There are two parts of the income tax puzzle for independent contractors in the gig economy:

- Determining your taxable income for your business

- Including your business income with other income to determine your income tax bill

A lot of it can be overwhelming. It can be more so when you throw in the whole self-employment tax thing. How do you stay on top of it and ensure you’ve done it correctly?

The truth is, it’s too much to try to tackle in a single blog post. That’s why we approached this a bit differently, breaking it up into a series of articles about delivery driver taxes. We dive deeper into different pieces of the tax puzzle, looking at things like how you can write off business expenses, how to use Schedule C to determine your taxable income, and how self-employment tax works. You can see an entire list of those articles at the end of this post.

For this article, we’ll assume you’ve already tackled the first part of taxes (determining your taxable income). Now we’ll examine how your business income influences your income taxes. We’ll take a look at three things that happen as you do your tax return:

- Determining your taxable earnings

- Adjustmentments to find taxable income.

- Calculating your tax bill

- Figuring out how much you still owe (or get back)

About this article

The purpose of this article is to discuss how the income tax process works with your independent contractor earnings. This is about income taxes in the United States. Different countries have their own tax regulations, which we do not cover in this article.

We focus on how these taxes impact independent contractors in the gig economy. However, the process is similar for most self-employed individuals who operate sole proprietorships, partnerships, and certain other business structures.

This is not tax advice and should not be taken as such. The purpose is to educate and inform about these deductions. You should seek guidance from a tax professional to determine how these deductions would work in your tax situation.

Step 1: Add up all the income.

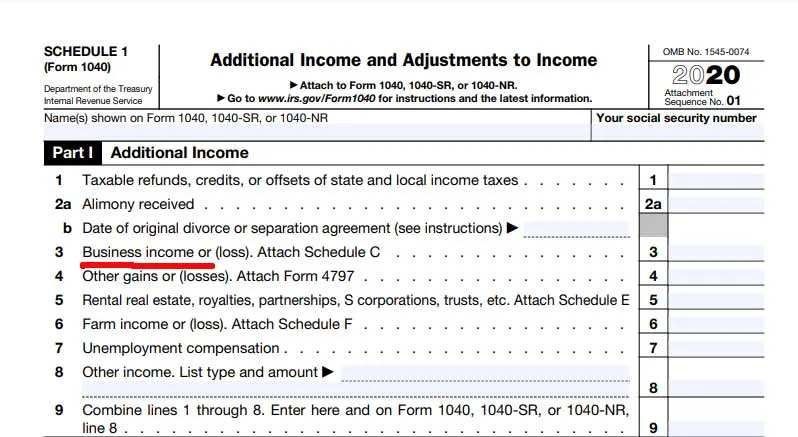

The first part of the tax form is where you add up all of your income. This happens on lines 1 through 9 in the screenshot above. Notice that the screenshot and line numbers referenced are from the 2021 version of the 1040 form.

Your total W2 wages (and your partner’s, if filing a joint return) goes on line 1. There are several other income types on the following lines, mostly related to retirement income.

Line 8 includes several other income types, including your business income. I call this business income because, as an independent contractor, you provide services as a business rather than as an employee. This is why I said earlier that the first part of the puzzle is determining your taxable business income.

Here’s how it works: First, you add up your gig worker earnings and list the total on Schedule C. Then you list your expenses, subtracting them from revenue to determine profit.

On IRS Schedule 1, you will add several different income types, such as alimony, investments, gambling, and other income. Your business profits are included in that total.

Step 2: Adjustments and deductions to determine taxable income

This is where all the different income adjustments and tax deductions take place. It happens in a few steps.

The first step is what you could call the pre-deduction stage.

We mentioned IRS form Schedule 1 earlier. There’s a second part to that form where you list several income adjustments. These adjustments will reduce your income to determine your adjusted gross income.

You can deduct part of your self-employment tax, self-employed health insurance, and certain self-employed retirement plan contributions on this form.

Two important things happen because of the adjustments at this stage.

One is that these things lower your adjusted gross income, an important number for determining used for qualification in several programs. Second, because this isn’t part of the tax deduction process, you can claim these things while taking the standard tax deduction.

Next is what you could call the deduction stage. These deductions happen after your Adjusted Gross Income (AGI) has been determined.

