In the first part of this series on Uber Eats Taxes we said Schedule C is the most important tax form for your delivery work as an Uber Eats independent contractor.

It’s even more important than the Uber 1099 forms you get . That’s because Schedule C, and not your 1099, is what determines what income gets moved over to your 1040 Tax Return.

Okay, but isn’t this starting to get really complicated? All these different forms and schedules and all that. Isn’t this like a bit much for someone to figure out?

It’s not as bad as it seems. I believe you can get a good idea how it works. If we explain some of the things on the form, the rest of it kind of takes care of itself.

There’s really three parts of Schedule C. There’s the personal and business information section, the income section, and the expense section. It’s really as simple as that. Let’s look a bit more at Schedule C: We’ll look at:

- Why it’s important to understand Schedule C.

- What to look for when using tax preparation software

- Filling out the personal information section

- How the income part of Schedule C works

- How the expense sections of Schedule C works

- What happens after Schedule C is done?

Before we go any further:

You need to understand that this is NOT tax advice. DO NOT TAKE THIS as tax advice. The purpose of this article is to educate you on how taxes work. I’ll explain things like what the form does and how it’s used.

I am not a tax expert. I’m just a normal driver who delivers for a number of food delivery companies like Uber Eats, Grubhub, Doordash, and a few others.

So why is a non-tax expert writing a series of articles on Uber Eats taxes? Because I think we get freaked out about taxes. We feel like it’s a mystery that no one can understand. While there are a lot of complexities in the details, the basic concepts aren’t that difficult. If a common delivery driver and blogger can understand the basics, so can anyone else.

That’s my goal here, to try to put all this in terms that are maybe a bit easier to understand.

I’m not trying to make you a tax expert. That’s kind of hard to do if I’m not one myself, right? Instead, my goal is to help some of it make sense. If some of it makes sense, then you might be better prepared for tax season. You’ll have a better idea what to look for through the year.

Having said all that, I really recommend you find a good tax professional. Tax preparation programs like H&R Block or Turbo Tax Self Employed are helpful in walking through taxes. However, if you’re still confused about taxes, it’s worth spending the money for a tax pro.

Disclosure: as an affiliate, I may receive a commission for purchases made from affiliate links like the ones above.

That said, even with the help of a tax pro, I think it’s good to understand how taxes work.

Why it’s important to understand Schedule C.

Schedule C is perhaps the most important part of your independent contractor taxes because:

- It’s the closest thing a self-employed person (sole proprietor) such as an independent contractor has to a W2

- It’s the one form that lets you reduce your taxes by claiming your business expenses (EVEN if you only take the standard deduction).

Why I call it our version of a W-2.

A lot of people make the mistake of thinking that their 1099 form is their version of a W2. 1099’s are very different from a W2 form for a variety of reasons.

- Unlike a W2, the income listed on a 1099 IS NOT the income you move over to your tax form.

- You don’t include a copy of your 1099 with your tax forms

- You don’t even need your 1099 to file your taxes (though it’s good to know what Uber and others are telling the IRS that you received).

The reason all this is true can be summed up in the title of the form: Profit and Loss from Business.

As a 1099 contractor, you are performing services as an independent business. This means you’re filing taxes AS a business.

Most of us are sole proprietors when we deliver for Uber Eats or any other gig economy platform. Some may have formed an LLC for their delivery businesses. Schedule C is the form that is used to report your business income.

As a business owner, you’re expected to keep track of your own business income. You have to report sales whether or not you get a 1099 form. The IRS doesn’t ask you to send in all your 1099’s, because a lot of businesses can end up with a large number of 1099 forms.

How Schedule C works (in a nutshell).

One of the differences between unincorporated small business owners and larger corporations is that our business income is taxed the same as personal income. This is called pass-through business income. This is a good thing for most of us in the sharing economy because our personal income tax rates are generally lower than corporate tax rates.

As a business owner, your profits are your real income. In other words, you’re taxed on what’s left over after your expenses.

On Schedule C, you list your income on the income section. You list expenses in the expense sections. Finally you subtract expenses from income to get your profit (or loss if expenses were more than income). THAT total is like your income total on a W2, it’s the part that gets moved over to your From 1040

Business profits also determine your Self-Employment Tax. Self-Employment tax is our version of FICA Social Security and Medicare taxes. We’ll talk more about Self-Employment tax in another part of this series.

