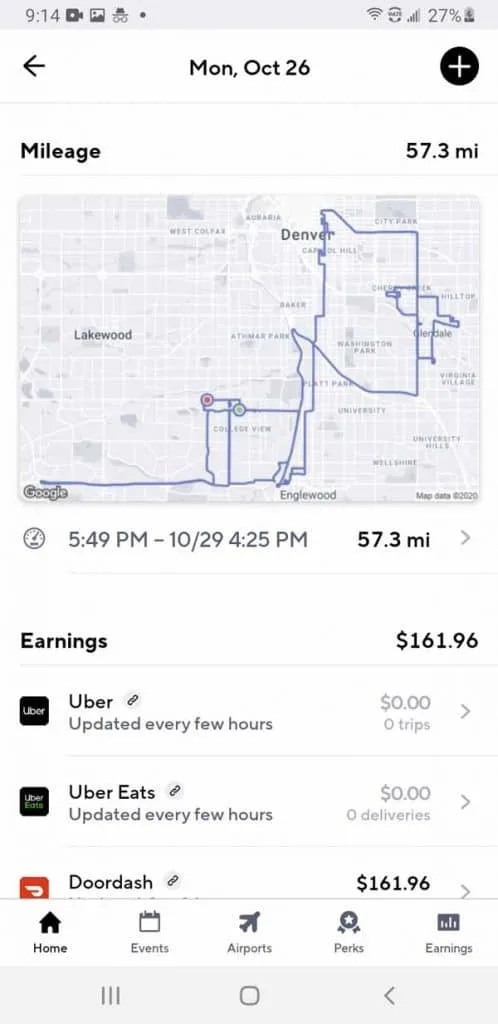

While some apps like Gridwise and Stride also give you a route map, one problem is that those maps show everywhere you’ve been during the time you were tracking. Look at your map after a twelve hour day and it just looks like spaghetti.

There are two things Triplog does differently. One, they create maps for individual trips. If you’ve stopped for a significant time, it will create a new route and map.

But the other one that impresses me is how you can tap on data points on the map and see the specific time, exact coordinates and even the speed you were driving.

If you need to show that you were at a restaurant on time, or that you were indeed at the customer’s at a certain time, this kind of data is huge.

Features – 5 Points

Triplog has a functional accounting program as part of the app. It’s all accessible on a web browser as well. I’ve played with the program and it does a nice job. It’s not as robust as Hurdlr or Quickbooks but more powerful than some like Stride.

Triplog does have some additional features on the mileage tracking end. There’s an odometer feature that you can adjust to match your car, which is good for tracking total miles, commuting and other types of driving. They have options that can even link to the OBD computer on your car to get data, or connect to a remote GPS sensor.

It’s more flexible in the mileage tracking categories. There are additional reports specific to where you’ve been. They even have a last known parking feature, where you can have GPS guide you to where you last parked.

You can also record fuel purchases on the app and have it calculate your fuel efficiency.

These extra features make it tempting to move it to number 1. I do think that the tax estimation capability is important for a lot of contractors, so that leaves this at an extremely, extremely close number 3.

Battery Use – 5 Points

Triplog did not seem bothered at all by battery optimization. The results were consistent whether in optimized or full power mode. It ranked slightly behind Hurdlr and MileIQ when it came to actual battery useage.

Value – 6 Points

This is an extremely powerful mileage tracker and a pretty decent expense and income tracker.

Of the paid programs, Triplog is the least expensive at $59.88 per year, or you can get it monthly for $5.99 per month. That’s pretty reasonable.

There is a free version.

For $5 per month, that’s a reasonable investment. I think the accuracy of this tracker and the lower likelihood of missing miles will actually more than pay for that $5 per month.

This does have a free version. It’s more powerful than the free Stide and Gridwise apps, though it is limited to only 40 trips per month.

Everlance: 20 Points (3rd Place)

Everlance is another full featured mileage, expense, and income tracking app. There is a web interface as well as being able to enter information through the app.

Everlance is a bit better known than many of the other apps. Some of the gig economy platforms have partnered with Everlance for promotional purposes.

Accuracy – 2 Points

When Everlance tracked miles, it did a pretty good job. In fact, it was slightly more accurate than Hurdlr.

