Gig workers using their car for deliveries (Doordash, Uber Eats, Instacart, Grubhub, Shipt, and a host of others) get a significant tax write-off claiming mileage or actual driving costs. But is there anything else?

What if you don’t drive? How do you avoid claiming things you shouldn’t?

There are several tax write-offs. We’ll talk about how it works to claim business expenses, including:

- The single most important guideline for what you can claim

- Three types of expenditures that are not business expenses

- Two myths that cost contractors a lot of money

- Common delivery driver business expenses by category

- How to claim those business expenses on your taxes

About this article

The purpose of this article is to explain how it works to claim business expenses other than your car. It’s also one of several articles in a series about delivery driver taxes. We’ll link to other articles where appropriate, and you can view the entire list of posts here.

This website focuses on running your business as a gig economy independent contractor, especially in the delivery sector. Many examples will relate to delivering for delivery companies such as Doordash, Instacart, Uber Eats, and Grubhub, to name a few. However, the concepts here relate to most forms of self-employment.

This is not tax advice. The purpose is to educate and explain how U.S. taxes work for independent contractors. If you need advice about your particular tax situation, you should seek a tax expert who can guide you individually. Likewise, you should seek out resources or professional tax help to understand taxes in other countries or for some particular state and local taxes.

The single most important guideline for what you can claim on your delivery driver taxes

Further down, we’ll discuss some examples that many gig workers can claim. However, it’s impossible to list every possible deduction. For that reason, understanding how the IRS defines a deductible business expense will help you determine if other items are deductible.

If you buy something specifically for the operation of your business, that’s a business expense. This is what the IRS says:

To be deductible, a business expense must be both ordinary and necessary. An ordinary expense is one that is common and accepted in your industry. A necessary expense is one that is helpful and appropriate for your trade or business. An expense does not have to be indispensable to be considered necessary.

IRS Publication 535: Business Expenses

The primary rule for the IRS is that the expense must be “ordinary and necessary” for your business. In other words, it must make sense for the type of business you operate, and it must have a business purpose.

We go into more detail here about how business expenses work for delivery drivers in the gig economy.

Three types of purchases that are not expenses

Even though an expense may be ordinary and necessary, you may not be allowed to deduct the expense in the year you paid or incurred it. In some cases, you may not be allowed to deduct the expense at all. Therefore, it is important to distinguish usual business expenses from expenses that include the following.

- The expenses used to figure cost of goods sold.

- Capital expenses.

- Personal expenses.

The quote above from IRS Publication 535 lists three purchase types that can not be claimed as business expenses. We’ll briefly discuss the three.

Cost of goods sold. “Cost of goods sold (COGS)” refers to purchasing or making items you will sell. It’s an accounting term. COGS is unusual for most delivery and rideshare contractors. It’s not that you can’t claim those costs, but the rules about how it works are different, and you write them off differently.

Capital expenses. Many items maintain significant value after the purchase. They’re known as assets. A general rule of thumb is it fits this category if it costs more than $2,5 00. A car is a good example. It’s not considered an expense because you’re trading one asset (money) for another (the car). You still have the same value of assets, so there’s no expense involved. When the item loses its value, you can claim that loss (depreciation). We talk more here about writing off your car purchase or payments for gig work.

Personal expenses. The IRS says you can not generally deduct personal, living, or family expenses. For example, meals and clothing are personal things you would need whether you were running your business or not. The fact that you are delivering or operating your business while you eat or wearing that clothing does not make it deductible.

Two business expense myths that cost contractors a lot of money in unnecessary taxes

There are two common expensive myths among independent contractors. Too many gig workers believe these myths and pay far more in taxes as a result. Both are very wrong.

- You can’t claim business expenses if you take the standard tax deduction

- You can’t claim business expenses if you claim mileage

Too many drivers assume these to be true and fail to track their expenses. That’s an expensive mistake. You can claim business expenses in both situations as a self-employed independent contractor.

You CAN claim business expenses regardless of whether you itemize or take the standard deduction. The type of personal tax deduction you claim is irrelevant. These are business deductions, not personal. When you are self-employed, you deduct your business expenses on IRS form Schedule C, not as part of the itemizing of deductions. This is a big deal, especially since the standard deduction has jumped so much in recent years.

You CAN claim business expenses even when claiming mileage on your car. People get confused by the either/or stipulation about claiming vehicle expenses. They think it means you can’t claim any expenses at all if you claim miles. The IRS offered the standard mileage rate as an alternative to claiming actual car costs, stipulating that you may only claim one or the other. However, that stipulation only vehicle costs versus mileage. It does not rule out any non-vehicle expenses.

