Unfortunately, there’s no pay stub or employment verification for Doordash delivery drivers. That’s because Dashers are independent contractors and not employees. That doesn’t mean you’re out of luck, just that you have to provide different kinds of records.

So how do you prove you deliver for Doordash? How do you know what you made? Are you just out of luck?

While you can’t verify employment when you’re not an employee, you can verify that you’re running a business and making money with Doordash as your customer. After all, that’s technically what’s happening when you make money DoorDashing. You’re providing delivery services as a business.

We’ll talk about all of this here, including how to know what you made on Doordash, and how to document that for the people that need it. We’ll look at:

- You can’t get your own pay verification from Doordash

- Doordash now offers third party verification through Truework.

- Five ways to get a Doordash earnings statement

- Shifting your thinking from employment verification to business owner verification

- Frequently asked questions about Doordash pay stubs, earnings statements and employment verification.

Please note: This is about delivering for Doordash in the U.S. and Canada, with any tax implications discussed related to United States independent contractor taxes. Also understand that is is only for educational purposes. If you need any tax advice, you should seek it from a tax professional who can advise you based on your personal situation.

You can’t get your own pay verification from Doordash

The Doordash website says you can request that information. What they don’t tell you is they won’t give you that information.

And, they don’t make it very easy to get whatever information you can get.

A couple of years ago I tried to get an earnings report. I received an email response that said they don’t provide that information.

I decided to see if it was any better this time around.

In the screenshot above, Doordash says you can file a support case to request proof of payment.

The thing is, that link doesn’t take you anywhere where you can create a support case like it did when I tried it a couple years ago. All it does is take you to a generic support page. That page has no mention of anything about requesting payment verification. As of July, 2022, this is the page it takes you to:

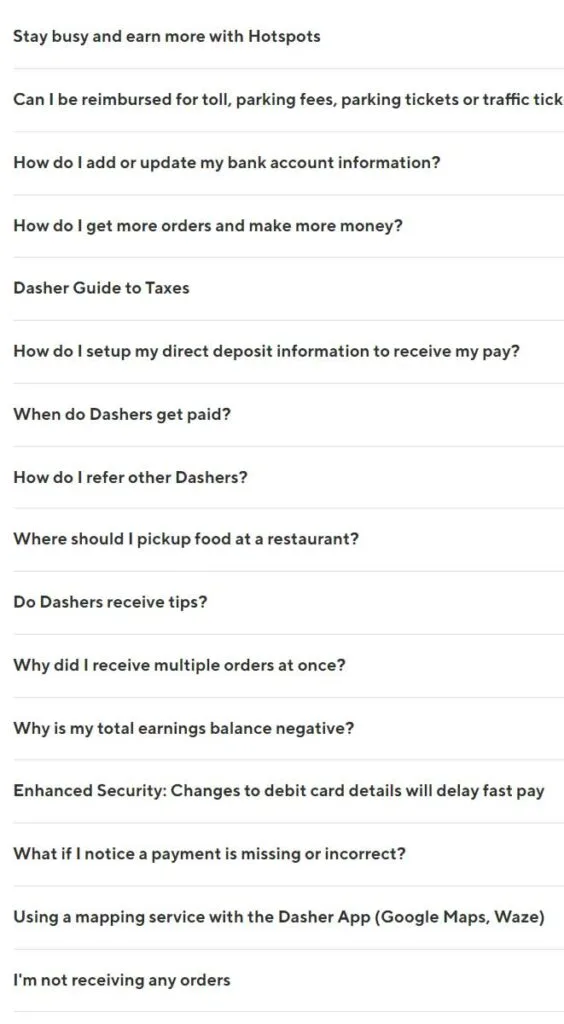

If you expand the Earnings and Payments section, there’s not a single option on there to request your income history or verification.

See where it’s pretty much a dead end? Nothing in this list is even remotely close.

I decided to try chat support. 21 minutes later I had nothing more than when I started.

Post this chat, I will be sending you an email how to get paystubs so please refer the email and follow the step to get the paystubs.

Doordash support person “Benadict” promising me I’d get pay stubs after the chat was over.

In the end, Benadict from Doordash support said all he could do was email the steps for HOW TO GET my paystubs. Even though there are no pay stubs. And even though when it’s all said and done, getting that information for yourself is impossible.

