It should be obvious by now that you’ve got to keep good records in the gig economy, but is Quickbooks Self Employed the best option for the Grubhub, Doordash, Uber Eats contractors? We’ll take a look at the pros and cons of this program.

You may have finished wrestling with 2019 taxes, thanks to the extended deadline. If you’ve wrestled with pulling all the information together for your Schedule C, it might make sense to find a program that can do all that for you.

The strangeness of 2020 has made good record keeping more important than ever. If you wanted to apply for any of the pandemic relief programs, you really needed to have good records. Each program asked for different information.

Having a good record keeping system helps you provide the information needed quickly and easily. We look at Quickbooks Self Employed to see if this is a good option for contractors with Grubhub, Doordash, Uber Eats, Postmates, and other Gig apps.

The importance of good records

If you are an independent contractor, you are running a business. Whether you feel like it or not.

You are taxed like a business.

Good record keeping can save you a ton of money. Your taxes are based on your profits or what’s left over after expenses. Good records can save thousands of dollars off your tax bill.

But you can’t just make it up. You need to have a record.

If you’re looking for financing, or want to rent a place, you have a problem if you don’t have paystubs. These places know how the gig economy works, and many of them are going to ask for business records. They’ll want a profit and loss statement.

Can you provide that?

The question we’re trying to answer today is, is Quickbooks Self Employed a good option for contractors with Grubhub, Doordash, Postmates, Uber Eats, Lyft, Instacart and others towards meeting those goals?

Quick Disclosure: I don’t use Quickbooks Self Employed personally.

I did set up an account for the purposes of seeing how it worked. Personally, I use Quickbooks desktop, mainly because I’m keeping records for three different businesses. To do that with online programs requires a subscription for each business.

I do have an affiliate relationship with Quickbooks. I may receive commissions for purchases made through links in this article. But I think you’ll find in this article that I’m going to be up front with my concerns about the program. You can read more about my affiliate policy link in the footer of this page.

Overview of Quickbooks Self Employed

Quickbooks Self Employed is one of the few mainstream book keeping programs that is designed specifically for the self employed person (such as independent contractors for companies like Uber Eats, Grubhub, Doordash, etc.)

This is not an accounting program. It’s a record keeping program designed for the self employed individual. It’s also not an overall tax program. The main purpose is for you to keep track of your income and expenses, and to be able to provide the information needed at the end of the year to fill out your Schedule C.

Quickbooks Self Employed (QBSE) is a paid program. With my referral link you can get it for $7 per month for the first 6 months (and then it will go to the normal price – as of this writing it’s $15 per month).

QBSE is designed to be as non-intimidating as possible for a book keeping program. There’s not a lot of set up. You don’t have to know accounting to make it work. It is designed specifically for contractors like us.

You don’t have to worry about losing your information. This is an online program where your information is kept in the cloud (on QB’s servers) instead of on your computer. You can log in with a browser or with their mobile app.

Tracking miles as an independent contractor with Doordash, Uber Eats, Grubhub and others is incredibly important. For that reason, QBSE can automatically track your miles via GPS. This feature alone can save a contractor thousands of dollars in taxes.

Setting it up

The beauty of this program is, you don’t have to do a lot of setup.

The account settings and expense categories are already in place. A lot of book keeping programs are designed for larger businesses with a different tax reporting requirement. I had to do a lot of customization on my desktop program to make it line up with Schedule C reporting.

QBSE doesn’t require any of that setup. It’s already configured for a self employed person. You don’t need to be an accountant to know how to make this work.

That said, there are a few things to set up.

You can connect your bank account. That can make things easier to track if you have a business only bank account. It can be a pain if you’re connecting to your personal account.

There’s an option to set up information about your home office. Understand that you can only claim that office expense IF you have space that is ONLY for your business and is used regularly for your business. For a lot of delivery contractors, that may not be likely.

Then there’s the option to set up vehicle information. The things they ask for are things you would report on your Schedule C when claiming vehicle expenses.

