What do you do if your Doordash 1099 is wrong? What if your Grubhub 1099 is screwed up? Should you be concerned if Uber Eats didn't send one to you?

It's an important question. If your 1099 is incorrect, you could end up either paying too much or under-reporting your earnings on your tax return. Both can be a problem. If they don't send a form at all, that can delay your ability to file.

Unfortunately, gig economy companies like Doordash and Grubhub have been incredibly incompetent with how they report 1099 forms. Doordash has been terrible at reporting too much income. Grubhub was extremely late sending out their 2020 1099's and then they often had the wrong names, social security numbers and other information.

And then there's the confusing way Uber Eats does theirs.

How do you stay out of tax trouble if they forget to send your 1099, or if they just get it completely wrong?

We'll walk through what you can do to protect yourself as an independent contractor from 1099 errors.

Step One: Do not ignore it!

That's not really a step, is it?

But it's just important enough that I'm calling it a step. In other words, take this seriously.

There are two major problems that can happen because of a screwed up 1099:

You pay too much in taxes

You under report your earnings

Here's the thing you have to understand about 1099 forms: Your earnings are reported to the IRS as well as sent to you on a 1099 form. The IRS knows that you made a certain amount of income. If your tax return doesn't have at least as much income as was reported, the IRS computers can kick out a report that says take a look at this person's taxes.

If Doordash says you made substantially more than you did, that's a problem. When you use that inflated amount on your tax form, you pay more taxes than you should. If you file based on what you actually made, the IRS is going to compare that to what Doordash told them you were paid, and they'll want an explanation.

What if Grubhub sends their report to the IRS but forgets to send your copy to you? If you thought you didn't have to file taxes on that income since you didn't get a 1099, but the IRS knows you made that money, you can guess what kind of problems that can create. But if you file taxes based on what you made, how do you know if that matches up with what Grubhub reported?

Having a wrong 1099 or not getting a 1099 when you should just creates headaches. Make sure they get it right.

If at all possible, make sure that your 1099 is correct.

Don't stick your head in the sand. Don't just ignore the problem hoping it will go away. As long as your 1099 is incorrect (or you haven't received it), that problem isn't going away.

Make sure it gets fixed. Make sure they give you the correct information. Just as important, make sure they are sending the right information to Uncle Sam.

Step Two: Know what you actually received.

You have to know if your 1099 really was wrong.

Unfortunately, too many people will just mindlessly enter the 1099 information into their tax program and pay the taxes. That can be an expensive mistake.

There's a common theme across the food delivery companies in what they tell you about taxes: It is your responsibility to track your earnings and your expenses.

It's like Doordash says on the disclaimer from their Dasher support page pictured above: As an independent contractor, you are responsible for keeping track of your earnings and accurately reporting them in tax filings.

They're not wrong.

It IS your responsibility. You are running a business. You should know how much you made, whether you get a 1099 or not.

And you should know enough about what you were paid by Doordash, Uber Eats, Grubhub, Instacart or any other gig app that you know when the information they gave you is wrong.

Do NOT, I repeat, DO NOT rely on the app to give you that information.

You can go into the app and click the earnings tab and scroll down to see what you made. If you are using that as your basis, it's very easy to think you earned less. That's because all of your earnings for the year may not show up there.

For whatever reason, Doordash in their infinite non-transparent wisdom has decided that they will pull your earnings detail off the app after a few months. Grubhub doesn't really give you much either.

And then you have Uber. The good news is, I can pull up every single Uber Eats delivery I've ever completed. I can get weekly, monthly, and yearly totals both on the app and through the website. The bad news is that what they report to the IRS is not the same as what shows up on the app. We'll talk more about that in a moment.

I don't know what it is that makes it so difficult for these companies to display what you earned.

The best way to know: Keep records

You're running a business.

I repeat that line often. It needs to be repeated. Whether you like it or not, whether you feel like it or not, you are running a business.

The best thing you can do is act like it. That includes keeping records. Record your earnings (as well as your expenses, miles, everything related to your business activity).

Every time you get paid, keep a record. Keep a running total of your earnings by gig economy platform. Use a spreadsheet like Google Sheets if you want something free and easy. Better yet use a good bookkeeping platform.