The problem is with the word “when.” I had a number of lost trips during this comparison where Everlance didn’t record anything at all.

It seems like Everlance was better when my phone was in full power mode than when I turned on battery optimization. That means you may be able to avoid some of the accuracy issues. However, the trade off is that if you work longer delivery schedules, you may have more challenges keeping your phone charged.

Usable Trip Data – 5 Points

Everlance is similar to Stride and Gridwise in that you get a map for each trip showing the route you took. It does not provide data like Triplog that tells you the time you were at certain points along the route.

The one thing that sets them ahead of other apps that provide a map is that Everlance breaks the trip down into smaller maps, though not as much as Hurdlr does.

Features – 5 Points

Everlance is like four other apps in that it is a combination of mileage, expense, and income tracking.

In my opinion, the accounting on Everlance was better than Stride and Quickbooks self-employed, but not quite as strong as Hurdlr and Triplog.

Hurdlr does have a nicer appearance than a lot of apps. It’s easy to use. It does let you add expense categories, which is a huge improvement over Quickbooks and Stride.

Battery Use – 3 Points

Everlance itself wasn’t as much a drain on the battery. In fact, it’s one of the best. The problem here with Everlance comes with its need to have the phone in full power or high performance mode.

Part of the problem with accuracy is that it often would not require if the phone was set to optimize battery use. The issue isn’t the power drain, it’s that it requires the phone to be in a mode that can allow it to run the battery down faster.

Value – 5 Points

Everlance is a solid product. I think they’re not far behind Triplog and Hurdlr. Their paid version is also at that $5 per month level if paid annually, and $8 per month on a monthly basis.

Everlance was the only app that offered automatic tracking with their free version. However, it only gives you 30 trips before you have to upgrade. That’s not bad, except that every time you stop very long (such as to pick up or drop off the delivery) it creates a new trip. The free version usually only lasts about fifteen to twenty deliveries.

Stride Tax: 16 points (4th place)

Stride has done a fantastic job of building an audience of users in the gig economy. Go into any gig worker Facebook group and ask about mileage trackers and you’ll be amazed at how many drivers recommend Stride.

Stride Tax is a free mileage tracker app that provides very basic mileage and expense tracking. The good thing is it is as focused on gig drivers as any other program out there if not more. The design seems to be intended to make it idiot proof.

Unfortunately that same design often limits its usefulness. We took a deeper dive with our review of the Stride Tax app, grading it on its features and benefits for delivery contractors.

Accuracy: 4 Points

Stride is a lot like Gridwise in that it tracks as long as you have tracking turned on. On most trips, Stride was nearly identical in the business miles tracked.

I did have one trip that I’m quite sure I started tracking, but it seems like the tracking had never started.

I’ve used Stride a lot in the past. There have been issues in the past with the app freezing, and a few times where the app duplicated delivery records. However, none of this has happened while doing the testing with other apps.

Useable Trip Data: 4 Points

The good news is, Stride does show you a map of where you were on a trip.

The bad news is, the map becomes less and less useful the longer you drive. There’s no data that indicates when you were at certain points. If you deliver or drive all day, you only see a jumble of lines showing everywhere you drove.

The one advantage of the Stride app over Gridwise, which also provides just a single map, is that I could zoom in on the Stride app to see the specific streets.

This kind of route detail is only marginally useful if you want to prove that you were indeed at a customer’s location. You can show that you were in the area at some point of the trip, however there’s no time stamp that indicates even roughly what time of day you were there.

Features: 3 Points

Of the five apps that have an accounting element to them, Stride’s was the least useful.

Income and expense tracking is very basic. You can’t categorize income, and you can only choose from a handful of expense categories.

Stride also does not have an online browser where you can look at your routes or your income and expenses. The only access is through the mobile app.

Battery Use: 1 Point

Stride is a battery hog. Whether you’re tracking or not, it’s using very high battery resources. On some days 11% of my phone battery use was by Stride, with a 7.4% average. None of the other apps are even close. The crazy thing is, Stride doesn’t even do automatic tracking, so there shouldn’t be as much need for it to be continually active.

Value: 4 Points

The good news is, Stride is free. The bad news is, you get what you pay for.

