It’s tax time, and you didn’t track your miles as an independent contractor delivering for Doordash, Grubhub, Uber Eats, Instacart, or others.

Is it time to panic?

Maybe you didn’t know or think you needed to. Or perhaps you didn’t realize you CAN claim your miles even when taking a standard deduction.

All you know is… that’s a lot of taxes you owe. Is it still possible to claim your miles?

You can breathe a sigh of relief. If you forgot to track your miles when delivering for these gig companies (or other business miles), it may still be possible to capture many of the miles you drove.

We’ll walk through what you can do to create an acceptable mileage record that meets IRS requirements. We’ll discuss:

- The necessity of IRS-Compliant documentation of your miles

- What the IRS says about retroactively creating a mileage log

- What you need to do to create a retroactive mileage log

- Can you calculate or estimate miles?

- How to track miles going forward

About this article

This is part of a series of articles on delivery driver taxes in the gig economy. Rather than try to cover everything about taxes in one article, we thought it better to go deep on the many different tax subjects. We’ll link to other relevant articles throughout the series, and have a complete list of the series at the end.

This article is about what to do if you forgot to track miles when delivering for gig companies like Doordash, Grubhub, Uber Eats, Instacart and others. It focuses on the mileage tax deduction in the United States. Other nations have their own regulations and things may be different.

Finally, this is not tax advice. The purpose is to educate and inform. You should seek guidance from a tax professional who can help you with your particular tax situation.

The IRS Requires Mileage Tracking.

Here’s the deal with miles: It’s easy for people to abuse this deduction. It happens all the time. In fact, the kind of miles we drive already puts us at a higher risk for audit.

You want to keep an accurate record of your miles, both to capture every mile AND to satisfy the IRS if they start asking if your numbers are legit.

The IRS requires the following:

You need to know your odometer reading at the year’s start and end. That’s because they want the total miles for each vehicle you use.

You then need a daily record that shows the date, the number of miles you drove, the business purpose of your trip, and where you went.

It is allowable to record those miles with a GPS app or a handwritten mileage log (or spreadsheet). The main thing is that whatever method you use captures those four criteria. This means you need a daily record.

What does the IRS say about creating an expense record retroactively?

Okay, so you’re getting ready to do your taxes and you don’t know how many miles you drove.

Rutro Rastro.

The worst thing you can do is just make it up or write down a number.

You can expect an auditor to disallow your deduction if you claim miles without any record. When that happens, you may not claim ANY miles OR actual car expenses.

You HAVE to have documentation of your miles.

There is good news. The IRS did make an allowance for when you don’t have complete records. You CAN go back and retroactively build a mileage log,

I like that they used delivery as an example.

For example, the nature of your work, such as making deliveries, provides circumstantial evidence of the use of your car for business purposes. Invoices of deliveries establish when you use the car for business.

IRS example in Publication 463 (2020) about if you have incomplete records.

Here’s what it boils down to: You can create a log but you cannot just make it up. The IRS wants evidence to support that log.

How Do I Create a Log if I Forgot to Record Miles?

You will need to provide three things to the IRS:

- A written statement that explains how you determined the miles you drove. Explain the evidence you used and how you determined how many miles you drove based on the evidence

- Evidence that supports the fact that you did drive for business

- Your IRS-compliant mileage log that was created based on your evidence.

That’s a lot of extra work. Isn’t it easier to just make up a mileage log and not bother with it?

It’s easier, but it’s risky. Auditors are smart and can often identify when things are simply made up. There are a lot of telltale signs. If they suspect you did not k as you keep your log up as you went along and haven’t done the above steps, you risk losing that mileage deduction.

Here are some steps that you should follow:

- Identify the dates that you were paid for deliveries

- Identify how many total miles you drove for the year

- Find evidence of how many business miles you drove each day

- Create your mileage log.

- Save all your documentation for future reference

1. Identify which days you drove for business.

In the IRS example quoted above, they said invoices of deliveries provide evidence that you did use your car for business. This is a good starting place.