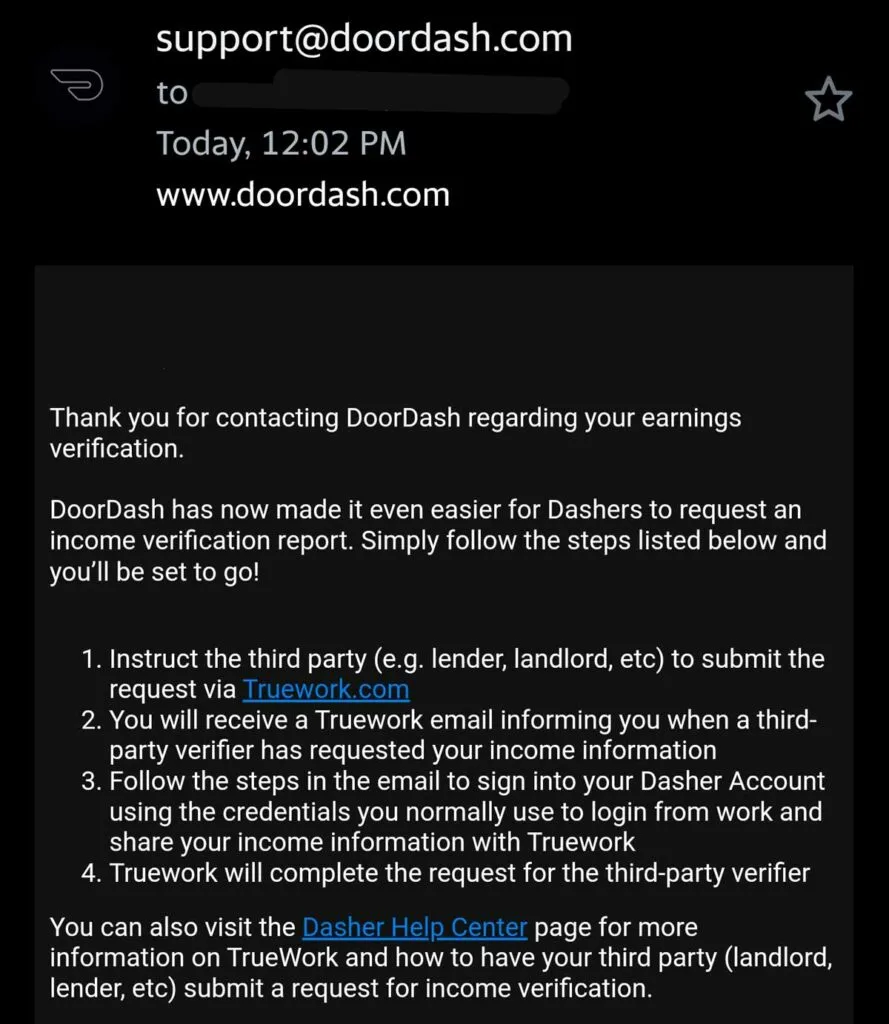

I did receive an email as promised. However, it didn’t do any of the things Benadict promised. It did provide steps for using a third party company called TrueWork to request verification.

However, Truework says you can not get that information for yourself.

Unfortunately, Truework is unable to process verifications of income or employment when submitted by the applicant or employee themselves. If you are needing your own verification of employment or income, a third party, such as a loan processor or landlord, needs to submit the verification on your behalf.

FAQ answer to “Can I verify income and employment for myself?” on Truework.com

Doordash does now use TrueWork for third party verification

The good news is, Doordash has contracted with another company to handle verification requests. This is an improvement over past years where there was no way to get any such proof of income.

Below is a screenshot of the email I received explaining how one needs to request verification. That email includes a link to TrueWork. If someone does need verification of your Doordash earnings, you can point them to that same link.

As pointed out above in the FAQ screenshot from TrueWork, they will not give you your own information. They will only provide proof of your income to a third party such as a lender or landlord.

Doordash does have a support article discussing how this works. I’m not sure why they haven’t taken the original page down or forwarded it to this one.

Essentially what happens is, you let the third party know that they can request verification through TrueWork. You’ll receive an email once they’ve requested information, and that will prompt you to log in using your Doordash login and password. That’s how you’ll approve the information to request data.

Doordash is not actually providing the income verification directly themselves. Instead, TrueWork logs into your Dasher account, downloads the pay history, and formats that into a report for the third party.