Stride Tax app is usually pretty good at tracking miles, and the expense tracking is a nice extra. However, both features fall short of the free version offered by other apps. There’s nothing that I see that Stride offers that other free apps don’t do as well if not better.

Gridwise – 15 points (5th place)

Designed to allow gig workers to analyze their performance and earnings, Gridwise is one of the free mileage trackers. Users can link Gridwise to their delivery apps and automatically pull down earnings data from those apps.

Mileage tracking is an important part of Gridwise’s information. You can tell the program when to start and stop tracking, and Gridwise will use the miles and the time you are tracking to evaluate your earnings per mile and per hour.

Ultimately, Gridwise was designed for rideshare. They have a paid version but those features don’t really add value for delivery drivers in my experience. If they can add some features that benefit delivery contractors, I might see value in the subscription program.

Accuracy. 5 Points

Gridwise uses manual tracking. In other words, you tell it to start a shift and it tracks everything that happens during that time. This type of tracking tends to be more accurate, as there’s no guessing as to when to start tracking.

Gridwise never really seemed to miss anything. The reliability put them ahead of most of the other apps. Of course, like any manual tracking, the accuracy is less useful if you tend to forget to start recording.

While you can’t get automatic tracking on Gridwise, the app does pop up with notifications when it sees that I’m moving and asking if I want to start recording. It will also give a simiilar notification when I’m idle for a long time and asks if I want to turn it off.

Useable Trip Data. 3 points

Gridwise is an improvement over Quickbooks and MileIQ in that you can see the route you took. Unfortunately, after a day of delivery, that route information is a giant blob of lines.

One issue with the Gridwise route map that makes it hard to use the data is, you cannot zoom in on the map to get a better view of which street you were on. About all it does for you is show you were near a certain spot, with no idea what the actual time was.

Features – 2 points

I like having data. I keep spreadsheets so that I can get a look at how I’m doing for the day.

Gridwise is designed to provide data. I like that. It’s a good fit for the geek in me. Unfortunately, the way that they gather the data makes the data not very useful to me.

The potential is there to provide some great information. I just feel like they’re missing much of it.

Gridwise links directly to your delivery apps. That means it can pull your earnings to date. It’s a great way to see what you’ve made on a platform if it’s not easy to get those numbers from them. That capability would be great if they had a more robust expense tracking feature. You can add expenses, but it’s as limited or more so than Stride’s.

One feature is to give you an hourly earnings estimate. That could be a good feature, but it calculates on time you have the app on and doesn’t use actual time on deliveries.

There are some interesting features, but I think it’s missing a lot of potential.

Battery Use: 2 Points

I did not experience any issues with Gridwise’s performance during times when the phone was loaded down with other apps or when in power savings mode. Everything seemed to work as well then as any other time.

However, battery usage reports on my phone reported that Gridwise was using a higher percent of my battery than most other apps. This is true even in times when I do not have the app active and am not tracking.

Value – 3 points

Free is good. I’ll never complain about free. Unfortunately, there’s not much on the app at this time that really adds value. The mileage tracking is nice but there are others that do it just as well or better.

MileIQ: 14.5 Points (6th place)

Mile IQ is the one app of all of these that seems to be designed only for tracking miles. If you try to look up features for the app on their site, every feature is related to mileage tracking.

Unfortunately, I didn’t feel like it was that good at mileage tracking.

MileIQ does have a trial version where you can track 40 trips. The paid version for individuals is $5.99 a month or $59.99 annually.

Accuracy – 3 points

Mile IQ never seemed to miss any trips. However, the total miles tracked were 88% of the baseline odometer reading. This was by far the worst of all the apps.

At the 62.5 cents per mile standard mileage rate, a person driving 25,000 miles a year losing 12% of their miles ends up paying about $470 more in taxes than if the business mileage was accurate.

The only reason that MileIQ wasn’t last in this category is that they didn’t miss any trips like a couple of others.

Useable Trip Data: 1.5 Points

MileIQ tied with Quickbooks for last place in this category. It’s the same issue here as QBSE: The only thing provided is a starting and ending location. There is no trip data or route information provided at all.

Map information for the start and end is useful for IRS purposes, but nothing beyond that.