Two major deductions happen for gig workers in this section. First, this is where you claim either your itemized or standard tax deductions. The second is that it’s where you can claim the QBI (Qualified Business Deduction), which allows you to write off up to 20% of your self-employment income.

The screenshot above is from the 2021 1040 form and includes a line for charitable contributions. That line will not be on the 2022 and later tax forms. You will have to itemize deductions to claim tax-exempt donations.

Subtract your tax deductions and QBI deduction to get your taxable income.

Step 3: Figure out your income tax bill.

This is the part where you calculate your income tax bill. Don’t mistake this for what you have to send in (or your refund). It’s what you would pay if you didn’t have any withholding or tax credits.

Income tax is calculated as a percentage of taxable income on a tiered system. Your rate (tax bracket) rises as taxable income increases.

The calculations are somewhat complicated, so it’s easiest to look your income up on the IRS Tax tables.

Say you’re single with a taxable income (after deductions) of $24,000. Comparing that to the table above (2021 tax year), your tax bill is $2,684.

The tax brackets can be confusing. The top tax percentage isn’t applied to your entire income but in steps. The first several dollars are taxed at 10%, and only the income exceeding the next threshold is taxed at a higher rate.

Let’s look at an example. The 12% tax bracket for a single filer in 2024 is between $11,600 and $47,125. The next bracket is 22%. A single person with a $50,000 taxable income would be in the 22% bracket. If the entire amount was taxed at 22%, the tax bill would be $11,000. However, here’s what it would look like.

- Tax on the first $11,600 is 10%, or $1,160.

- Tax on the next $35,525 (between $11,600 and $47,126) is 12%, or $4,263).

- Only the final $875 is taxed at the 22% rate, for $193

- The total tax is $5,616, significantly lower than if the entire $50,000 were taxed at 22%

Keep in mind that income tax isn’t your only tax obligation as an independent contractor. You may have self-employment taxes, which we discuss here. That gets added to your tax form just a bit further down.

Step 4: Determining what you owe (or what you get back)

I mentioned in Step 3 that the tax bill is not the same thing as whether you pay in or get a refund. That step determined your tax bill. Now it’s time to see if it’s already been paid.

This is where payments and credits are applied to your tax bill, such as:

- Paycheck withholding

- Estimated payments you made through the year

- Non-Refundable Tax Credits

- Refundable Tax Credits.

Of course, the IRS can’t make it too simple, can they? This all happens in a series of steps.

Subtracting non-refundable credits from your income tax bill.

Non-refundable tax credits act like a payment, but only to the point that they pay off your tax bill. Some of these credits include:

- Childcare credits

- Education credits

- Electric Vehicle and alternative energy credits

- Adoption credits

IRS form Schedule 3 has two pages of non-refundable credits.

Subtract these credits from your tax bill. If the credits equal more than your tax bill, enter $0 as the total. You do not put a negative number here.

Because of this process, you will not get a refund if your non-refundable credits are more than your income tax bill.

Adding your self-employment tax to the total.

Adding your self-employment tax from Schedule SE gives you your current balance.

There’s a reason this happens here and not when calculating your income tax bill. That’s because non-refundable credits are only intended to apply to income taxes.

It makes sense when you think about how self-employment tax covers Social Security and Medicare. Employees can’t pay those taxes with non-refundable credits because payments are taken from their paychecks.

Applying payments and refundable tax credits

Finally, payments and refundable credits are applied. Any money withheld from paychecks, quarterly tax payments, and refundable credits are subtracted from the remaining balance.

They’re called refundable credits because if the credit is more than what you owe, you can get that money back as a tax refund. They act just like cash payments in that way.

Some refundable tax credits include the American Opportunity credit (for college), part of the child tax credit, and earned income credit (EIC).

Total those refundable credits and payments. If that total is less than your balance, you owe the difference. If it’s more than the balance, you’ll get a refund.

Wrapping it up.

This should give you a better idea of how the income tax filing process works when you work with companies like Doordash, Uber Eats, Instacart, Lyft, Grubhub, and others.

Much of this is the same whether you are self-employed or not. I hope that it gives you a better idea of what to expect and how your self-employment income impacts you.

As you understand how the entire process works, it helps you better prepare for tax day. You get a better picture of what your bill may be, and that lets you plan and save accordingly.