I do not recommend Stride. I know it's popular among drivers, but it's not a good bookkeeping program. You cannot enter specific details about your income. There is no way to know how much of your earnings were with Doordash, how much were from Grubhub, from Uber Eats, or anyone else. Unless you only use one platform (and that's all you'll ever use) Stride is useless for double checking your 1099 form.

There are three bookkeeping options I'll mention:

- Hurdlr is the best free option I know of. Personally I prefer their free version over the paid version of Quickbooks Self-Employed. You can categorize your income so it will track earnings by platform. You can read more about them in my review of Hurdlr.

- Triplog has the most accurate mileage tracking of any of the apps and their expense and income tracking features are very solid. They're also the very best at customizing income categories. Triplog is the best paid option, in my opinion. The free version has some pretty severe limits on how many things you can track.

- I'll list Quickbooks Self Employed only because Quickbooks is well known. They're the costliest of the three and least flexible. The thing I like the least about Quickbooks Self-Employed is that you cannot categorize your income. You can write down where the payment came from, but you'll have to do some extra work to sort your income and come up with totals per platform. You can read more in my review of Quickbooks Self Employed.

How do you find out what you earned if you haven't kept records?

If you haven't kept your records so far, there are a few ways that you can find out what you've earned.

Requesting an earnings history.

Doordash and Grubhub are bad at making total earnings available for you to look up. You can always try to request an earnings history from them, but don't hold your breath. For now I'll look at the three main delivery apps: Grubhub, Uber Eats and Doordash.

Doordash earnings history.

Doordash posts on their website that you can request a payment history.

They lie.

They state that ” To receive proof of the payments you have received from DoorDash for your independent contractor work, please file a support case using the link below. For us to process your request more quickly, be sure to include the email address that is associated with your Dasher account.”

I tried it. They responded by saying they cannot provide that information. They told me I can get it from my Earnings tab.

You know, the earnings tab that only goes back a few months.

Youtube creator UDM talked about this on his community awhile ago. He had the same thing happen. He went through the steps and got this response: “Although we cannot provide you your total earnings for 2019, but I can help you on how you can get that on your App. All Dashers can verify a history of pay through the Dasher app by visiting the Earning page.”

Even if you could pull up all your earnings on the earnings tab, it wouldn't match up your 1099. Doordash reports your earnings based on what you were paid in the calendar year. Deliveries completed in the last few days of the year may not be paid out until the next week and count as earnings for the following year.