Features: 1 Point

This one was pretty easy. There are no features. All MileIQ does is track mileage. There is no expense tracking or receipt loading or anything else that I could find. Even for expense tracking, I found MileIQ to be lacking in comparison to other programs that provided extra data based on the miles driven.

Battery Use: 7 Points

This was the best thing that I found about this particular app. It did not seem to bog the phone down or use a high percent of battery power. The app did give me notifications that they did better at knowing when a trip was starting if battery optimization was turned off, however I didn’t notice any times where no trip was recorded.

I wondered if it was possible that part of the reason for the less accurate readings was because of battery optimization settings. However, there was a full day session where I had the phone in full power high performance mode, and the accuracy was just as bad then. While that’s bad news on the accuracy side, it doesn’t seem like the battery issues were a problem.

Value. 2 Points

This is a specialty app. It’s designed to do one thing: Track miles. It costs the same per month as several of the other apps evaluated. It should at least track miles as well as or better than the other apps that have additional features. Instead, MileIQ is among the worst.

Mile IQ’s one saving grace is they do offer a free version. That version is limited to 40 trips per month. Considering that one day of delivery can take up several trips, you’re doing well if you can last a week with that limit.

Quickbooks Self Employed. 13.5 Points

Quickbooks Self Employed wasn’t designed primarily to be a mileage tracking app. Made by Intuit, Quickbooks is well known for accounting programs.

As you can guess, this is meant to be a book keeping app for folks who are self employed. The mileage tracker was added in to support the overall expense tracking feature.

The affiliate link above is to the Android version. For IOS/iPhone you can go to the Play Store version.

Accuracy: 1 Point

There are two issues with accuracy where Quickbooks SE’s mileage tracking is concerned.

One is that a lot of automatic tracking apps tend to miss some miles. Quickbooks is one of the worst at this. In order to avoid tracking things like when you’re walking, the app waits til you reach a certain speed to figure out that you’re driving. This made QBSE miss a lot of miles (only MileIQ was worse).

The other issue is that there were a number of times that Quickbooks Self Employed simply didn’t track anything. There were even a couple of times where it posted duplicate trips.

Useable Trip Data: 1.5 Points

Outside of giving you a number, of telling you how many miles you drove, Quickbooks Self Employed was pretty much worthless.

All that Quickbooks SE gives you is a starting point and an end point. There is no record of the route that was taken. Instances like the above trip record are where this can be a problem. In about 2-1/4 hours, I completed seven deliveries, and this is all I have for a record of that time.

QBSE tied with MileIQ for last place.

Features. 6 Points

There are two things that makes me rate Quickbooks Self Employed this high. One, this is really designed as an accounting program, with mileage tracking a second thought.

The other thing that stands out is their tax estimation feature. They take the miles you drove and factor them in with other expenses and your income. They also ask you for filing status and information about other income, and use that to provide a personalized estimate of what you should save for your tax return.

Power Use. 4 Points

Quickbooks Self Employed was the most efficient of the automatic tracking apps (other than MileIQ) as far as the percentage of power used.

Unfortunately, Quickbooks missed several trips either when the phone was in battery optimization mode, or when it was being used the most heavily. It seems to require more power than many of the apps.

Value: 1 Point.

Quickbooks Self Employed costs $15 per month. That’s three times as much as the paid versions of the other apps on this list. There is no free version of QBSE (some offers may allow a 1 month free trial, others will offer half price for the first three months).

I’m sure Quickbooks is going off their name here. People expect it’s going to be a great app. It’s stable and it works, but overall it’s a much less flexible accounting program than the other apps. The mileage tracker definitely leaves a lot to be desired.

Honorable Mention: Google maps timeline

During this comparison, I ran eight apps at one time. In reality, eight were running. Google Maps was always keeping track in the background.

Maybe we could say Google Maps is the one sitting on the bench ready to pinch hit.

Google maps is not designed or intended to be a mileage tracking app. However, the timeline feature is one of those rarely known gems.

Personally, I track my miles with odometer readings on a Google Sheets spreadsheet. At one time I ran Stride Tax at the same time, just to give me a GPS record and backup.

And then I discovered the Google Maps timeline.

Without even realizing it, you may have been tracking your miles for years. Some folks need to go in and enable it, others find it’s always been enabled. Go enable it.

