If you are like most people who are trying to figure out this whole Uber Eats tax thing, you may have had a bit of a surprise the first time you read the words “Self-Employment Taxes.”

Wait, what?

Maybe like some folks, you didn’t realize you were self-employed to begin with. Perhaps you’ve discovered some disadvantages of being self-employed and wondered if this was another.

Is this self-employment tax thing making you nervous? I mean, why do we have this extra tax just for being self-employed?

The good news is, there really isn’t an additional tax. The government just chose a confusing name. We’ll get into that soon.

However, the bad news is that self-employment taxes do create a lot of headaches for independent contractors. And, oh by the way, we pay twice what an employee pays. We’ll talk about all that in a moment.

This article is intended to help understand how Self Employment taxes work.

This is part of a series of articles on Uber Eats taxes and how they work.

There are some things about self-employment taxes that are very different from income taxes. And some things are different for employees than they are for self-employed people like you and I. Let’s take a look at how self-employment taxes work.

Read on, and we’ll talk about:

- What exactly IS Self Employment Tax?

- Why didn’t we have to file for this tax as employees but do as self-employed individuals?

- Why are self-employment taxes so high for independent contractors?

- Lessons from an employee paystub that help you understand self-employment taxes

- Introducing Schedule SE: How Self-Employment tax works on your 1040 tax form

- What you can and can’t do to protect yourself from self-employment tax headaches

- One drawback to low Self Employment tax you may not have thought about, and what you can do about it.

But before we get to any of that, a disclaimer:

There are two things you need to know:

One, this is written about Uber Eats taxes in the United States. Different countries have different tax structures, especially when it comes to the things involved in the US Self-employment taxes. If you deliver for Uber Eats or are an independent contractor in another country, this may not be relevant for you.

Two: This is not tax advice. Do not take anything here as tax advice. The purpose of this article is to educate you on how self-employment taxes work. What you do with that information is entirely your responsibility. If you need tax advice, you should seek out that advice from a tax professional who can help you with your unique circumstances.

What exactly IS Self Employment Tax?

Self-Employment tax is the self-employed person’s version of Medicare and Social Security taxes. Maybe you know them as FICA taxes.

So why confuse us by calling it self-employment taxes? Couldn’t the US Government come up with a less intimidating or confusing term? The following is my guess as to why.

Medicare and Social Security are known as employment taxes. They are taxes on employed income.

That’s different than income tax. Income tax is based on ALL income, including things such as interest and investment income, social security and retirement income, things like that.

We don’t pay Social Security and Medicare on those “other income” items, only on employment income. Thus they call them employment taxes.

But the thing is, Uncle Sam wants to get that money from small business owners such as independent contractors, sole proprietors and LLC owners. So, since we’re not employees, they decided to call it “Self Employment Tax.”

That’s my theory anyway.

Why do we have to file Social Security and Medicare taxes when we never had to as employees?

I think the reason that self-employment taxes catch us off guard is that if you’re an employee, you never really have to think about it.

Your employer just takes the money out of your paycheck.

We’ll talk more about this in a moment, but Social Security and Medicare are very different from income tax in one big way: It’s a flat rate tax that is charged against every dollar you earn.

There’s no sliding schedule. Tax brackets don’t mean anything here. It doesn’t matter how many dependents you have or if you itemize or take the standard deduction.

An employee pays 6.2% of every dollar for Social Security and 1.45% for Medicare.

As an employee, it’s pretty straight forward. Your pay is your income. And since it’s a flat rate, there’s nothing really to figure out. Your employer takes 7.65% of your income and sends it in.

Done and done.

As an independent contractor, things are very different:

- It’s impossible for an employer to take the money out of your check because you don’t have an employer.

- As a small business, your income is your profit. In other words, it’s not what you get from Uber Eats, but it’s what’s left over after expenses. Expenses are so variable that it would be impossible for Uber to know what to keep if they did hold any money out.

The US Government can’t determine your self-employment tax without knowing your profits. Therefore, as part of the tax process you figure those profits out by filling out form Schedule C.

So that leaves it all up to you. You figure out what your business income is. Then you calculate your medicare and social security. And finally, you are the one who has to send it in, since there’s no employer to do it for you.

Why are self-employment taxes so high for independent contractors?

One, because self-employment taxes ARE higher. And two, they seem even higher.

They seem higher because we usually have an income tax mindset.

We’re used to a lot of things lowering our taxable income for income taxes. We can throw standard or itemized deductions at it, a lot of other deductions, all the things. It’s possible to earn a lot of money before you start owing any income tax.

It’s easy to think the same thing is going to be true on Self-Employment taxes. Unfortunately, since self-employment tax starts with the first dollar, it feels like even more.

But the other thing that catches us off guard is that self employment tax is 15.3% of your net income (profit).

Not many of us in the gig economy get past the 10 or 12 percent tax bracket (unless we have significant outside income). But now we’re looking at a 15.3% tax ON TOP OF income tax?