The one setup thing that I think is most important is creating your tax profile. Here you enter all your other income by you or your partner (if applicable). This is related to one of the most impressive features of QBSE: its tax savings calculations.

The tax profile is kinda like a self employed person’s version of a W-4. That information helps QBSE put together maybe THE best estimates in the industry of what you need to save for taxes.

And now, you can record your earnings and expenses.

You’re all set up and you’re ready to enter your earnings and your expenses.

As easy as snapping a picture

QBSE lets you take a picture of receipts. This serves two purposes: One, it’s an incredibly effective way to store your receipts. Two, it can make it easy to enter your expenses.

The program can scan the receipt and if it identifies the information, it will start an expense record for you already filled in with the description and the amount. I’ve found it takes a few minutes for it to process before you can go in and confirm the information.

When it works, it works great and can save some time. You do still have to go in and complete the entry, but it does save some steps. If it doesn’t recognize the information in the receipt, you’ll have more manual information to enter.

Manually entering transactions

If you set up a bank account, you can go through the transactions and classify them as business or personal and then identify what category the expense fits under.1

I linked a personal account that’s mostly for spending money. You can see why I recommend not using a personal account. You would have to go through every category and identify whether it’s business or personal. That can just be a lot of extra time.

Otherwise you can choose to add a transaction. This is fairly simple: You enter the date, the transaction description (usually who you paid) and the amount.

Then you click the blue Select a Category line and it will drop down a list of common categories, and an option to see the whole list.

And really, it’s that simple.

Sometimes it’s tough to figure out which of their categories is the best fit. However, from there, Quickbooks determines which category for your taxes is the best fit.

Tracking your car expenses

I want to look at three things about tracking your car expenses.

Entering vehicle costs

You have a choice between claiming actual expenses or the standard mileage rate as an expense to offset your taxes. Very few of us pay more than the 57.5¢ per mile (2020 rate) in actual costs. Because of that, a lot of contractors don’t even bother tracking gas, maintenance and other costs.

Here’s the deal: for most of us our actual costs are not going to come out to more than 57.5 cents per mile (the 2020 standard mileage rate).

I recommend that you do track them. It’s just good to have a handle on what your actual costs are for your vehicle. Quickbooks Self Employed allows you to do that as well as tracking your miles. The nice thing is, it understands the distinctions.

Manually entering miles

A lot of accounting programs don’t even have an option for tracking miles. That’s one thing I like about QBSE – there’s a main menu item just for that. You can manually add the information from a trip using this feature.

One great feature is, you can enter the start and finish locations and QBSE will calculate the distance. That can be a lifesaver if you forgot to track. With all the addresses we go to on deliveries, it may not be AS useful.

Then you identify the business purpose. This is a detail that’s required by the IRS. In the end you have a mileage log that follows the IRS standards.

Automatically tracking miles

If you have the mobile app, you can use it to automatically track your driving.

Quickbooks Self Employed has a GPS tracking app that will detect when you are driving. You can then go through the different trips it records and mark them as for business or for personal use.

This can be a huge time saver for someone who’s prone to forget to record. However, it can also have some issues that we’ll get into shortly.