This is the other reason that Schedule C is so important: Many drivers think they can’t claim their expenses because they don’t itemize their taxes. They usually don’t understand the difference between their Uber Eats business expense deductions and a normal tax deduction.

Schedule C is a form that’s filled out as part of the Income part of your tax return. It’s totally different than your itemized deductions. Because you list your expenses on Schedule C instead of itemizing them, you can claim your business miles and other expenses AND claim the standard deduction at the same time.

What if I do other delivery gigs (Doordash, Instacart, etc) or a combination of Rideshare and Delivery? Do I need a separate Schedule C.

Generally I would say you’re going to fill out one Schedule C for all gigs that are a similar form of business. You likely will not need a separate form for Grubhub, Uber Eats, Doordash, Instacart and other delivery gigs. Look at those platforms as different customers for your one delivery business.

Personally, I have created a separate Schedule C for my website. The type of business and how it’s operated is fundamentally different, so I treat them as two different businesses. All records, bookkeeping and finances are completely separate from one another.

Where it’s a little tricky is if you do both rideshare and delivery. Those two do have different business codes, however they’re under the same general category. If I were doing both passengers AND delivery for Uber I would still treat it all as one business. That’s because I would be continually operating, taking a delivery one time, taking a passenger another time. It’s hard if not impossible to keep finances and records individually for rideshare AND delivery.

For that reason, I would lean towards having one Schedule C for the combined business. Ask your tax professional for their advice for your specific situation.

What to look for when using tax preparation software

If you decide to file your own taxes using tax preparation software, you want to make sure that you are using a program that will work with Schedule C.

For the major brands like H&R Block, Tax Slayer and Turbo Tax (affiliate links), look for the Self-Employed versions. If you can’t find a self-employed version, look through the features or the FAQ’s for anything that says they do Schedule C filings.

Most of the lower cost programs and the free programs are strictly for simple tax returns and do not have support for Schedule C. While it’s great to have a free tax program, if you use one that doesn’t support Schedule C, you’re unable to claim your miles and expenses.

What that means is, you’ll pay a far bigger difference in your tax bill at the end than what you would pay for the tax program or for getting a tax professional.

Some programs are pretty good at walking you through entering your expenses. Some aren’t so intuitive. If you are using a tax program, make sure that it walks you through Schedule C. This should happen right as you’re entering your 1099 information.

You may have to look for a link like “Add a Schedule C.” If you get past the income side and are on to the deductions side, you’ve gone too far.

Filling out the personal and business information section

The first thing you’ll have to do is to enter information about your business.

You can see the questions that are part of that section in the image above. We’ll talk about the questions and field.

Name of Proprietor

You will enter your legal name here. To the right you enter your social security number. This allows the IRS to match up your Schedule C with your tax return.

A. Principal Business or Profession

This is where you put a brief description of what your business does. Here you enter just a short simple phrase. Personally I’ve used “On demand delivery services.” If you happen to also do rideshare, you might put “Delivery and Rideshare.”

To the right, the form asks you to “enter code from instructions” in section B. There’s a list of business codes at the back of IRS Schedule C Instructions grouped by category. I’ve always used code 492000, which is Couriers and Messengers under the larger Transportation and Warehousing category.

If you do both delivery and rideshare, you will probably choose a code that describes the bulk of your business. For example, if most of your revenue is as an Uber or Lyft driver hauling passengers, you might choose 485300 Taxi, limousine & ridesharing service (also under Transportation and Warehousing).

C. Business name.

Do NOT put Uber Eats here. You do not own Uber Eats and Uber Eats is not the name of your business. This is where you enter YOUR business name (but only if you have a formal name for your business).

If you have not created an LLC, incorporated, or formally established a DBA (Doing Business As), leave this blank.

D. Employer ID number (EIN)

Even if you are just a sole proprietor, you can create an Employer ID Number (EIN). It’s a very simple process. It’s necessary if you create an LLC or incorporate your business. An EIN is simply a tax identification number for your business. It also may allow you to create a business bank account with certain banks or a Fintech company like Novo (affiliate link).

If you have an EIN for your business, you’ll enter that in box D to the right. Make sure you have filled in BOTH your EIN and your social security number (Box B). If you have not created an EIN, leave this blank.