The Delivery Driver’s Tax Series

The Delivery Driver's Tax Information Series (Grubhub, Doordash, Postmates, Uber Eats, Instacart)

The Delivery Driver's Tax Information Series is a series of articles designed to help you understand how taxes work for you as an independent contractor with gig economy delivery apps like Doordash, Uber Eats, Grubhub, Instacart, and Postmates. Below are some of the articles

What are your delivery driver taxes based on?

It is important to understand your taxable income is your profit, NOT your pay from Grubhub Doordash Postmates Uber Eats etc. Schedule C figures that.

How does itemizing or taking the standard deduction affect writing off delivery driver business expenses?

We examine the difference between business expenses and tax deductions, and why you can claim your expenses even when taking the standard deduction.

Tax Guide: Understanding Your Income

The following three articles help you understand what your real income is as an independent contractor.

Understanding business income as a 1099 gig worker

What income do you have to report as a contractor for Grubhub, Doordash, Postmates, Uber Eats and other delivery gigs? How and where do you report?

What are 1099 forms and what do we do with them?

Episode 57 of the Deliver on Your Business Podcast. Once you receive your 1099 forms from Doordash, Uber Eats, Grubhub, Postmates and others, what do you do with them?

What If My 1099 is Wrong?

What if the amount reported on your 1099 is incorrect? This is not an uncommon problem. Do NOT just let it ride, incorrect information could cost you a lot in extra taxes

Tax Guide: Understanding Your Expenses

The following eight articles help you understand the expenses you can claim on your Schedule C. Most of these are about your car, your biggest expense.

How do business expenses work for Delivery Drivers in the gig economy?

Introducing and explaining the business expenses as they are claimed on your taxes as a contractor for Grubhub, Doordash, Postmates, Uber Eats.

How to write off car expenses for gig workers

For those of us who do use our cars for gig economy delivery, the car expense is the largest expense item. You can choose between the standard mileage allowance and actual expenses.

How to Track Your Miles As a Delivery Contractor

Every mile that you track as a contractor delivering for Doordash, Uber Eats, Grubhub, Instacart, Lyft etc, is saves about 14 cents on your taxes. When you drive thousands of miles, that adds up.

What Miles can you and can you not claim for delivery and rideshare?

What miles can I claim when delivering for Grubhub, Doordash, Postmates, Uber Eats and other delivery gigs? Understand what miles you can and cannot claim.

What if I Forgot to track my miles?

What do I do if I didn't track my miles as a gig economy driver? We look at different places you can find evidence to use in building a mileage log.

How the actual car expense method works for gig workers

It is important to understand your taxable income is your profit, NOT your pay from Grubhub Doordash Postmates Uber Eats etc. Schedule C figures that.

Three Car Expenses Gig Economy Drivers May Not Know You Could Claim Even When Claiming the Mileage Deduction

You probably didn't realize that even if you claim the standard mileage deduction, there are some car related expenses you can still claim.

Besides My Car, What Other Business Expenses can I claim for Grubhub Doordash Postmates Uber Eats etc?

Besides your car, what expenses can you claim as a contractor for Grubhub, Postmates, Uber Eats, Doordash etc? We look at some different possible expenses.

Filling Out Your Tax Forms

Once you understand your income and expenses, what do you do with them? Where does all this information go when you start filling out your taxes?

Filling Out Your Schedule C as a Grubhub Doordash Postmates Uber Eats Contractor

How do you fill out the Schedule C when you contract with gig companies like Uber Eats, Postmates, Grubhub, Doordash etc.? We talk about different parts of this form.

Understanding Self Employment Taxes for Delivery Drivers for Grubhub, Doordash, Postmates, Uber Eats etc.

Understand how self employment tax works as a contractor for Grubhub, Uber Eats, Doordash, Postmates or any other gigs. Know what it is,how much & be ready!

Here are Four Tax Deductions for Self Employed Contractors That Don't Go on Schedule C.

Most of our deductions as self employed contractors go on Schedule C. Four deductions benefitting Grubhub Doordash Postmates Uber Eats Contractors.

Do 1099 Delivery Drivers Need to Pay Quarterly Taxes?

We look at how quarterly tax payments work for gig economy workers (Uber Eats, Doordash, Grubhub, Instacart, Uber, Lyft, etc.)

How Much Should I Save for Taxes? | Grubhub Doordash Uber Eats

How much should I save for taxes when delivering for gigs like Grubhub, Doordash, Postmates, Uber Eats and others? These ideas help you prepare for taxes.