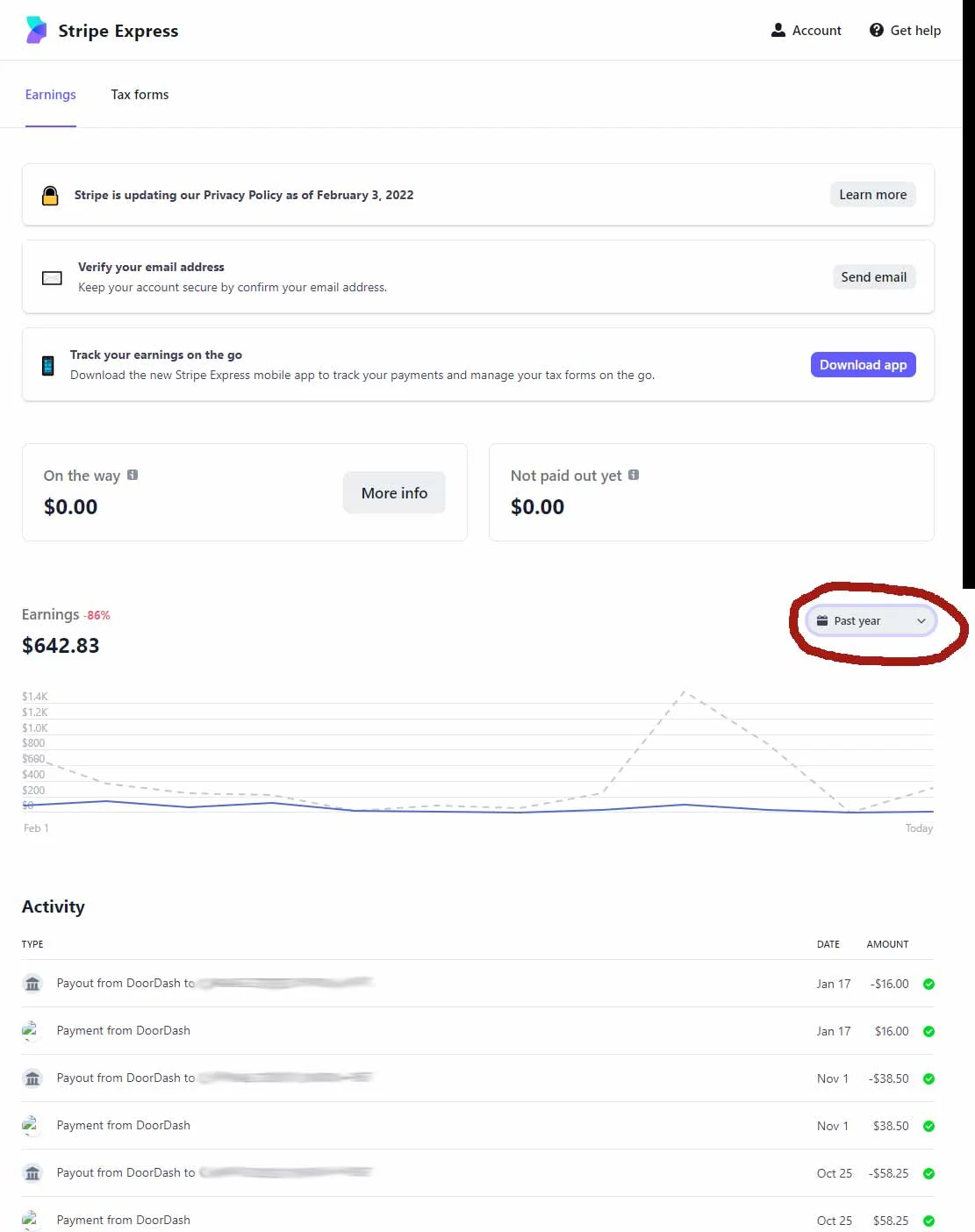

Update (2022): There is a portal on Stripe to let you see your earnings

In past years, Doordash used Payable to process their 1099 forms. Payable was bought out by payment processor Stripe. Stripe has a portal where you can see your exact earnings history as well as download your 1099 form.

Stripe will have sent you an email inviting you to verify your tax information. If you haven't received it, search for emails from Stripe.com or a subject like “Confirm y our tax information.” You may have to search your spam folder.

You can log into the Stripe portal using your Doordash login credentials. The login as of January, 2022 is connect.stripe.com/express_login. You can read more about the Stripe Express Doordash connection and how 1099's work with Doordash.

Warning: do NOT rely on the Earnings amount (the example above is $642.83). That amount is not your previous full callendar year total, it is the total going back one year from the date you ran the report. Unfortunately Stripe does not give you the option to run a total for Calendar Year 2021 or for any custom dates. You will have to manually add the totals to get the exact amount for any given year.

This is the same portal from which you can download your 1099 by tapping on Tax Information.

Grubhub earnings history.

Grubhub also does not keep a running total of earnings on their app.

To their credit, at least they don't lie about getting access to the earnings. Grubhub is up front about how you cannot get a copy of your earnings history:

It is your responsibility to retain a copy of your summaries throughout the year. Unfortunately, the 1099 Team and Driver Support Teams do not have access to any copies you may be missing. If your driver account is active, you can see the last 8 summaries in the Grubhub for Drivers app.

Grubhub faq response to “How can I get a summary of my annual earnings from last year?”

The good news is that Grubhub emails a weekly summary when you are paid. If you kept your emails, you can go through your emails and add up your weekly totals.

Uber Eats earnings history.

Uber Eats stands out from the crowd on this one. You can log into the driver portal and pull any kind of detail you want about what you made.