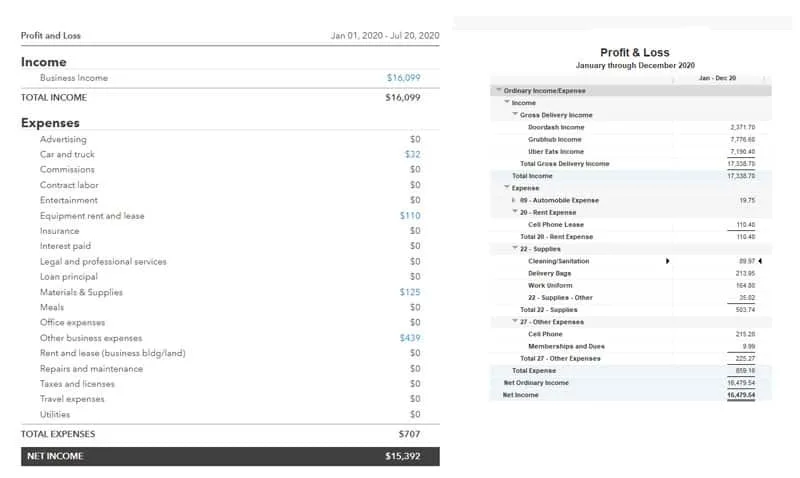

Get your reports

Quickbooks Self Employed doesn’t get into all the different accounting type reports like Cash Flow reports or Balance Sheets.

It wasn’t designed for that.

For most independent contractors, those are likely never necessary. The reports here are much more practical.

- Mileage log

- Profit and loss

- Breakdown of business and personal expenses (if you used your personal checking account, for example)

- Receipt download

- Tax Summary – your Schedule C report

- Tax detail – a list of transactions in each spending category.

Understand that this is not an accounting package. It’s simply for tracking your expenses and income and being able to provide your information when it comes tax time. The reports are structured accordingly.

What is good about Quickbooks Self Employed for independent contractors with Grubhub, Doordash, Uber Eats, Postmates, Instacard, Shipt, Lyft and others?

The main benefit?

Simplicity.

It provides the basics in a way that is easy to understand. Quickbooks Self Employed takes away a lot of the guess work when it comes to keeping your records as an independent contractor for gig economy apps.

Take a picture of a receipt. Enter your earnings or your expenses on a browser or a phone app. Track your miles.

For a lot of us, that’s all we need.

As long as it’s doing what it should be doing, it can be a great program.

I like that there is desktop and mobile access for Quickbooks Self Employed.

You may do EVERYTHING on your phone. I’m not as fast on my phone as I am on my old school desktop.

That said, I love that I can use either one. When I’m out and about, being able to take a picture of a receipt and start the process of entering a transaction that way can be huge.

QBSE seems to understand the importance of tracking miles better than most programs.

A lot of accounting programs don’t even bother with miles.

That’s because for a business that’s incorporated, you track actual expenses. The reporting is different.

But for those of us who are delivering for Uber Eats or Grubhub or Doordash or any of the others, if we’re using our cars for that, that’s a HUGE part of our overall expense. QBSE gets that.

The mileage log feature is one of the best out there. It makes it easy to add information if you forgot to log. Then you have the option to automatically track miles.

The tax estimates in QBSE are best in class.

The tax profile is one of the things that impresses me most about this program.

Quickbooks Self Employed doesn’t make the assumption that this is your only gig. The tax profile takes into account other income you have. It looks at income from your partner if applicable. It takes into account whether you’re itemizing or taking standard deduction.

I have a simpler process for figuring out what to save. But if you want something a little more precise, you can’t do much better than QBSE’s estimates.

Nothing’s going to give you a perfect number. However, QBSE does better than anyone I know of looking at the overall picture and factoring in other things to help you decide how much to save.

What problems would an independent contractor with Quickbooks Self Employed run into?

I think the biggest drawback to QBSE for anyone, including contractors with Grubhub or Doordash or Uber Eats or other delivery or gig economy apps, is this.

It’s simplicity.

Its greatest benefit is also its greatest downfall.

It’s made to be easy. Some of the features that make it easy can take away from its functionality.

Here are a few of the issues I have with Quickbooks Self Employed.

There is no customization.

You cannot customize the categories. I think this can create some problems when it comes tax time.

It’s harder to confirm your income

QBSE has one income category. That’s it.

I prefer to track each company I deliver with. This gets really important when you are getting your 1099’s. Doordash is notorious for getting your 1099 information wrong. Uber Eats probably won’t even give you a 1099 because they use a wonky 1099-K reporting system.