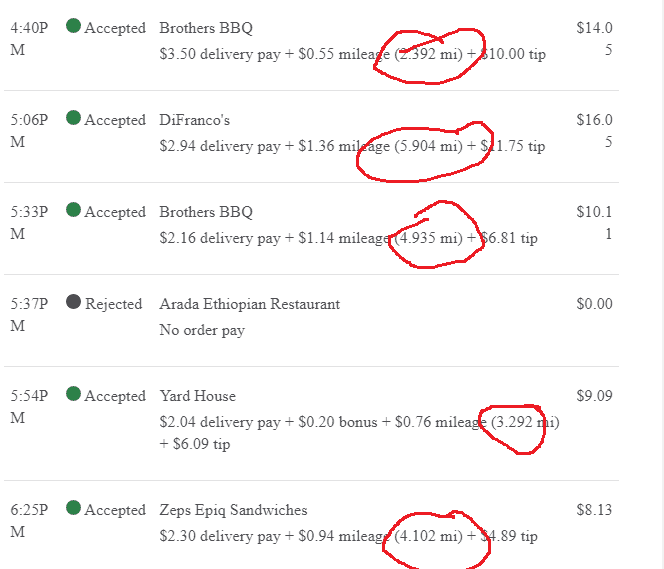

As delivery contractors, we usually don’t have invoices. However, most apps provide evidence that you received payment on certain dates for your delivery work. Suc

Get as much detail as you can. We’ll go into more detail about where you can find that detail.

The first thing you want to do is identify and document which days you delivered. This does two things for you:

- It adds legitimacy to your log. You have evidence that you did indeed drive for business on a particular date.

- It gives you a starting point to help you look for information supporting how many miles you drove.

How to identify the dates you delivered.

There are three primary ways to identify which dates you delivered.

- Trip or earnings history in the delivery app

- Emailed records of your earnings

- A third-party app that can pull your account history.

Not all delivery services are created equal. Some provide extensive information that can help you identify when you delivered. Others are minimal. For that reason, you may need to use option number 1 for one platform and option 3 for others.

App history: Most delivery services have a history section in their driver apps. On the one hand, Uber Eats lets you see your entire history, while Doordash only shows the previous four to six months.

Emailed records: Some delivery programs will email daily or weekly summaries of your earnings. Grubhub is one of the best at doing so.

A third party app: Some third-party mobile apps can log into your driver accounts and pull your earnings history. Those apps can then give you a report of your earnings, usually broken down by day, week or year. These apps often cannot work with some of the smaller delivery companies but usually can work with the larger nationwide platforms. Solo is the best app that I know of for doing this. I go into a more detailed Solo App review of how the different features work for delivery and rideshare workers.

You can download the Solo app using my affiliate link.*

*For a limited time, Solo is offering a $10 bonus when you download Solo and link your active gig work account(s) in the Solo app. Connected accounts must have a minimum of one previous job, be using the latest version of the app, and have a connected payout method (Venmo or Paypal) in order to qualify for the Entre Courier X Solo sign-up bonus. Bonus is only valid for US-based gig workers. amounts are subject to change.

2. Identify the total miles you drove for the year.

When you fill out form Schedule C and enter your car expenses, a part of that form requires additional information. For one thing, the IRS wants to know how many total miles you put on your car, how many were for business, and how many miles were for commuting.

It would be best if you had a reasonable estimate of the total miles you drove for the year. This is because an IRS auditor may be more likely to question the details if you are re-creating your mileage log. There’s a higher probability that they could think you’re making things up.

They may also examine whether a reasonable percentage of your driving was for business purposes or personal use.

If you have maintenance records for your car, that’s a great way to establish how much you are driving. Many garages record the odometer reading when they perform maintenance or repair services and you can often find them on the receipt.

Another is to get your driving history from your GPS if it’s available. Most GPS apps keep some form of history, and many of the in-car GPS programs do as well.

The GPS on your phone may not be as reliable. Some apps only record when you’re using their navigation. The ones that record everything have no way to determine which car you are driving, so its total may not be trustworthy.

3. Look for documentation of miles you drove on any given day.

Once you know which days you made money with your deliveries, you have a starting point for figuring out how far you went. The following methods can help you track down documentation of how far you drove.

- In-app trip details

- Emails that show miles driven

- Point-to-point mileage estimates

- GPS history records

Here are some examples of how you can get data from different apps.

Uber Eats’s trip details include a map and an estimate of how far the delivery was. That estimate is based on the distance from the merchant to the customer.

Grubhub emails a payment detail that includes a breakdown of each delivery. That detail includes how many miles they estimated the total trip would take.

If you keep screenshots of delivery offers, many delivery apps give you an estimate of how far you will have to drive.

Some apps will give you the starting and ending point of a trip, either with addresses or showing them on a map. Using the directions feature of a map program like Google Maps, you can enter those locations to measure the distance.

Using GPS History to estimate miles.

Phone GPS programs may keep a history of where you have been. The most helpful information is provided by Google Maps.