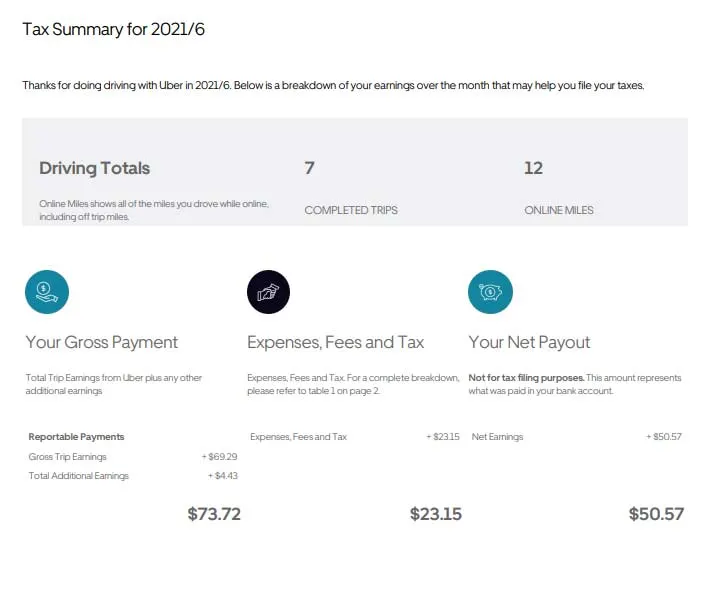

Unfortunately, the total earnings on your pay statement won't add up to the amount that Uber Eats will report that you earned. That's because Uber plays games with their reporting.

The driver in the example above made $50.57. Uber will report to the government that the driver made $73.72. They will claim that the driver received more, but then service fees were deducted from that total. We talk more here about how Uber Eats claims you made more than you actually earned.

With Uber Eats, you need to look up your tax document. They provide monthly as well as annual statements. The Gross Payment is what Uber Eats will claim that you made. The total Net Payout should equal what you actually received from Uber Eats. Just understand that the Expenses, Fees, and Tax are deductible expenses and that will keep you from over paying.

Getting your information from Bank Records

If you haven't kept records, and you can't get a reliable earnings report from the gig companies, the next step would be to comb through your bank records. Search for every deposit that you received. This is a lot easier if you use a separate bank (I use Novo) for your delivery business than trying to wade through all the personal transactions.

The thing to remember if you want accurate information is you have to go through every bank that you may have had money deposited to. A lot of drivers who use the Fast Pay feature will use a debit card that's not tied to their main bank account. If you used the Dasher Direct or Uber Go debit cards, you want to make sure you add up all of the money deposited to those as well.

Use 3rd party apps to pull earnings records

David Pickering of Para joined us on the podcast in December 2020 to talk about some of the things they're working on. They have a tool that can pull the entire trip history for the year on Doordash and several other apps.

The app does this by connecting to your app accounts through a third party company called Argyle. I've written before that there could be some issues providing access to third party apps based on new language in the Independent Contractor Agreement. David assures me their data provider has secured permission to connect to Doordash accounts. This would eliminate worries about unauthorized access.

Gridwise is another app that uses Argyle to connect to your account. After logging in, you can tap the earnings tab on the app. Unfortunately, Gridwise is a little more cumbersome, in my experience, because I haven't been able to find out how to get it to run a report that breaks down earnings by platform. You can manually add up the entries.

One thing to keep in mind when using third party apps is that they add totals up based on your daily earnings. Keep in mind that 1099's are based on when you were paid.

For example, at first my Para earnings didn't line up with my 1099. It was close. However, when I subtracted the Para totals for December 28-31 of 2020, and then added in earnings from December 30-31 of 2019, it matched up exactly with my 1099 total.

Add it all up and compare it to your 1099.

Add everything. If you're using a calculator double and triple check your math. If you put it all in a spreadsheet make sure everything is entered correctly.

You want an exact amount. What did you make? How does that cmpare to your Doordash 1099 and is that 1099 wrong?

Step Three: Know if you should have received a 1099

I notice that a lot of people start freaking out around January 15 because they haven't received their 1099.

Companies that use independent contractors have until January 31 to send out the 1099 forms. If sending by mail, that means they only have to get them dropped in the mail. It could be a few days into February before you receive them.

Be aware that you may not have earned enough money to receive a 1099 form. For companies that use the 1099-NEC, they don't have to send out a 1099 unless you've earned at least $600. That usually means they won't do so.

This is why it's so important for you to know what you made. If you know you made more than $600 from Grubhub or Doordash or Instacart or most of the others, and you haven't received a 1099 by around February 10, you know there's something wrong.