Common delivery driver expenses by category

As an independent contractor, you provide delivery services as a business, not as an employee. Your income as a business owner is your profit, not the money you get from Instacart, Uber Eats, Doordash, Amazon Flex or others. It’s the money left over after taxes.

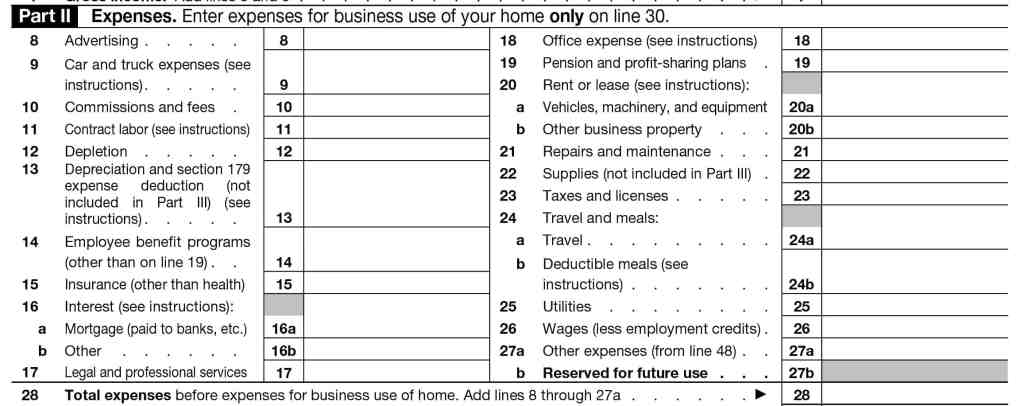

To determine that taxable income, the IRS has you fill out a form called Schedule C: Profit or Loss from Business. You can download a copy of the Schedule C from the IRS, but we have a screenshot below of the expense section:

Here, you total up your expenses for each category listed. Add those expenses up and subtract them from your income to get your profit.

We’ll look at the different categories and provide examples of expenses that might fit into each.

Schedule C is designed to fit several business types. Several of these rarely involve independent contractor gig economy work. We’ll note that in those sections.

Line 8: Advertising

Gig work rarely involves advertising, as all opportunities are transmitted to us on the driver apps. Here are two possible expense items:

- Business Cards printed to advertise your availability for courier work, such as if you did freelance work outside gig work, could be categorized as advertising.

- Printed materials reminding customers to tip or rate you. Some couriers get stickers asking for ratings or encouraging tips. Items encouraging behavior that improve your profits qualify as advertising.

Line 9: Car and Truck Expenses

Here’s where you claim either the business portion of your actual car expenses or your total mileage allowance. You can also add trip-related parking and tolls. We go into a lot more detail about car expenses in these articles.

- Claiming your car expenses

- How to track miles for the standard mileage allowance

- What miles you can claim as business miles as a delivery contractor

- Claiming actual expenses vs the standard mileage allowance

Line 10: Commissions and Fees

If you accept payment for services via Square, Paypal, or other processors, the payment processing fees fit into this.

You may be surprised to learn that this is a common expense item for contractors with several platforms like Uber, Uber Eats, and Lyft. We’ll use this Uber Eats tax summary screenshot as an example.

With this example, the driver only received $11,140.76 for their deliveries. However, Uber reported a $13,275.80 income. On the tax summary, they said expenses, fees, and taxes were $2,135.04.

This is because Uber claims to act as a payment processor, supposedly taking out commissions. In this case, the driver would claim the entire income reported by Uber and then deduct the service fees on line 10.

You can read in more detail about how the amounts reported on your Uber 1099 form are calculated.

Line 11: Contract Labor

If you paid someone to help with your delivery services, you could enter the total payments here. Remember that you are required to file a 1099-NEC form to report payments of more than $600 made to any individual.

Line 12: Depletion

Depletion is the using up of natural resources by mining, drilling, quarrying stone, or cutting timber.

TaxAct.com: Schedule C – Depletion.

Depletion is not a typical expense item for gig workers.

Line 13: Depreciation

We explained earlier that capital expenses are not considered expense items because you receive one asset (property purchased, such as a car) for another (money). You still have the same total assets at that moment, only distributed differently.

That property doesn’t become an expense item until it loses value. This loss of value is called depreciation.