It’s not much different than a number of financial services that use a third party app like Argyle to do the same thing.

Four ways to get a Doordash earnings statement

While the good news is that you can now request a third party verification, you can’t get that information for yourself. TrueWork won’t provide that to you directly.

But what if you need that information yourself? While you can use tax returns and Schedule C information for last year or the years before, what if you need year to date earnings or total earnings for a portion of the year?

For example, some parts of PPP and EIDL applications that were part of the pandemic stimulus needed earnings totals that weren’t tied to the calendar year.

Also, Doordash is known to get their 1099 forms very wrong. Maybe you want to just make sure it’s correct before you file your taxes.

What do you do in situations like that?

There are a number of ways to get reliable Doordash earnings statements. You might have to do some math with some of them.

Share this Image On Your Site

Click on the text box below to copy the code. Please include attribution to EntreCourier.comThe important thing to remember is, you’re delivering a business, not as an employee.

Think about it this way: What if your favorite restaurant says they need to fill out an application and need to know how much money you’ve spent with them this past year so they can know their income for the year?

You’re probably thinking, “that’s not my job to do your bookkeeping for you.”

The truth is, neither is it Doordash’s job to do your book-keeping for you. Neither is it the job of any other gig companies you contract with.

That’s why I believe that Option number 1 below is the best way to come up with what you need. It’s the option that takes seriously that you are indeed operating a business.

With that said, there are four ways you can find out what you made with Doordash.

Option 1: Keep good records for your business

The best thing you can do as an independent contractor is to think like a business owner. Part of that involves keeping good records.

The thing is, when trying to prove how much money you made, you can’t claim Doordash as an employer. That’s because you aren’t an employee.

When you need verification, you don’t want to go at it like Doordash is a delivery job. It’s not. Instead, you are self-employed, you’re running your own business, and you need to approach it with that in mind.

When you can go to whoever needs to verify employment or income and say this is my business and here’s my gross profit and loss statement, that’s going to make a big difference.

The reason anyone needs proof of your income is, they want to know you’re reliable. Either to pay off a loan or to pay rent or whatever it is. If the money is from employment, they want employment things. If it’s from running a business, they want to know your business is stable.

However, if you can’t give them what they need, that’s a red flag. If you think and act like an employee when you aren’t, or if you are running a business but aren’t acting like it’s a business, that kind of thing can create doubt. You want to act and keep records like you are running a business.

Here are some things you can do to help with keeping your own records.

1. Open a bank account for your delivery business

The first sign of running a business is if you keep business and personal money separate. The best thing you can do is get a bank account for your business finances. This gives you a few benefits:

- Record keeping is easier when the only bank transactions you have to wade through are from your business account.

- This makes taxes easier as well. You won’t have to figure out if that purchase was for personal or business purposes

- All of your business transactions in one account (without any personal spending) is so much better for using bank records for verification purposes.

- Giving yourself a paycheck by having weekly payments direct deposited in your bank account, setting aside money for expenses and taxes, and then paying yourself what’s left gives you a better idea of what you really are making (and if it’s enough)

Start with your own bank and ask if they’ll open a separate account for your business. Credit unions are often very helpful. If they’re going to charge fees, it might be time to look somewhere else.

I have a business bank account with Novo (you can use my referral link). Novo is a fintech company, powered by its banking sponsor Middlesex Federal Savings, F. A. It’s more of an online bank than a brick and mortar financial institution. I like that they have no fees, no minimums and are easy to use. The only drawback is not having local branches for deposits, but then again, with everything in the Gig Economy being direct deposits and bank transfers, that’s not usually needed.

2. Get a good bookkeeping program

You don’t need anything fancy or even expensive. If you’re good with spreadsheets, you could just do it on Google sheets, with different tabs for listing and totaling income and different types of expenses.

Hurdlr has an amazingly effective free app (you can use my referral link here) that is pretty easy to use. I think it’s much better than programs like Stride, or than paid programs like Quickbooks.

- My review of Hurdlr

- A comparison of several mileage and expense tracking apps

- A review of GoDaddy Bookkeeping

- A review of Quickbooks Self Employed

3. Keep your records up to date

Every time you get paid, put an entry into your program. With every expense, record it. That way you don’t have to go dig through records when you need them.