Google has a timeline feature that shows your location history. It will work even if you weren’t using Google Maps for navigation. The feature does need to be enabled. However, many have found it was enabled by default.

Google maps isn’t quite the same as a GPS tracking program. The timeline works by constantly updating your location based on GPS coordinates. It then maps those locations and estimates the route based on those coordinates.

Suppose you know the dates you have delivered. In that case, you can look at your Google Maps timeline for those dates and see the driving patterns that would be consistent with providing deliveries.

Other GPS apps have history features. Waze and Apple tend to only keep a history of when they were used for navigation, so may not have captured your location and routes as much as Google did.

4. Create your DAILY log based on your information.

Remember the four things the IRS requires for a compliant log: Date, total miles, business purpose, and where you went.

That means you need a log that meets all that criteria. You cannot just provide a total number of miles. That means the emails you get from Doordash or Grubhub or the mileage summary on the tax record for Uber Eats will not meet the requirement. You have to break it down.

5. Document and save everything you used to create your log.

Remember that when retroactively creating a mileage log, you must provide a written statement explaining the methods used to make that log.

If it ever comes to the IRS needing your statement and log, you can bet that they’ll want to see the evidence. That’s why you must keep your documentation saved in a single location.

The best practice is to print it all out. Print those all out if you use screenshots from the app or records from Google Maps or anything like that. Also, print the emails that detail your mileage or any other information that supports your log.

These things can be kept digitally if that’s your preference. If you do that, create a folder on your computer where you store everything. Remember that if it ever comes to an audit, you probably will need to provide a printed copy of it all.

Forgot to track your miles? Don’t make the same mistake again

There are several ways to track your miles. I compared several gps apps and found Triplog and Hurdlr to be the best of the bunch.

Triplog has a unique Gig Apps mode that records your trip automatically any time a gig app is open.

Hurdlr is in my opinion the best free tracking app. Automatic tracking is available with a subscription. I find it to have better additional features.

Can you use year-end emails or estimates from the delivery companies?

Many of the delivery companies will provide a year-end estimate of your miles. Uber lists miles driven on their tax summary. Doordash and Grubhub email the estimated miles driven.

The problem with these summaries is that they are not IRS-compliant. They do not have the daily totals that the IRS requires.

The other issue is they may miss a lot of miles. Many of them only use merchant-to-customer mileage to calculate their totals. None of them actually track your miles for you.

I don’t know how an auditor would look at these year-end totals. On the one hand, they are not IRS-compliant, as mentioned before. However, they are a form of third-party verification.

For that reason, it’s not wise to rely on those numbers. They should only be a last-ditch alternative if no other documentation is available.

What about Calculating or Estimating Miles?

There are instances where you can legitimately calculate how far you drove. However, do not confuse calculating with guessing.

When can you calculate miles?

You should have evidence of starting and end points to use calculated distances. If you know where you started and stopped, it’s reasonable that you had to drive between those points.

Be careful that you have not duplicated any other miles claimed in the methods you used to create a log.

In on-demand delivery, where we can make dozens of daily stops, most contractors will not have information about starting and ending points.

However, if you have incomplete information from other sources, calculated distances can fill in the gaps.

Say your GPS only has a history of when you used navigation. Maybe you navigated to a customer but did not need navigation to drive from that customer to the next merchant. Or perhaps you have the map points from where you dropped off an Uber Eats delivery and a map where you picked up from the following merchant.

In those cases, you have evidence you were in those two different places. It’s reasonable to calculate the distance between the two.

Many map programs have a directions feature. You can input a trip’s starting and finishing points, and the program will calculate a route. Some GPS tracking programs like Hurdlr have such a feature.

Do not guess. The IRS is clear that you need a basis for the miles you claim. When you do use calculations, be sure that you include the details in your written statement that goes with your log.

How to start tracking miles so this doesn’t happen again.

You already know the requirements from the IRS. You need a record of your miles that includes:

- The date

- How many miles you drove

- The business purpose of your trip

- Where you went.

There are two good ways to do this.

You can keep a log manually. Record your odometer reading at the start and end of your trip and write down all the things in that log.

There are GPS tracking apps that can record for you. The free ones tend to require you to manually start and stop recording. If you’re prone to forgetting, consider using a GPS app with automatic trip detection.

Continue reading for more detail on how to track your miles.