You can not claim vehicle depreciation if you use the standard mileage allowance method for calculating car expenses. However, if you use the actual expense method, you can claim the business portion of your car’s depreciation.

Equipment or property you purchase for your business that costs more than $2,500 must be capitalized. Depreciation is the only way to write that cost off.

Aside from a car, gig workers’ most common items depreciated are high-end bicycles, e-bikes, motorcycles, or scooters used for delivery.

Calculating depreciation can be complicated. You should seek a tax professional to guide you in how depreciation works.

Line 14. Employee Benefit Programs

As gig workers rarely hire employees, we will not discuss this item.

Line 15. Insurance (other than Health)

This is for insurance related to your business. Do not include health insurance, as that’s a personal item. Car insurance is part of your vehicle expense and should not be claimed here.

Some insurance examples for gig workers include:

- Business Liability Insurance: General business or liability insurance.

- Motorcycle, bicycle, or scooter insurance. Bikes, motorcycles, and scooters are not considered car and truck expenses (line 9). You can not claim miles for them, either. The business portion of such insurance might be included in this category.

- Workers Compensation for Self-Employed Persons. Some states or municipalities may require a self-employed person to purchase worker’s compensation insurance.

Line 16. Interest Expense

You can claim interest expenses on loans or financing related to your business. The purchases must be business related. If the item financed has mixed use (personal and business), you would claim a percentage relative to what portion of use was for business.

Avoid using a credit card for both personal and business purchases. Calculating how much of that interest is for business can be complicated.

- Car Loan Interest. You can claim the business percentage of your interest on your car loan, regardless of whether you claim mileage. If 60% of your miles were business miles, you’d write off 60% of the interest portion of your payment.

- Business Loan or Credit Card Interest. The interest is deductible if you have a loan, line of credit, or credit card that you use exclusively for business. If you use a credit card for your vehicle costs, the percentage of interest relative to business use is deductible.

- Pandemic Relief Loan Interest. If you received the Paycheck Protection Program loan or EIDL loan and have any interest charges on that loan, you can claim that here.

Line 17. Legal and Professional Services.

Quickbooks defines this as “fees for short-term professional advice (including lawyers and accountants) regarding specific deals, sales transactions, or yearly taxes.” Some fees and services for delivery contractors might include:

- Accountant fees (ask your accountant to break out how much is related to business and how much is related to personal).

- Legal fees. If you set up a corporation or had costs related to consultation over business-related issues.

- Business Coaching. Suppose you hired a business coach or paid for consultation on how to improve your delivery business. In that case, this is where you would apply it.

- Other Business Consulting: Fees paid for consulting on how to set up a business or consulting about a particular aspect.

Line 18: Office expense

Gig work is different from many businesses in that it’s almost all done on the road. It may be more helpful to consider office expenses as the cost of day-to-day operations.

Here are some things that might fit in the Office Expenses category:

- Software subscriptions and paid apps. Mileage tracking apps like Hurdlr or fees for productivity apps like Solo.

- Bank Charges. Monthly fees, transaction fees, and checks related to a business bank account.

- Instant Pay Transaction Fees. Delivery apps often charge $0.50 to $2 per transaction. These fees act the same as a bank charge and are deductible.

- Cell phone and data plans. Determine what percentage of your phone use is personal and deduct that percentage of the plan fees. Typically you would split your cell bill, claiming the plan under office expenses and the phone costs in other places.

Line 19: Pension and profit-sharing plans

If you don’t have employees, this won’t apply. Personal retirement savings do not go here.

Line 20: Rent or lease

The rent or lease category includes any costs related to renting or leasing property or equipment for your business. Businesses that rent office space would include rent in Part B: Other business property. Cars and other items rented for business use fit under Part A: Vehicles, machinery and equipment.

- Vehicle Rent or Lease. You can not claim your lease payment if you use the standard mileage deduction. However, you can claim the business percentage of your lease payment if you use the actual expense method.

- Cell Phone Lease. If you have a monthly lease payment on your cell phone, you can claim the business percentage of that payment here. You may end up dividing your cell bill, with the plan portion being listed under Office Expense and the equipment lease under Rent or Lease.

- Bicycle, scooter, or motorcycle lease or rental. There are some e-Bike rental programs for delivery contractors. You may use bike-share programs or scooter rentals from time to time. Or perhaps you rent from a local bike shop to try out bike delivery. You can claim the business portion of those payments here.