I mentioned Hurdlr has the free account. They also have a paid subscription that can automatically download transactions from your bank account (as well as automatically track miles).

That brings me back to having a dedicated business bank account. Think about how easy that is if your bookkeeping program can just download everything, and you don’t have to sort through whether it’s business or personal.

4. Start tracking actual car expenses in your bookkeeping.

Here’s the thing: If you’re telling someone you’re making money as a business, they know you have expenses. They’re not going to let you skate on just your gross receipts.

The problem is that while 62.5 cents per mile (second half of 2022) is great for tax deductions, that’s much higher than your actual out of pocket expenses.

The beauty of the standard mileage allowance is it’s high enough that it often drops taxable income by quite a bit. However, banks can see that as you’re not really making any money. If you have an accurate list of those actual business expenses, that can help offset some of that problem.

Not sure what to track? We talk more here about some simple tips for bookkeeping as a gig economy business owner.

6. Run your business reports

At this point you make your own Doordash earnings statement. You run what’s called a profit and loss report.

The bottom line is, as a business your actual income is your bottom line (yes, the pun was shamelessly intended). Banks and other creditors see your real business income as what’s left over after expenses.

Remember what I said, where people who need verification need to know that you’re stable? There’s a lot of credibility when you can walk in to somewhere, say I’m running a business and here’s my P&L.

If you’ve filed taxes before as an independent contractor, you may already be familiar with that term. That’s because the Doordash Schedule C from the IRS is called Profit and Loss from Business.

Option 2: Add up your payments from bank records

If you don’t have a book keeping program, the next best option is to get what you need from your bank statements.

Not to beat a dead horse, but this is why I said earlier it’s best to have a bank account just for your delivery business. Then you don’t also have to wade through all the personal transactions that would be in your personal account.

Generally you can use your tax returns as proof of self-employment income for the last year and before. However, if you need current information, or you want to verify that your 1099 is correct, bank information and statements are a good way to go.

If you don’t have a dedicated business account, most online banking programs will let you search for transactions. Then, simply add them up.

If you use instant pay, were some payments direct deposited to your bank and others to a different account altogether (whatever debit card you set up for Fast Pay)? If so, make sure you’re adding up all payments deposited to all your accounts.

Finally, Door dash charges $1.99 per instant pay transaction (unless you have it sent to your Dasher Direct card). Make sure you’re taking that into account. Whatever was deposited in your account is $1.99 less than what you made.

For instance, actual pay on a $100 listing in your bank is actually $101.99.

The good news is you can write that $1.99 off as a business expense on your tax return.

Option 3: Add up total earnings from the Dasher app (there is a place you can find them)

The Dasher app Earnings tab only shows you about four to six months worth of earnings. If you’re more than a few months into the year, you’ll find that you can’t add up all the income.

However, Doordash has added an option that lets you see all of your earnings. Go to the Earnings page and tap on the part that says Deposits and Transfers. There you have a list of all deposits made to your bank accounts.

You’ll get a list of deposits that goes back at least to the start of the previous year. All that list gives you is the amount. It doesn’t tell you which bank account was transferred to.

Supposedly you can tap on a deposit and get all the details for each of your Doordash orders including base pay, Peak pay incentives and customer tips. However, if the transfer is more than a few months old, tapping on the transfer line item only gives you details for your most recent payment.

It should be no surprise that Doordash did a terrible job with the transfers feature. They’re known as Doorcrash for a reason.