If you delivered for Uber Eats, you may not get a 1099 even if you earned thousands of dollars. Uber reports earnings on a 1099-K and for the 2021 tax year, they don't have to send out a report unless you made more than $20,000 (that threshold will drop to $600 for the 2022 tax year).

Then again, you might get a 1099-NEC from Uber Eats. You'll notice that it's for a lot less money than you made. Uber uses two different 1099 forms. The 1099-K reports fares, delivery fees, base pay and customer tips. The 1099-NEC covers incentives and referral fees.

In summary, if you made less than $600 for any one platform, you won't get a 1099 from them. If you delivered for Uber Eats and made less than $20,000, you won't get a 1099 for the larger part of your income.

If you shouldn't be getting a 1099, don't get too concerned that you didn't get one.

Step Four: Request (DEMAND) they fix the screwup.

First, make sure they have your correct contact information. Through January you'll be getting notices to make sure your information is up to date.

If you know your contact info is correct and you haven't received your 1099:

Be a squeaky wheel. Be a dog with a bone. Hound them. It's inexcusable.

Here's what the IRS says:

Payers have until January 31 to mail these (1099 forms) to you. If you have not received an expected 1099 by a few days after that, contact the payer. If you still do not get the form by February 15, call the IRS for help at 1-800-

IRS Tax tip: What to do if you haven't received a form 1099

829-1040.

The problem here is that these companies are terrible when it comes to driver support. Their business model requires they keep any labor costs at a minimum. It's all about trying to manage with an algorithm and to pay the least possible to manage or support their drivers.

Doordash doesn't provide any information on their site for dedicated contact regarding 1099 issues. When they were using Payable.com to manage their 1099's (through last year) there was a link for “Request a Correction.” At that point it displayed some contact information: Call 855-973-1040 or email Support@Doordash.com.

Grubhub does have a dedicated email address for 1099 issues. If you have not received a 1099, they ask that you email 1099@Grubhub.com. I can tell you from experience they aren't very responsive, but it's worth a try.

With Uber, the good news is you can log into your dashboard and download your 1099 form. Uber recommends that you update your tax settings with current contact information. “You should also follow these steps if you qualify to receive a 1099 but the form is not available on your dashboard.”

If the 1099 form is incorrect

Contact the company and ask them to provide you a corrected 1099. Use that exact terminology. It HAS to be a CORRECTED 1099, otherwise it can be taken as an additional 1099 and that adds up to even additional earnings being reported to the IRS. Document everything you do when contacting them.

Generally you're going to use the same contact procedures as above.

You need to hound them. As long as the information they provided to you is incorrect, the information they provided to the IRS is incorrect as well. That can create an issue where your tax return and your reported income don't line up.

Document it all. Write notes from the phone calls, ask for identification information from who you talk to, ask for a case number, write down specifically what was discussed, anything that you can do to identify your phone call. .

Note the date and time of the phone call – even make a screenshot of the call information if you used your cell. Screenshot or print your email (and any replies) and your tweets related to it. Keep a record of everything and of all the replies.

If you actually get a live body on the phone, advise them you're ready to go to the IRS if they don't fix things. Be ready to do that if necessary.

That may or may not get a better response. Realize when talking to support you may not be talking to an actual employee of the company, so they may not care. It's great if it helps, if it does not, you've at least done what you need to do. If you aren't getting a response in an appropriate time, follow up.

Step 5: If you get a corrected Doordash 1099, make sure it IS corrected

There is a box on the top of the 1099 form. Make sure that has been checked. If it is not, you need to go through the whole process. If they sent a second one and it is not checked, there is a possibility that the IRS sees this as ADDITIONAL earnings, not a correction.

If you do not get a corrected copy:

Here's where it gets way over my head, to be honest. I won't offer advice, instead this is when you really need to get a tax pro in your corner.

It may be time to contact the IRS. You can call the number that they provide in the quote above, 1-800-829-1040.

I've heard some suggest you follow this link where you can report suspected tax fraud. What that will do is lead you to file a form called Form 3949-A. This is a form that you would mail in. Going that route isn't going to speed up any results by any means.

I'll be honest, I'm torn as to whether that's a good next step. Was this intentional or was it incompetence? At times when I see a lot of incorrect 1099's out there and they ALL seem to be inflated, you wonder. The thing is, the purpose of the fraud report is not to resolve your particular issue, but to report something you think is fraudulent.