Line 21: Repairs and Maintenance

Car repairs do not go here. They’re included in line 9: Car and Truck Expenses. Repair and maintenance of other equipment you use for business fit in this area. If you use the items for both personal and business purposes, you would claim the percentage related to what portion of usage is for business.

- Bicycle, motorcycle, or scooter repairs and maintenance. Because these are not considered car and truck expenses, and because you can not claim mileage for these, you would list repair and maintenance costs here.

- Cell phone repair. Repair costs for cracked screens and other issues.

Line 22: Supplies

The Supplies category includes things you need to operate your business. Some possible deductions include:

- Delivery bags and drink holders.

- Cell phone holder.

- Battery packs or chargers

- Emergency toolkit.

- Carts for hauling large orders

- Work Specific Clothing. Note: the IRS says that clothing must be “exclusively for work” and “unsuitable for street wear” to be a deductible expense. Simply wearing clothing while working does not make it deductible. Gig company branded apparel purchases may be deductible as it’s not everyday streetwear.

Line 23: Taxes and Licenses

However, most delivery drivers aren’t going to have federal taxes to claim here, it’s usually local fees.

This category includes taxes and regulatory fees related to your business. Do not include sales taxes here, as those are to be included with the cost of the taxed items in the appropriate category.

- Business licenses. Some states or communities might require you to obtain a business license.

- Incorporation Fees. If you choose to create an LLC or incorporate your business, incorporation fees would fit here.

- Property Tax on your vehicle or business equipment. The IRS specifically states you can claim the business portion of property taxes regardless of the vehicle expense method you choose.

- Permits. For example, you would enter the cost of a permit allowing you to park in loading zones.

Line 24: Travel and Meals

This category includes travel for business trips and business-related meals. It does not include everyday meals eaten while on deliveries.

- Business-related trips. Lodging and meals during a business-related trip can be deducted. The best example I can think of for gig work is if you traveled to a meetup or convention for other gig workers.

- Business Meals. The IRS has specific criteria for business meals. It must involve you and another person, and the meal must have a particular business purpose. Two examples include: 1) meeting a fellow driver to share best practices and 2) discussing how delivery works with someone who may use your referral code. You should note who you met with and the business purpose of the meeting. The IRS only allows you to write off 50% of meal costs in this situation.

- Dinner mints or candy packets. Some people hand those out with deliveries to help improve tips.

Line 25: Utilities

Utilities include such charges as electricity, gas, and sewer for a business office. They do not include utilities for a home office.

Line 26: Wages

As gig workers rarely hire employees, we will not discuss this item.

Line 27: Other

“Other expenses” include expenses that do not fit comfortably into one of the above categories. The IRS requires a description of that expense, which would be listed in Part V of Schedule C. It is not uncommon to have several items listed in this category.

- Professional Memberships. This could include Patreon memberships for gig-related content, or fees for an association of independent contractors.

- AAA or Roadside Assistance.

- Professional Development and Training . Training courses on how to do accounting for your business or how to operate as a business would apply here.

How to claim these expenses on your income taxes.

Remember that as an independent contractor, you file taxes as a small business owner. We mentioned this earlier, but it’s worth repeating: You do not claim these expenses as itemized deductions but as business expenses on form Schedule C.

These are not the only self-employment deductions. We’ve only discussed the expenses that fit into the 20 categories in Part II of Schedule C.

Line 30 of Schedule C lets you claim home office expenses. We won’t detail that deduction here as most gig workers don’t qualify. You can read more about how the home office deduction works for delivery drivers.

Schedule C has a place to list your business income. Then you add expenses for each category we discussed and enter those totals on each line. Add those up to get your “total expenses.” Subtract that total from income to reach your net profit. That net profit is counted as personal income tax on your 1040 tax form.

This article in our series details more about how to fill out the other parts of Schedule C.

Other Resources

The IRS has a special web page to help people understand taxes in the gig economy.

The following books are more in-depth about gig economy taxes.

Income Tax Guide for Rideshare and Contract Delivery Drivers: How to Prepare your Tax Return when you have Uber, Lyft, Doordash or other Contract Driving Income by John C. White.

475 Tax Deductions for Business and Self Employed Indiduals: An A-to-Z Guide to Hundreds of Tax Write Offs by Bernard Kamoroff

J. K. Lasser’s Small Business Taxes 2020: Your Complete Guide to a Better Bottom Line by Barbara Weitman

Finally, you can find several articles below that detail different aspects of taxes for delivery contractors.