E. Business Address

For the vast majority of us, the business address is going to be your home address that you put on your 1040 tax form. If you have dedicated office space for your business (which is extremely rare for Uber Eats drivers) then you would use the address for that office.

F. What is my accounting method?

If you have to ask, it’s probably (1) Cash. There’s a form of accounting called Accrual, but that’s more typical with larger businesses that have invoices and bills. Generally if your accounting method is Accrual, you probably already know the answer to this question.

G. Did you materially participate in the operation of the business?

I’ll go out on a limb and say you probably did. If you were doing the deliveries, or were managing the people who did the deliveries for you, then you materially participated. If you want a more detailed definition you can read this article by FreeTax USA.

H. If you started or acquired the business in 2021, check here

I think this one’s pretty self explanatory. One thing I will add: If you’ve filed a Schedule C in the past for other gigs such as Doordash, Grubhub, Instacart or others, you probably wouldn’t check this off. If you’ve already filed for a business using the same business code, even if it was contracting with someone other than Uber Eats, you’re probably going to just treat this as a continuation of that business.

I and J: Did you make payments requiring a 1099?

This is NOT asking if you received a 1099. It’s asking if you paid someone else as a subcontractor for your business.

If you hired a subcontractor to do work for you, and you paid any subcontractor more than $600, you have to fill out a 1099 form and report their income. It’s the same was gig companies sending in a 1099 reporting our income. Keep in mind that if you claim a significant amount as a Contractor expense and did not send a 1099, the IRS can seek out an explanation.

The way our contractor agreements are set up, using a subcontractor is technically allowed but impractical and thus pretty rare.

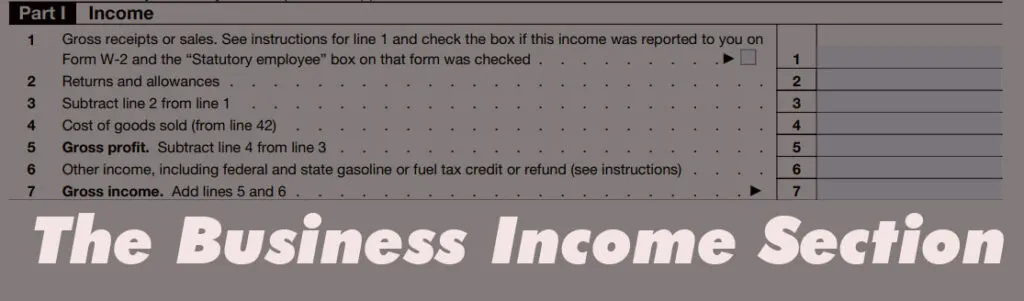

How the income part of Schedule C works

We won’t go into as much detail as we did the business information section.

On line 1 for gross recipts or sales, you add up all the money you received from Uber Eats and any other gigs that you are reporting. For example, last year I made money with five different platforms. All of that money is added up and the total is put on the gross income line on just one Schedule C.

You’ll notice that there’s nowhere on this form where you enter the details of who paid you.

By law, you’re supposed to report your income, even if you didn’t get a 1099. In fact, you’re even supposed to add in cash tips. With the funky way Uber Eats does their 1099’s, it’s possible to have made thousands of dollars without getting a 1099. In that situation you can rely on the Gross Income reported on the tax summary document available in the driver portal.

It’s pretty rare to have Cost of Goods Sold or Returns and Allowances for Uber Eats income. Cost of Goods sold usually relates to merchandise that you sell (purchasing or manufacturing costs). Your business expenses are NOT counted under Cost of Goods Sold. Those go in the expense part of your form.

Returns and Allowances relate to if you had to refund money and that refund wasn’t reflected by a lower income amount.

For example, if you were tip baited, where a customer tip was included in the Uber Eats offer, and then the customer changed their mind, that does not count as a return or allowance. It’s only if you had actually received money and it was reported as income that you could claim a return or allowance.

The Other Income is also pretty rare for what we do. If you suspect there are circumstances where you should be claiming Cost of Goods Sold, Returns and Allowances, or Other Income, you definitely want to clarify that with a tax professional or accountant.