The Delivery Driver’s Tax Information Series

The Delivery Driver's Tax Information Series (Grubhub, Doordash, Postmates, Uber Eats, Instacart)

The Delivery Driver's Tax Information Series is a series of articles designed to help you understand how taxes work for you as an independent contractor with gig economy delivery apps like Doordash, Uber Eats, Grubhub, Instacart, and Postmates. Below are some of the articles

What are your delivery driver taxes based on?

It is important to understand your taxable income is your profit, NOT your pay from Grubhub Doordash Postmates Uber Eats etc. Schedule C figures that.

How does itemizing or taking the standard deduction affect writing off delivery driver business expenses?

We examine the difference between business expenses and tax deductions, and why you can claim your expenses even when taking the standard deduction.

Tax Guide: Understanding Your Income

The following three articles help you understand what your real income is as an independent contractor.

Understanding business income as a 1099 gig worker

What income do you have to report as a contractor for Grubhub, Doordash, Postmates, Uber Eats and other delivery gigs? How and where do you report?

What are 1099 forms and what do we do with them?

Episode 57 of the Deliver on Your Business Podcast. Once you receive your 1099 forms from Doordash, Uber Eats, Grubhub, Postmates and others, what do you do with them?

What If My 1099 is Wrong?

What if the amount reported on your 1099 is incorrect? This is not an uncommon problem. Do NOT just let it ride, incorrect information could cost you a lot in extra taxes

Tax Guide: Understanding Your Expenses

The following eight articles help you understand the expenses you can claim on your Schedule C. Most of these are about your car, your biggest expense.

How do business expenses work for Delivery Drivers in the gig economy?

Introducing and explaining the business expenses as they are claimed on your taxes as a contractor for Grubhub, Doordash, Postmates, Uber Eats.

How to write off car expenses for gig workers

For those of us who do use our cars for gig economy delivery, the car expense is the largest expense item. You can choose between the standard mileage allowance and actual expenses.

How to Track Your Miles As a Delivery Contractor

Every mile that you track as a contractor delivering for Doordash, Uber Eats, Grubhub, Instacart, Lyft etc, is saves about 14 cents on your taxes. When you drive thousands of miles, that adds up.

What Miles can you and can you not claim for delivery and rideshare?

What miles can I claim when delivering for Grubhub, Doordash, Postmates, Uber Eats and other delivery gigs? Understand what miles you can and cannot claim.

How the actual car expense method works for gig workers

It is important to understand your taxable income is your profit, NOT your pay from Grubhub Doordash Postmates Uber Eats etc. Schedule C figures that.

Three Car Expenses Gig Economy Drivers May Not Know You Could Claim Even When Claiming the Mileage Deduction

You probably didn't realize that even if you claim the standard mileage deduction, there are some car related expenses you can still claim.

Besides My Car, What Other Business Expenses can I claim for Grubhub Doordash Postmates Uber Eats etc?

Besides your car, what expenses can you claim as a contractor for Grubhub, Postmates, Uber Eats, Doordash etc? We look at some different possible expenses.

Filling Out Your Tax Forms

Once you understand your income and expenses, what do you do with them? Where does all this information go when you start filling out your taxes?

Filling Out Your Schedule C as a Grubhub Doordash Postmates Uber Eats Contractor

How do you fill out the Schedule C when you contract with gig companies like Uber Eats, Postmates, Grubhub, Doordash etc.? We talk about different parts of this form.

Understanding Self Employment Taxes for Delivery Drivers for Grubhub, Doordash, Postmates, Uber Eats etc.

Understand how self employment tax works as a contractor for Grubhub, Uber Eats, Doordash, Postmates or any other gigs. Know what it is,how much & be ready!

Understanding the Income Tax Process For Grubhub, Postmates, Doordash, Uber Eats Contractors

How does our self employed income from Grubhub Doordash Postmates Uber Eats etc impact our income tax? We walk through the process on the 1040 form.

Here are Four Tax Deductions for Self Employed Contractors That Don't Go on Schedule C.

Most of our deductions as self employed contractors go on Schedule C. Four deductions benefitting Grubhub Doordash Postmates Uber Eats Contractors.

Do 1099 Delivery Drivers Need to Pay Quarterly Taxes?

We look at how quarterly tax payments work for gig economy workers (Uber Eats, Doordash, Grubhub, Instacart, Uber, Lyft, etc.)

How Much Should I Save for Taxes? | Grubhub Doordash Uber Eats

How much should I save for taxes when delivering for gigs like Grubhub, Doordash, Postmates, Uber Eats and others? These ideas help you prepare for taxes.