If I had a breakdown by app, I could tell if someone has it wrong (or if I made a mistake).

you cannot create sub-categories in “other income”

When you fill out your Schedule C, there’s a category for “Other Expenses.” However, you are supposed to specify what all that “other income” is further on down the form.

QBSE doesn’t let you do that. All you can choose is “other income.” That means there’s extra work you have to do at tax time, going through all those “other income” expenses and breaking them down yourself.

There are a number of things that are often put under “Other Expenses” as it would relate to couriers.

- Cell phone service

- Roadside assistance

- Professional development or business training

- Memberships that help your business.

It’s not necessarily a deal killer

You can go through at the end of the year and manually add things up. You can download transactions into a spreadsheet and sort them to come up with totals. If you have a tax person, maybe they’ll do that part for you.

QBSE does have an option in settings to “manage categories.” I don’t know if that’s meant for future improvement or not. Right now all you can do is toggle on or off the ability to track personal expenses.

This might be intentional. They’re trying to make it as simple as possible, and allowing people to customize might complicate things.

But this is the biggest issue I have with QBSE. These are issues that go against the purpose of this program to begin with.

Quickbooks Self Employed is designed not as an accounting program, but as a place to record your income and expenses. The purpose is so you can have the information you need to enter your business profits into your Schedule C. The problem is there’s a couple of limitations to even being able to do that.

Some of the data entry can be buggy.

One of my biggest pet peeves is that if you don’t enter the year into the date field on a transaction, it will default to 2001. Say you enter 7/1 as the date, it will record it as July 1 of 2001. Ninetee. Years. Ago.

The problem is, when you run your reports, those transactions won’t show up because QBSE figures it didn’t happen this year (or last year or whenever it’s reporting on.

Part of my complaint about data entry comes from being spoiled by other versions of hte program. The desktop program ins more intuitive about filling in information based on my description, etc.

Another issue is that you cannot split a transaction. Here’s an example that would be common for gig workers: Your cell bill. There’s really two different categories involved here. There’s the phone service, and the phone itself. Most programs let you split that transaction with some going to one category and some going to another. QBSE WILL let you do that if it was a transaction from a linked bank but not if you manually enter it. That means you have to make two or more entries.

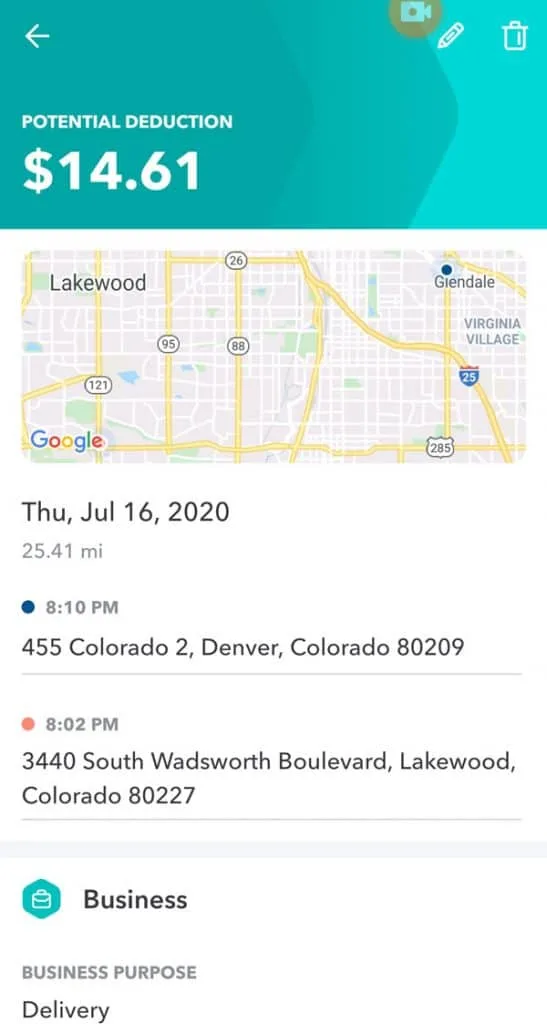

I am not a fan of the GPS tracking functionality

I think it’s awesome that they include the ability to track your trips.