The Delivery Driver’s Tax Series

The Delivery Driver's Tax Information Series (Grubhub, Doordash, Postmates, Uber Eats, Instacart)

The Delivery Driver's Tax Information Series is a series of articles designed to help you understand how taxes work for you as an independent contractor with gig economy delivery apps like Doordash, Uber Eats, Grubhub, Instacart, and Postmates. Below are some of the articles

What are your delivery driver taxes based on?

It is important to understand your taxable income is your profit, NOT your pay from Grubhub Doordash Postmates Uber Eats etc. Schedule C figures that.

How does itemizing or taking the standard deduction affect writing off delivery driver business expenses?

We examine the difference between business expenses and tax deductions, and why you can claim your expenses even when taking the standard deduction.

Tax Guide: Understanding Your Income

The following three articles help you understand what your real income is as an independent contractor.

Understanding business income as a 1099 gig worker

What income do you have to report as a contractor for Grubhub, Doordash, Postmates, Uber Eats and other delivery gigs? How and where do you report?

What are 1099 forms and what do we do with them?

Episode 57 of the Deliver on Your Business Podcast. Once you receive your 1099 forms from Doordash, Uber Eats, Grubhub, Postmates and others, what do you do with them?

What If My 1099 is Wrong?

What if the amount reported on your 1099 is incorrect? This is not an uncommon problem. Do NOT just let it ride, incorrect information could cost you a lot in extra taxes

Tax Guide: Understanding Your Expenses

The following eight articles help you understand the expenses you can claim on your Schedule C. Most of these are about your car, your biggest expense.

How do business expenses work for Delivery Drivers in the gig economy?

Introducing and explaining the business expenses as they are claimed on your taxes as a contractor for Grubhub, Doordash, Postmates, Uber Eats.

How to write off car expenses for gig workers

For those of us who do use our cars for gig economy delivery, the car expense is the largest expense item. You can choose between the standard mileage allowance and actual expenses.

How to Track Your Miles As a Delivery Contractor

Every mile that you track as a contractor delivering for Doordash, Uber Eats, Grubhub, Instacart, Lyft etc, is saves about 14 cents on your taxes. When you drive thousands of miles, that adds up.

What Miles can you and can you not claim for delivery and rideshare?

What miles can I claim when delivering for Grubhub, Doordash, Postmates, Uber Eats and other delivery gigs? Understand what miles you can and cannot claim.

What if I Forgot to track my miles?

What do I do if I didn't track my miles as a gig economy driver? We look at different places you can find evidence to use in building a mileage log.

How the actual car expense method works for gig workers

It is important to understand your taxable income is your profit, NOT your pay from Grubhub Doordash Postmates Uber Eats etc. Schedule C figures that.

Three Car Expenses Gig Economy Drivers May Not Know You Could Claim Even When Claiming the Mileage Deduction

You probably didn't realize that even if you claim the standard mileage deduction, there are some car related expenses you can still claim.

Filling Out Your Tax Forms

Once you understand your income and expenses, what do you do with them? Where does all this information go when you start filling out your taxes?

Filling Out Your Schedule C as a Grubhub Doordash Postmates Uber Eats Contractor

How do you fill out the Schedule C when you contract with gig companies like Uber Eats, Postmates, Grubhub, Doordash etc.? We talk about different parts of this form.

Understanding Self Employment Taxes for Delivery Drivers for Grubhub, Doordash, Postmates, Uber Eats etc.

Understand how self employment tax works as a contractor for Grubhub, Uber Eats, Doordash, Postmates or any other gigs. Know what it is,how much & be ready!

Understanding the Income Tax Process For Grubhub, Postmates, Doordash, Uber Eats Contractors

How does our self employed income from Grubhub Doordash Postmates Uber Eats etc impact our income tax? We walk through the process on the 1040 form.

Here are Four Tax Deductions for Self Employed Contractors That Don't Go on Schedule C.

Most of our deductions as self employed contractors go on Schedule C. Four deductions benefitting Grubhub Doordash Postmates Uber Eats Contractors.

Do 1099 Delivery Drivers Need to Pay Quarterly Taxes?

We look at how quarterly tax payments work for gig economy workers (Uber Eats, Doordash, Grubhub, Instacart, Uber, Lyft, etc.)

How Much Should I Save for Taxes? | Grubhub Doordash Uber Eats

How much should I save for taxes when delivering for gigs like Grubhub, Doordash, Postmates, Uber Eats and others? These ideas help you prepare for taxes.