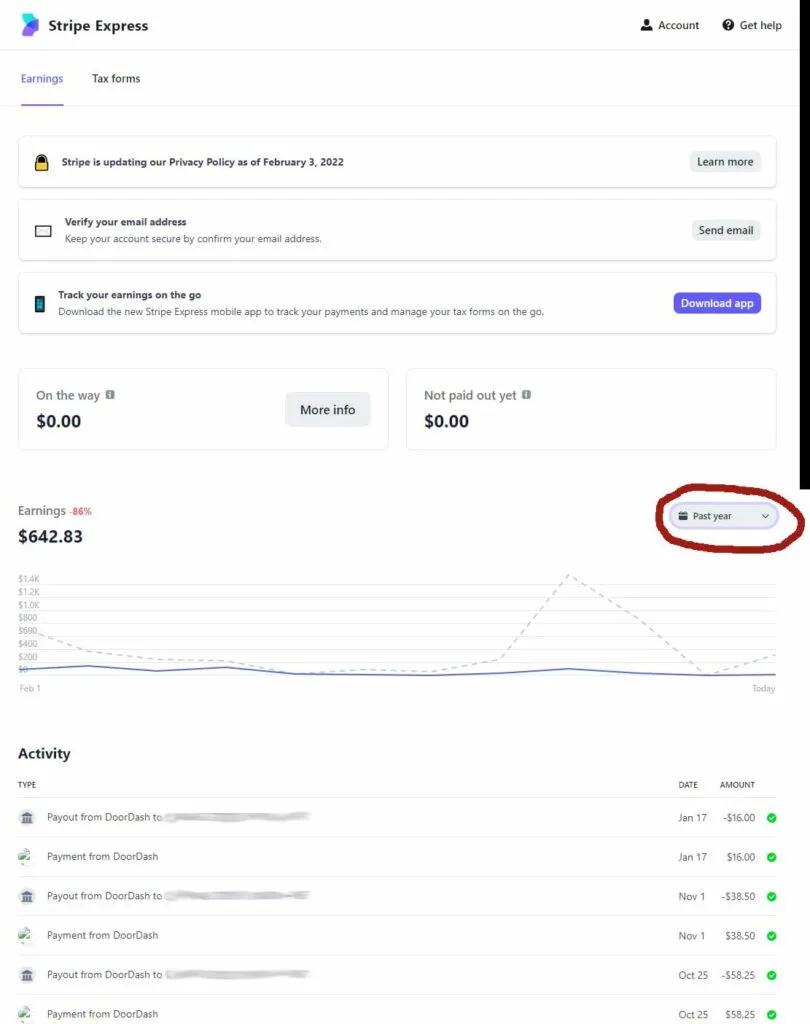

Add up earnings from the Stripe portal and DasherDirect.

Stripe is the company that Doordash uses to handle ACH Direct Deposit transactions to Doordash drivers, and also that processes the 1099 forms for Doordash.

I can see my very first deposit on the Stripe portal from March of 2018.

You can log in using the link at https://connect.stripe.com/express_login. There you’ll enter the email address used for your Dasher account. Stripe will then text an authorization code to you to complete the login.

The report shows two lines for every time you got paid. The first line is the payment from Door Dash into Stripe, and the second line is payment from Stripe to your bank account. The second one also lists the bank account.

Unfortunately, Stripe doesn’t let you customize the date range for the report. For instance, you can’t get a list of earnings for this calendar year.

You’ll either have to manually add up every deposit, or you can export the deposit list into a report (csv spreadsheet), where you can then add total reveue up using that.

Payments to Dashers using the DasherDirect prepaid debit card do not go through Stripe, and so they are not reflected in the Stripe portal. To get those payments, you’ll have to go into the DasherDirect app. In that app, you can either tap on your account balance and see a list of all transactions, or tap on More and then Statements, where you can pull up monthly statements and transactions for those particular months.

Use a third party app that logs into your Dasher account

This is very similar to what happens when a third party requests proof of the payments received from Doordash using TrueWork. All of your past earnings are stored on your Doordash account for the Dasher app.

With TrueWork, there’s a point in the process where you give them access to your Dasher account by providing your login information. That logs them into your account where they can then access how much money you’ve made.

There are other third party programs that can do the same thing. Most of them use a third party company called Argyle. Using these programs, you are not actually giving them your login information, but instead you are logging into your account through their system.

In December 2020, David Pickerell of Para was a guest on the Deliver on Your Business podcast. Para was a new app being developed for gig workers and one of the first things they did was to make it possible to see your historic Doordash earnings.

I’m not sure that feature is available at this point in time on Para. However, I do know of a couple of apps that do provide that information. The best one that I can point to is the Solo app. Using the Solo app you can get totals by gig company for the week, month, quarter or total year.

You can get the Solo app from my affiliate link* and, as of October 2022, get a $10 bonus from Solo once you’ve linked your Dasher account (and other gig apps) to the app. The free version of the app includes the income dashboard as shown above, and there’s a subscription version with additional features. I have a detailed review of the Solo app here.

*Connected accounts must have a minimum of one previous job, be using the latest version of the app, and have a connected payment method (Venmo or Paypal) in order to qualify for the signup bonus. Bonus is only valid for US-based gig workers, and amounts are subject to change.