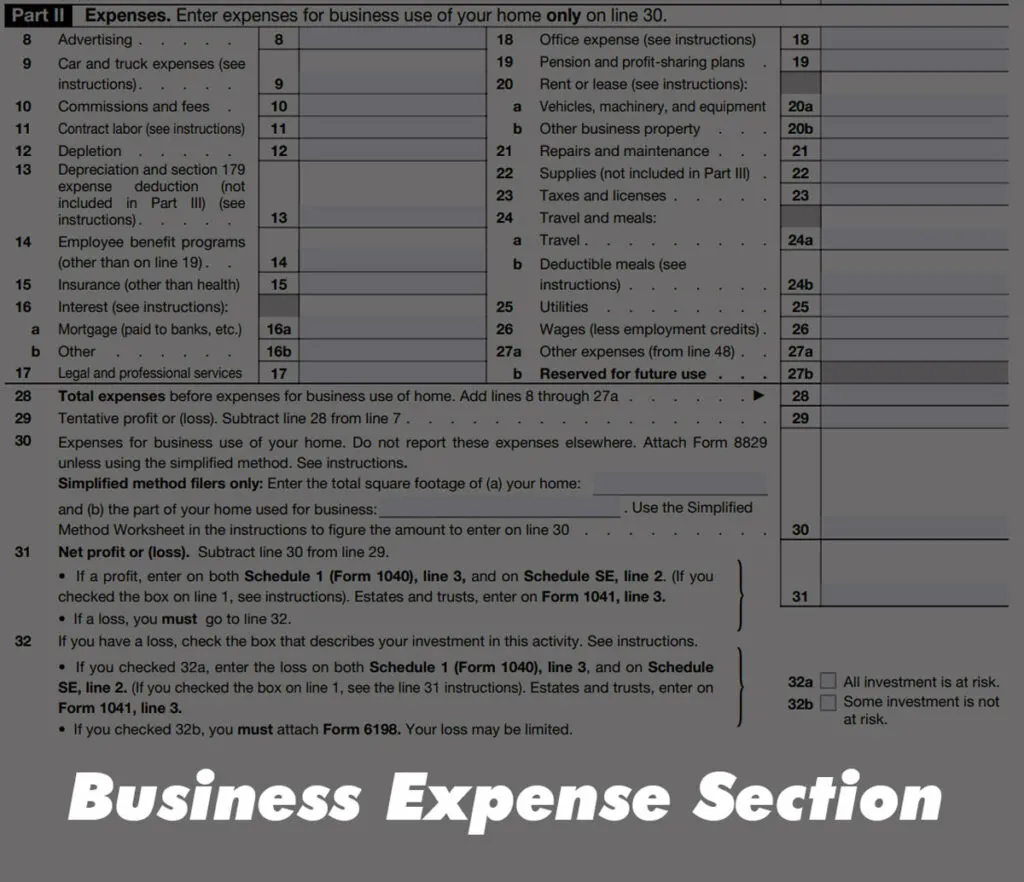

How the expense sections of Schedule C works

The business expense section looks a bit more complicated, but it’s really pretty simple. Here’s where you add up your total expenses.

I’m not going to get into all the categories here. We have a full article in this series that talks about Uber Eats Business Expense deductions. We also have this article that looks at each category in Schedule C and talks about some expenses that may fit in that category.

The first part of the section deals with the expense categories. The IRS has created 19 specific expense categories that are common to small businesses. And then there’s a line where you can total up any expenses that don’t fit into those categories.

For each category, you total up all of the expenses that fit in that category. For example, under #22 Supplies, I usually add up things like any insulated delivery bags I purchased, the cell phone holders I seem to have to replace at least once a year, and PPE such as gloves, etc.

We’ll talk a bit more in a bit about two further sections on Schedule C that go into more detail about certain expenses (use of your car and “Other Expenses.”

Once you’ve entered expense totals for all categories:

You add them all up. That’s your total expense on line 28. From there you subtract that from line 7 (your gross income) to get what’s called a tentative profit.

Line 30 is where you’d add any deduction for the business use of your home. I don’t know why this isn’t included in the other expense categories, but it is what it is.

Because you can only claim a home office deduction if you have space used ONLY for your business and it’s a substantial and regular part of your business activity, I’m of the opinion that this is rarely a deduction an Uber Eats driver can justify. I go into more detail in this article about the home office deduction for delivery drivers.