Step 6: With no correction and tax day is near

At this point, you really should be consulting with a tax professional. Have them help you figure out your next steps. My understanding is you have two choices:

File an extension to get more time to get this resolved.

You can file an extension that will give you six more months. That will hopefully give you more time to get this whole thing resolved. The main thing is that you want to make sure that your tax filings and the income reported to the IRS are on the same page.

Filing an extension will not let you delay your payment. You should estimate to the best of your ability what, if anything, you have to pay in, and pay that. An extension doesn't change the due date, only the date for when you have to file the tax forms themselves.

File your return based on what you know you made.

Once again, if it's gotten to this point, get a tax professional.

I have heard of some who suggest that you can go ahead and file your return based on what you know you have earned. They say to include a statement that explains that you are filing based on what you were paid, that you have requested resolution and have not had a response.

If you do this, make extra sure that you are correct. Have the evidence for your claim. Chances are the IRS will be contacting you because there's a discrepancy between what Doordash or Grubhub or whomever said you made, and what you reported on your taxes.

Like I said, many times now, get a tax pro to help you through this.

Why are so many 1099's wrong in the gig economy?

I don't know. Maybe in the end, the why doesn't matter. They need to fix it.

On the one side, I wonder if it's that these companies grew so quickly that their systems couldn't keep up with it. It's not like these apps don't have a ton of other glitches.

But why hasn't Uber had the same problems? Usually 1099 problems with Uber and Uber Eats are related to the wonky way they do 1099's in the first place.

My theory is it's related to how they keep their information. Uber (and UberEats by extension) make all of your previous trip data available. I can go back to when I did my first Uber Eats delivery about four years ago. All of that data is still there. On Grubhub and Doordash, I can't do that. They limit how far you can go back and look at your history. They provide no dashboard where you can pull up your information.

My best guess is that Uber can provide accurate documents because they keep all of their data available real time. For some reason Doordash and Grubhub choose to archive that information. I wonder if it's just difficult to access that information after the fact, and it leads to these massive blunders when it comes to 1099 reporting.

When I wrote about this originally about recurring problems that Doordash was having, I wondered if it was a smoking gun of some kind. That somehow Doordash was fudging numbers somehow, maybe trying to inflate how much they were paying contractors.

Either way, it's important that you stay on top of things. You shouldn't have to rely on Doordash, Grubhub, Instacart or any others to tell you what you made. However, you don't want them giving Uncle Sam the wrong information.

Was your 1099 from Doordash wrong?

Comment below if it was.

The delivery driver's tax guide

Independent Contractor Taxes

Taxes are particularly challenging for independent contractors for gig economy apps like Doordash, Instacart, Uber Eats, Grubhub and others. We have tax related articles listed under the following sub categories.

All About Taxes for Grubhub Doordash Postmates Uber Eats Instacart and other Independent Delivery Contractor gigs.

This tax overview for delivery contractors examines several important concepts about how taxes work in the gig economy.

Income and 1099s for delivery contractors

What is your true income as you deliver for Doordash, Uber Eats, Instacart, Grubhub and others? How do 1099 forms work?

Mileage and Car Expense for Delivery contractors

For those of us who use our cars for delivery, vehicle expenses are typically the largest deductible expense by far.

Business Expenses for Delivery Contractors

Understand the other non-car related expenses that are typical for gig economy delivery contractors.

Tax Filing and Forms

How does the Schedule C work? What is it like to file taxes as a self employed individual contractor for gig econony apps like Doordash, Uber Eats, Postmates, Instacart, Grubhub and others?

The Delivery Driver's Tax Information Series (Grubhub, Doordash, Postmates, Uber Eats, Instacart)

The Delivery Driver's Tax Information Series is a series of articles designed to help you understand how taxes work for you as an independent contractor with gig economy delivery apps like Doordash, Uber Eats, Grubhub, Instacart, and Postmates. Below are some of the articles

What are your delivery driver taxes based on?

It is important to understand your taxable income is your profit, NOT your pay from Grubhub Doordash Postmates Uber Eats etc. Schedule C figures that.

How does itemizing or taking the standard deduction affect writing off delivery driver business expenses?