Shifting your thinking from employment verification to business owner verification

One reason a lot of people have problems with Doordash employment verification is that they’re going down the wrong path. They list Doordash as an employer, when there is no employee/employer relationship in place.

When you need to verify your relationship with Doordash for some reason, that means you need to show that you are credible. Usually that’s to show that you do have a certain amount of income.

However, many institutions look at businesses very differently than they do individuals. There’s a higher standard. And if you come in with a business relationship but using employee terms, that can really impact your credibility and work against you.

It’s not just for verification purposes that this is important. You agreed that you’re doing this as a business. The best way to be taken advantage of in the gig economy is to act and think like an employee while only being paid as an independent contractor.

Once you understand and embrace the fact you’re running a business, you can take control of things. You can make business decisions rather than just taking everything Doordash throws at you. You can choose to have multiple customers rather than rely only on Doordash.

In the end, it also puts you in a spot to be able to do so much more. I call it a gateway drug in that you get a taste of the freedom, and some training in operating a business. Maybe it opens the door for further and greater forms of self-employment.

Frequently asked questions about Doordash pay stubs, earnings statements and employment verification.

That’s it in a nutshell. That’s how you come up with your Doordash Pay Stubs: you do it yourself. Do it in the form of business records.

Some of these questions below may have been answered in whole or in part. Forgive me if I repeat myself on any of that, but I wanted to answer them here in case you happened to just skip down to these questions.

Can I get a paystub from Doordash?

No. You are not an employee, so there is no paystub. In fact Doordash doesn’t provide any form of printable earnings record. The Doordash support center lets you request an earnings history. However, Doordash customer support typically comes back and says you can just get it off the earnings tab in your Doordash driver app.

Does Doordash Give You a W2?

No. A Doordash W2 is only for Doordash employees. Doordash workers are independent contractors. You would instead receive a 1099-NEC at the end of the year if your earnings were more than $600.

How do I get Doordash employment verification?

You can’t. There is no proof of employment because you are not an employee. You contract with Doordash as a business. With that in mind, you would need to instead provide proof of business income. You can do that either through your own bank records or having a third party request verification through TrueWorks.com using this link.

Why is Doordash so bad at providing this information?

I wish I knew. Doordash is really the worst of the delivery gig economy apps at providing total earning information. My theory is that Doordash has greatly outgrown their app and their systems. No one expected them to grow this large this fast.

It seems too that for a long time, Dasher pay information was never kept all in one place. For years Doordash had a terrible time coming up with accurate 1099 forms at the end of the year. To this day the company that handles their 1099 processing, Stripe, doesn’t have data on all Doordash payments, and thus they’ll have to import in DasherDirect payments at the end of the year. I’m sure there will be errors.

Is a separate bank account required for my Doordash business?

A separate bank account is not a requirement, but it is a really good idea. It is best to keep your business and personal finances separate. If you are applying for anything that requires proof of income, and your income is from a business (as is the case when you’re paid for independent contractor work), then a dedicated business account will get you taken much more seriously.

Do I need to bother with all this if this delivery job is only a side hustle?

You should do all this any time you want to include your Doordash income considered for anything that would require paystubs or verification. Whether you do your business as though it’s like a full time job or it’s just part time, it’s still considered a business.

Is it safe to let third party programs like Solo or TrueWork have my Dasher account login?

You don’t actually give them your log in information. What happens is you actually log their program into your own account so that they can download your payment information.

Also understand that they only have access to the information you can get yourself from the Dasher app. For instance, it’s impossible for you to get your own bank account information.

There are concerns voiced by some that letting another company access your account could get you deactivated by Doordash. I have yet to see actual evidence of that actually happening.

Obviously, there shouldn’t be an issue with TrueWork accessing your account, as Doordash has a direct relationship with them. Solo and a number of other third party apps use a company called Argyle to log in to your Dasher account. Several companies who have a working relationship use the same company. The third party login approach is often preferred as they can limit access only to certain data.

What did I make on Doordash?

I added this question at the end because the answer to that is different than most people think. What you really made on Doordash is NOT the total earnings that you received from them. Instead, it’s your profit, or what’s left over after expenses. Too many Doordash delivery drivers make the mistake of thinking the payments received are similar to W2 wages, and forget to account for taxes and the cost of using their car.