Did you notice something here? When we were talking about an employee FICA taxes earlier, it was 7.65%

Self employment tax is 15.3% but an employee only pays 7.65%. How is that fair?

But the thing is, Uncle Sam doesn’t get any more money in the end. That’s because of how the FICA taxes work. See, whether an employee or self-employed, the government gets 12.4% for Social Security and 2.9% for Medicare.

The difference as an employee is that your employer has to pay half of that tax.

When you’re self-employed, guess who gets to pay that other half? You get to pay the employee half AND the employer half.

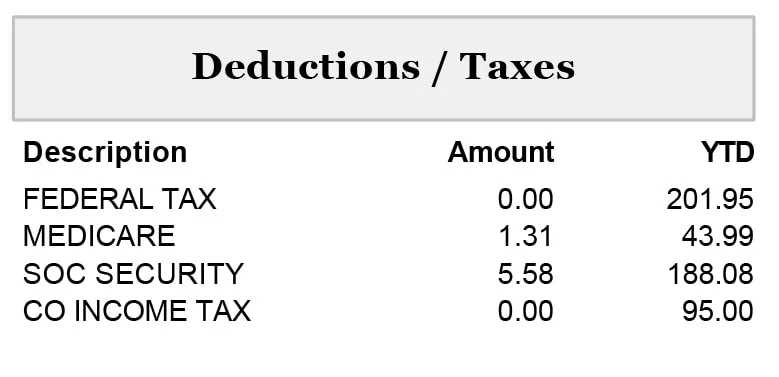

Lessons from an employee paystub that help you understand self-employment taxes

I worked as a business manager for a non-profit organization. We had a job training program for youth to teach them career skills.

One of their big learning moments was getting that first paycheck. We would sit down with them and go over their paystub with them.

We’d almost always get a question like “who is this FICA and why are they taking my money?”

When their checks were smaller, they’d wonder why was money being taken out for Medicare and Social Security but not for state or federal taxes? We had to explain that it works different for those taxes.

Like we talked about above, Social Security and Medicare are charged against every dollar.

It’s a small surprise on a single paycheck. But adding it all up for an entire year can be a real shock for the self-employed.

For example, say you made $12,000 as an independent contractor. That’s less than the standard deduction, so you think you’re safe, right?

Until you find out you owe $1,721 in self-employment taxes.

It’s incredibly important that you understand that taxes for Medicare and Social Security start with the very first dollar you earn.

Introducing Schedule SE: How Self-Employment tax works on your 1040 tax form

Here’s how it works if you’re manually filling out your tax forms:

- You start out by adding up your income such as from your Uber Eats 1099’s or tax summary. That gets put in the income section of Schedule C.

- Then you figure out all your business expenses. That includes figuring out your car expenses or miles, if you drive for your deliveries.

- Subtract total expenses from income to get your net profit on line 31 of Schedule C.

- Your profit gets moved to line 2 on Schedule SE. (If you had more than one Schedule C, profit from all of them gets added up here)

- Multiply your profit times .9235 (this is giving you a deduction for the “employer half” of your self employment tax).

- Multiply that total times .153. This is your self-employment tax.

- Your self-employment tax gets added to your income tax bill and is part of what you have to pay in.

- One downfall of lower self-employment taxes you may not have thought about (and what to do about it)

Obviously, if you’re using tax software like TurboTax, H&R Block, Tax Slayer, or others, those programs will walk through all those steps for you. Note that these are affiliate links, where I may earn commissions that help keep this site operating if you purchase off those links.

There’s a couple of things to pay attention to:

You’ll notice that once you’ve figured out your self-employment income or net profit, the process is very different than figuring out income taxes. There are no deductions or adjustments based on income or dependents or anything like that.

I know I’m beating a dead horse here, but it’s an important concept. This is a flat rate tax on every dollar you earn.

The other thing to note is that there actually is ONE deduction from self-employment tax. That happens on step 5 in the list above. Your profit gets reduced by 7.65% before calculating self-employment tax.

There’s a reason for this. It levels the playing field between employers and self-employed. See, a business can write off the 7.65% employment taxes they pay on their employees to reduce their profits.

Since your self-employment taxes aren’t written off in Schedule C, this is your way of writing off what you could call the employer’s half of your self-employment taxes.

There’s also a place where you write that half off in your income taxes. It’s done in a way that you can claim that even when taking the standard deduction.

One exception to the “taxed on every dollar”

If your net profit from independent contractor work is very low, you won’t owe Self Employment tax.

As you can see in the highlighted portion of the screenshot from Schedule SE, if your tax basis for self-employment tax is less than $400, you don’t owe any self-employment tax.

This happens between step 5 and step 6 in the process above. In other words, it’s after you’ve multiplied your profit times .9235.

In the end, if your total net profit from all of your self-employment income is $433 or less, you won’t owe Self-Employment tax.