We examine the difference between business expenses and tax deductions, and why you can claim your expenses even when taking the standard deduction.

Tax Guide: Understanding Your Income

The following three articles help you understand what your real income is as an independent contractor.

Understanding business income as a 1099 gig worker

What income do you have to report as a contractor for Grubhub, Doordash, Postmates, Uber Eats and other delivery gigs? How and where do you report?

What are 1099 forms and what do we do with them?

Episode 57 of the Deliver on Your Business Podcast. Once you receive your 1099 forms from Doordash, Uber Eats, Grubhub, Postmates and others, what do you do with them?

Tax Guide: Understanding Your Expenses

The following eight articles help you understand the expenses you can claim on your Schedule C. Most of these are about your car, your biggest expense.

How do business expenses work for Delivery Drivers in the gig economy?

Introducing and explaining the business expenses as they are claimed on your taxes as a contractor for Grubhub, Doordash, Postmates, Uber Eats.

How to write off car expenses for gig workers

For those of us who do use our cars for gig economy delivery, the car expense is the largest expense item. You can choose between the standard mileage allowance and actual expenses.

How to Track Your Miles As a Delivery Contractor

Every mile that you track as a contractor delivering for Doordash, Uber Eats, Grubhub, Instacart, Lyft etc, is saves about 14 cents on your taxes. When you drive thousands of miles, that adds up.

What Miles can you and can you not claim for delivery and rideshare?

What miles can I claim when delivering for Grubhub, Doordash, Postmates, Uber Eats and other delivery gigs? Understand what miles you can and cannot claim.

What if I Forgot to track my miles?

What do I do if I didn't track my miles as a gig economy driver? We look at different places you can find evidence to use in building a mileage log.

How the actual car expense method works for gig workers

It is important to understand your taxable income is your profit, NOT your pay from Grubhub Doordash Postmates Uber Eats etc. Schedule C figures that.

Three Car Expenses Gig Economy Drivers May Not Know You Could Claim Even When Claiming the Mileage Deduction

You probably didn't realize that even if you claim the standard mileage deduction, there are some car related expenses you can still claim.

Besides My Car, What Other Business Expenses can I claim for Grubhub Doordash Postmates Uber Eats etc?

Besides your car, what expenses can you claim as a contractor for Grubhub, Postmates, Uber Eats, Doordash etc? We look at some different possible expenses.

Filling Out Your Tax Forms

Once you understand your income and expenses, what do you do with them? Where does all this information go when you start filling out your taxes?

Filling Out Your Schedule C as a Grubhub Doordash Postmates Uber Eats Contractor

How do you fill out the Schedule C when you contract with gig companies like Uber Eats, Postmates, Grubhub, Doordash etc.? We talk about different parts of this form.

Understanding Self Employment Taxes for Delivery Drivers for Grubhub, Doordash, Postmates, Uber Eats etc.

Understand how self employment tax works as a contractor for Grubhub, Uber Eats, Doordash, Postmates or any other gigs. Know what it is,how much & be ready!

Understanding the Income Tax Process For Grubhub, Postmates, Doordash, Uber Eats Contractors

How does our self employed income from Grubhub Doordash Postmates Uber Eats etc impact our income tax? We walk through the process on the 1040 form.

Here are Four Tax Deductions for Self Employed Contractors That Don't Go on Schedule C.

Most of our deductions as self employed contractors go on Schedule C. Four deductions benefitting Grubhub Doordash Postmates Uber Eats Contractors.

Do 1099 Delivery Drivers Need to Pay Quarterly Taxes?

We look at how quarterly tax payments work for gig economy workers (Uber Eats, Doordash, Grubhub, Instacart, Uber, Lyft, etc.)

How Much Should I Save for Taxes? | Grubhub Doordash Uber Eats

How much should I save for taxes when delivering for gigs like Grubhub, Doordash, Postmates, Uber Eats and others? These ideas help you prepare for taxes.

Frank

Wednesday 4th of March 2020

Yes your 10-99 is wrong because you are really supposed to be labeled as a employee not an independent contractor so you need to file a SS-8 with the IRS doordash is just trying to cheat uncle sam

Martin

Friday 14th of February 2020

Yes I strongly feel my 1099 is wrong