Timeline isn’t as accurate as any of the other apps. It’s not meant to be. However, it does provide a reasonable history that is a legitimate form of documentation if you forgot to track any miles. You do have to do some extra work, since you’ll have to do some math adding each segment up.

Final thoughts on the GPS apps

Should you use one of these apps? It really depends on you.

Which one is the best mileage tracker app? It really depends on you.

Here’s what I’ve noticed: Every app is going to lose miles or miss something. None of them captured 100 percent of everything I drove. Manually tracking miles was THE best way to track miles.

But that only works if you’re good at actually doing the tracking. If you’re more likely to write down the information when you start and less likely to forget, that’s the best way to go in my opinion.

If the app goes down or battery runs out on your phone, it doesn’t impact your miles.

But if you forget to do that, you’re kind of up a creek. That’s the huge advantage of using an app. Added detail from the GPS recordings is always a nice bonus.

In the end I felt like Triplog was the best at just simply tracking miles. It was a bit more accurate than Hurdlr, and I really like the way the maps give you a bit more information than anyone else.

But for a complete package, no one seems to come close to Hurdlr. The powerful bookkeeping features and the tax information make it a great program.

This all of course is just my experience. You can always try what I did: load them all up and give them a try. It can be done for a short while without paying a bunch because they all have the free or trial versions.

Your results may vary.

Either way: go check out Google maps and make sure the timeline feature is on. It’s a bit creepy that Google knows everywhere I’ve been for the past few years, but having that as a backup can be a lifesaver.

The Best Mileage Tracking Apps for Delivering with Doordash Uber Eats Grubhub Instacart

I took a look at the following apps, to get a feel for which is the best fit for delivery contractors with gig economy apps like Grubhub, Doordash, Uber Eats, Instacart, Postmates and others. The Read More button will take you to the site for each app listed.

Hurdlr

Hurdlr was our winner with an impressive list of features for both paid and free versions, including a powerful income and expense tracking capability.

Triplog Mileage

TripLog Mileage especially impressed me with the trip details they provide in their tracking, an impressive widget for tracking fuel efficiency and a strong book keeping function.

Everlance

Everlance was solid in all five categories that we evaluated. A very solid mileage tracking app with good value.

Stride Tax

Stride Tax is a free app that provides some basic mileage, expense, and income tracking.

Gridwise

Gridwise provides manual mileage tracking as part of a package designed for gig drivers to track their income, calculate profits, and other features.

MileIQ

MileIQ was designed specifically for tracking travel expenses.

QuickBooks Self-Employed:Mileage Tracker and Taxes - Apps on Google Play

Quickbooks Self Employeed is one of the best known income and expense tracking programs and includes automatic mileage tracking. (Note:) The "Read More button links to Android - you can check out the IOS version here.

Google Maps Timeline

Google Maps was not designed as a mileage tracking service and thus we did not include it in the rankings. However, the timeline feature does provide a serviceable history of where you've been.

Lisa

Wednesday 16th of December 2020

Hi there! I have a small restaurant and find your site to be very helpful as I am learning to set up inhouse delivery service during covid19. I am wondering do you have to heat/ freeze the hot/ cold delivery bags? I know this is out of context with the article but I could not find comment option on other article. Thank you in advance! -Lisa

ronald.l.walter

Saturday 19th of December 2020

Hi Lisa

I apologize, I didn't get a notice about your comment. So to try to answer your question, I don't personally heat or freeze the bags. Make sure you get ones that are well insulated and essentially how they work is the heat from within the package will kind of reflect inward. If you have cold items one thing you could look at is using re-useable freeze packs that you can drop in the bag. In the end it depends a lot on how far you'll be going or how long you need to keep the food in a hot bag.

Check out the restaurant supply places to find some good bags. My favorite are the Servit bags sold by Webstaurant - they're well insulated and the velcro closure makes it easy to open and close the bags and quickly seal up. You can check out this article too at https://entrecourier.com/2020/01/17/using-insulated-delivery-bags-and-drink-carriers-for-grubhub-doordash-postmates-uber-eats/.

Thanks for asking, I hope this is helpful. Let me know how the delivery service goes for you!