But here’s the crazy thing. If your net profit is $434, you owe $61 in self-employment tax. You jump from $0 to $61 in one dollar of earnings.

What you can and can’t do to protect yourself from Self-Employment Tax headaches

I believe that it’s the Self-Employment tax that gets more independent contractors into tax trouble than anything else.

I can’t tell you how many times I’ll hear someone say that they make less than the standard deduction, so they’re okay. They’re in for a rude surprise.

This piece of the tax puzzle leaves more self-employed people in trouble at tax season than anything else. It’s the one thing that creates the biggest tax surprise.

Here’s the thing: For income taxes, it’s only when you’ve made more than about $53,000 as a single person, or $106,000 as a married couple that your income tax rate goes higher than the 15.3% self-employment tax.

As a gig economy contractor, your self-employment taxes are almost always higher than income taxes.

If you’re not prepared for that, tax day could be a really bad day for you.

What you can’t do to reduce your self-employment taxes.

Here’s that dead horse again.

Itemized deductions will do nothing to reduce your self-employment taxes. Neither will the standard deduction. None of those deductions happen like they do with income taxes.

In fact, a lot of tax credits won’t help. The order in which everything is done on your tax form, non-refundable credits are applied BEFORE your self-employment tax is added to the form.

Even with refundable credits, the fact remains that you pay based on every dollar. You may still receive a refund, but the refund would have been higher if not for that extra self-employment tax.

Okay, I’m done beating that horse.

The only way to reduce self-employment taxes

The ONLY thing that will reduce your self-employment taxes is reducing your profit.

And the thing is, you earned what you earned. You can’t change that, and you run a risk if you try to under-report your earnings.

That means the only effective way to reduce your self-employment tax bill is to claim every expense that is reasonable and necessary for your business on form Schedule C.

If it’s a legitimate expense, you should claim it. That includes every mile that you drive for business. It includes every dollar spent operating your business.

You need to know what you spent. And yes, you CAN claim it no mater whether you itemize or take the standard deduction.

How to stay out of Self-Employment tax trouble.

There are two important things you can do here.

Track everything.

Keep track of your miles and expenses. Have a record of everything you spend.

The most important rule of record keeping, in my opinion, is if you think it might be a business expense, keep a record of it. You can always sort it out later by clarifying with your tax professional.

Track every mile you drive for business. Find the method of mileage tracking that works best for you. I use a spreadsheet and put down my starting and ending odometer miles. You might find that a GPS program works better.

In my opinion, after looking at all the different programs, I found Hurdlr to be the best app for tracking both miles and expenses (affiliate link). The free version is more full featured than a lot of popular apps that you have to pay for.

Here’s the thing: every mile you track knocks 10 cents off your self-employment tax bill. I know, ten cents doesn’t seem like much. However, if you put tens of thousands of miles on your car that adds up.

Save money for taxes.

No employer is withholding taxes for you.

However, if you treat your Uber Eats income (and any other self-employed income) like a paycheck, and do your own tax withholding before you spend a penny of that pay, you’ll keep yourself out of trouble.

Make a rough calculation of your profits each week. Determine what percentage you need to set aside of that profit. Start with 15% since your Self-Employment tax is there. I personally set aside 20%, but you can read more about how to save for taxes here.

The Uber Eats tax calculator, the last part of this series, also has a place where you can plug in your income, miles, and other expenses to get an idea how your profits will impact your entire tax picture.

Put that money aside where you won’t touch it. It’s best to put it somewhere where you can’t take it from your checking account. You can make estimated payments each quarter, and that’s the best way to keep from spending the money.

One drawback to low Self Employment tax you may not have thought about, and what you can do about it.

Here’s something to think about: Your social security benefits are based on how much money you earned over your career.

There’s a beauty in gig work, in that we can write off a lot of expenses and lower our taxable income.

However, I noticed something when playing around with the Social Security Administration’s benefit calculator. If I add money to my total earnings, the benefit goes up slightly. In my case, the calculator said that the total increase in benefit was about $9 per year for each thousand dollars I made.

That’s not a lot of money, but in 15 years it makes up for the self-employment tax savings that came from writing off a thousand dollars.

I don’t think that means we just avoid writing off expenses for that reason. In fact, over 20 years PLUS however long before I retire, that’s a really really bad rate of return.

But here’s what I’m getting at: Paying less in social security taxes means you’ll get less later on in Social Security.

And what that means is, you want to make sure you’re putting some of those savings aside for retirement. The good news is, you can write off certain retirement savings from your income taxes (though they won’t lower your self-employment taxes).

In the end, that points out one overwhelming lesson about self employment and being an independent contractor. Personally, I love the freedom and flexibility. I can’t imagine going back to employment life.

However, here’s the lesson: Being self-employed means you have a greater responsibility to yourself. Whether it’s taking care of yourself in retirement or keeping up on your taxes, a lot more is on your shoulders.

Take care of your employee.