If your expenses were more than your gross income, you had a loss. At this point the IRS asks if your investment is entirely at risk. This is almost always going to be yes (Box 32A).

Another way of phrasing the question is, if your business had a loss, who pays for it? If it’s all you, then “all investment is at risk.” If you have an outside investor who is taking some of the loss, then some investment is not at risk. I cannot think of a circumstance where 32B is the case for gig economy independent contractors.

Because of the generous mileage allowance and the sheer amount of mileage we can put on our cars, operating at a loss isn’t uncommon.

If you had a loss, the good news is that a loss means you don’t owe self-employment taxes and your income taxes may be lower. The bad news is, you may not be making as much money as you think you are.

IRS Schedule C Part IV: Information on Your Vehicle

If you are claiming any car expenses such as claiming the standard mileage rate, you need to fill out Part IV. This is where the IRS is asking for information about your car.

Here you need to tell them when you started using your car for business, how many total business miles you drove, how many commuting miles you drove, and how many other (personal) miles you drove.

Usually the amount you put in line 9 for Car and Truck expenses is going to be the business miles times the standard mileage rate (67 cents per mile in 2024). If actual expenses are higher, that’s what you’ll put instead.

The only time you’re not going to fill this form out is if you are claiming actual expenses and need to fill out form 4562 to figure out the depreciation you can claim. Section V of that form asks all the same questions about the car.

If you drove more than one car, you may need to fill out a Part IV for each car. Especially if you’re claiming actual expenses on one and mileage on the other. Some software programs create multiple Part IV forms and others don’t. Check with your tax professional for advice on your particular situation.

Pay careful attention to lines 47a and 47b. You are asked if you have evidence to support your deduction. In other words, do you have a written log that meets IRS standards? You can say yes if using a GPS program like Hurdlr (affiliate link) if the program can give you a printable log.

The important thing here: You MUST have a record of your mileage and expenses if you want to claim car expenses.

IRS Schedule C Part V: Other Expenses

If you had expenses that do not fit into the categories in the expense section of Schedule C, you need to categorize them yourself. That is done in Part V as pictured above.

Unfortunately you can not just generalize them by calling it “Other” and leaving it at that. The IRS wants to know what those expenses were.

This is one reason I’m not a fan of Quickbooks Self-Employed (review here) and Stride Tax (review here) for keeping records. Some others may be this way too. Unfortunately, both of these programs only let you categorize something as “Other” and it just adds it up as one lump category.

You want to explain the expenses as well as possible to demonstrate that they are legitimate business expenses. Some of the descriptions I’ve used include:

- Memberships and Dues (for things like Kover subscription)

- e-Bike upgrade costs (85%)

- DashCam

- Cellphone Services (75%)

Adding the percentages aren’t necessary, but I do it because I think it avoids any question if someone is reviewing my return.

Add the totals up and the total is what gets moved to line 27 in the Expense section.

What happens after Schedule C is done?

If your income was greater than your expenses, you made a profit. If not, you had a loss.

There are two places that your Schedule C profit or loss make a difference on your taxes.

First, your income (or loss) get added to your income on Form 1040. If you had other income such as W2 employment or investment income, it all gets added together to figure out your gross income. From there you’ll figure out adjustments and deductions, calculate your income tax bill, then apply any payments, withholding and credits.

The Uber Eats tax calculator, the last part of this series, has a place where you can plug in all your information and get an idea how your business profits will impact your total tax bill.

Notice that the deductions are part of what comes AFTER Schedule C. In other words, it’s a different part of the tax return. This is just to reinforce what I’ve been saying, that whether you itemize or take the standard tax deduction has no bearing on if you can write off business expenses.

Schedule C lets you claim those expenses either way.

The other thing that happens is that your income gets moved over to a form calles Schedule SE. That income is used to calculate your Self Employment Tax. We’ll get more into Self-Employment tax in another part of this series.

And that’s pretty much it.

A lot of detail, but as a general rule it’s not that complicated.

Once you’ve finished Schedule C, you’ve finished the bulk of the tax process as it relates to your self-employment such as Uber Eats. Other than the Self-Employment tax part, the rest is pretty similar to the remaining tax process for typical W-2 income related taxes.