That miles can be tracked automatically is awesome.

I just wish it worked better.

In three days, QBSE failed to track about 25% of my miles. If I weren’t tracking manually it would cost have cost me $38 in deductions (and about $10 in extra taxes). A lot of times it’s not an issue with the app as much as it is your phone, but that points out the caution when relying only on GPS tracking.

The problem with automatic tracking is it tracks EVERYTHING when you have your phone. In another car? On the light rail? Flying across country? It’s tracking. And the problem is, you can’t just mark it as not in your car. You can only choose business or personal.

That one is a real problem when it comes to deductions if you are claiming anything based on the percentage of business miles (loan interest or property tax for instance). All the extra personal miles inflates the non-business miles tracked, and significantly reduces how much you can claim if you don’t catch that.

Finally, I don’t like that it doesn’t show the route. All you see is the start and end point. I have to wonder what kind of problem that can create with an auditor when you can’t show how much you meandered around from one place to the next.

I can’t switch between business and personal mid trip.

This screenshot illustrates some of the problem here. The distance between the two points is 11 miles. But the weird thing is somehow it decided I drove 25 miles in 8 minutes. I KNOW my Equinox isn’t that fast.

What you can and cannot track on miles is troublesome.

First off, you can only track one car for the entire year (whether maunal or automatically).

If you sell your car mid year and get a replacement, the IRS wants you to track miles on each one separately. You can’t do that with QBSE. If you have two different vehicles you use, you can’t track them separately. Even though you should.

Along those lines, I wish you could manually stop and start tracking. There are times that I transition between business and personal miles. If the automatic tracking didn’t register that point where I transitioned, it’s either all business or all personal.

Is Quickbooks Self Employed the right option for you?

There are some great things about QBSE. There are some real issues.

What does that mean for you? It really depends on what you are looking for.

Personally, it’s not my choice. Some of that is because of tracking multiple businesses. But part of it is if I’m paying for a program to do certain things, I expect it to do at least those things. I can work around it and make it work, but I’m the kind that thinks nah, if I’m paying for it to do these things I shouldn’t have to do some elementary stuff.

But then again, at only $15 per month (and $7 per month for the first 6 months with my referral code) you might find this a great fit for the price.

There aren’t many programs geared specifically towards the independent contractor or the sole proprietor. Some are even less flexible. Most don’t integrate mileage as well as QBSE. There’s some give and take, I’m not sure there IS a perfect program.

If simplicity and being geared to your situation as an independent contractor is most important for you, this could be the one. If you need more flexibility like I do, you might look elsewhere.

What’s your experience with Quickbooks Self Employed?

Do you use it or have you used it?

What did you love about it?

What did you hate?

Were my criticisms of the program non-issues for you? Did you have issues that I didn’t bring up?

Audible overview 2020 is service Worth it?

Tuesday 18th of August 2020

Does Audible Function? To begin with, you receive a complimentary audiobook and take a trial of Audible out. This really is one of even an Audible originals or the classics.

At the end of your trial, you can buy a monthly subscription of Audible.

You want to register for the membership. Each month, are awarded by Audible with one credit. It is possible to take advantage of this credit to purchase Audible audio books in different categories such as technology, fashion, romance, social media, advertisements, etc.. You can buy more Audible credits or pay per audio publication, if you wish to buy more books.

Interestingly, a member may download a couple of six Audible Originals. They don't charge any credits. These Audible Originals can be kept by you .

You have Audible books in your library if you cancel your subscription. You can listen to Audible books anywhere using apps for Windows, your telephone or Mac computer or Alexa device.| What is Audible? With over 300,000 titles to its name, Audible is the world's largest vendor and producer of audiobooks. https://mymumbook.com/2020/08/06/audible-overview-best-and-worst-features-of-audible/